Natural Gas Prices Should Be Competitive With Coal This Summer, FERC Says

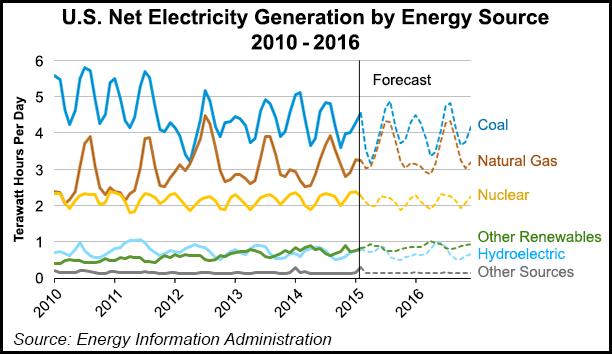

With summer futures prices below $3.00/MMBtu in most regions, natural gas is expected to be competitive with coal when prices are adjusted for the relative efficiency of gas- versus coal-fired electric generation units, according to FERC’s Office of Enforcement (OE) and Office of Electric Reliability.

“Any further downward price pressure would give natural gas an even greater advantage in the supply stack and is comparable to 2012, when the Henry Hub price dropped to the lowest level in over 10 years, averaging $2.65/MMBtu,” the FERC offices said in their Summer 2015 Energy Market and Reliability Assessment, which was released Thursday. “According to industry estimates, this resulted in 5.1 Bcf/d of coal-to-gas-switching. Estimates for this summer indicate that a $2.50/MMBtu natural gas price could result in 4-5 Bcf/d of incremental natural gas demand from power generators.”

Those low gas prices should help keep electricity prices relatively low for customers across the nation this summer.

“Natural gas is the predominant fuel on the margin, or price-setting fuel, in most regions for most of the summer,” said OE’s Lance Hinrichs.

Also according to the report, a continuation of recent strong natural gas injections into storage — weekly injections have averaged 65 Bcf — could result in record high inventories by the end of the injection season on Oct. 31.

For the week ended May 8, the Energy Information Administration on Thursday reported an injection of 111 Bcf, well above the 82 Bcf five-year average rate (see related story). Inventories now stand at 1,897 Bcf and are 752 Bcf greater than last year and 38 Bcf less than the five-year average.

Planned natural gas pipeline maintenance outages in New England could impact capacity availability in the region this summer, according to the report.

“In late August, ISO-NE may experience some impacts to the region’s natural gas-fired generating fleet when Spectra Energy begins maintenance and expansion of the Algonquin pipeline.”

The gas-dependent region has felt the fuels pinch in recent winter heating seasons, so it “makes perfect sense” that Spectra would plan maintenance on its Algonquin pipeline during summer months, Hinrichs said. The New England ISO does not expect the work to present “a major reliability threat this summer, but we do want to pay serious attention to it…what we want to do is make sure that we’re looking for local reliability issues. Fortunately, there are other plans and technologies that are available” to the region, including demand response, dual-fuel units, liquefied natural gas and coal.

“So we’ll be looking to see how the potential gas impacts cause the shift from the lower priced gas to these other resources, which tend to be more expensive.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |