Bulls Add a Nickel Following EIA Storage Report

Natural gas futures jumped after the release of government inventory figures showing an increase in working gas storage that was less than what traders were expecting.

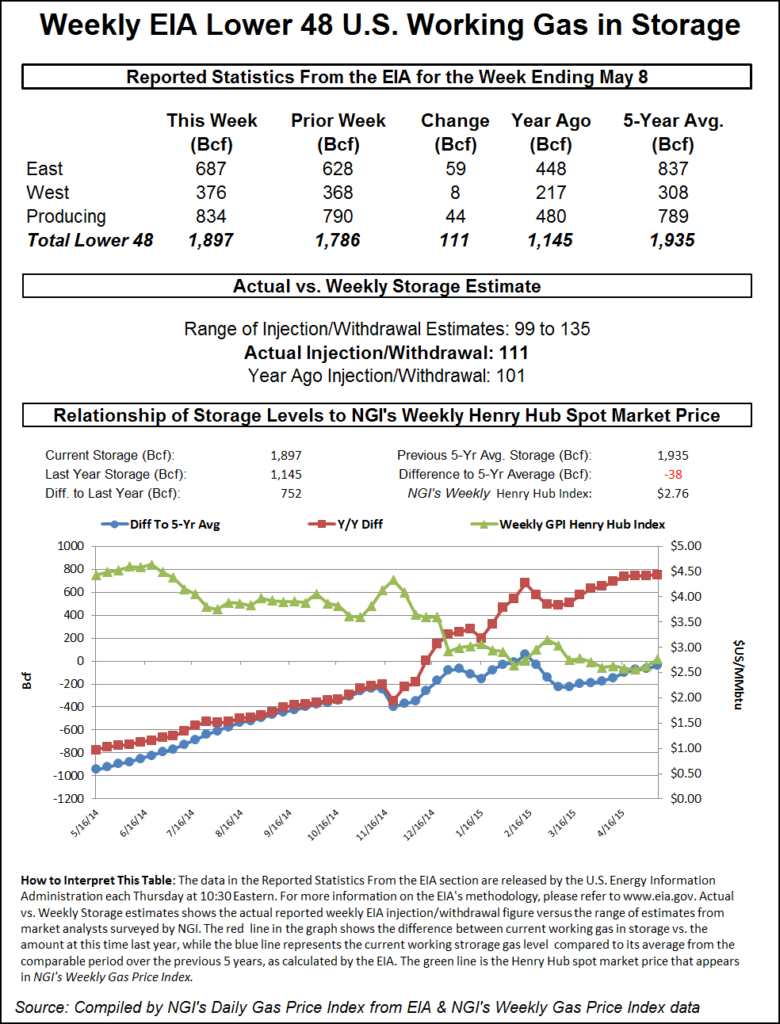

For the week ended May 8 the Energy Information Administration (EIA) reported an injection of 111 Bcf in its 10:30 a.m. EDT release. June futures rose to a high of $3.020 after the number was released and by 10:45 a.m. June was trading at $2.983, up 4.8 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase close to 116 Bcf. ICAP Energy calculated a 116 Bcf increase, and industry consultant Genscape was looking for a build of 119 Bcf. A Reuters poll of 26 traders and analysts showed an average 116 Bcf with a range of 99 Bcf to a 135 Bcf injection.

Analysts see a somewhat tighter supply-demand balance. “The 111 Bcf net injection for last week was still above the 82 Bcf five-year average rate, but it was below the consensus expectation and bullish relative to our weather-driven model,” said Tim Evans of Citi Futures Perspective. “The data implies a tightening of the background supply-demand balance, which is at least more constructive than prior data suggested. It’s a bullish report, at least in terms of short-term price impact.”

“The market would have to close above $3 if we are going to see anything significant on the upside,” said a New York floor trader. “Given the actual number, I wouldn’t have expected a market reaction much different.”

Inventories now stand at 1,897 Bcf and are 752 Bcf greater than last year and 38 Bcf less than the five-year average. In the East Region 59 Bcf was injected and the West Region saw inventories increase by 8 Bcf. Stocks in the Producing Region rose by 44 Bcf.

The Producing region salt cavern storage figure was up by 20 Bcf to 243 Bcf, while the non-salt cavern figure increased 24 Bcf to 591 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |