EVEP’s Waterless Utica Frack Fails to Unlock Volatile Oil

After 90 days of production, EV Energy Partners LP’s closely watched Nettles 3H well in Tuscarawas County, OH, which was stimulated with a mixture of liquid butane and mineral oil instead of water, has failed to meet the company’s expectations.

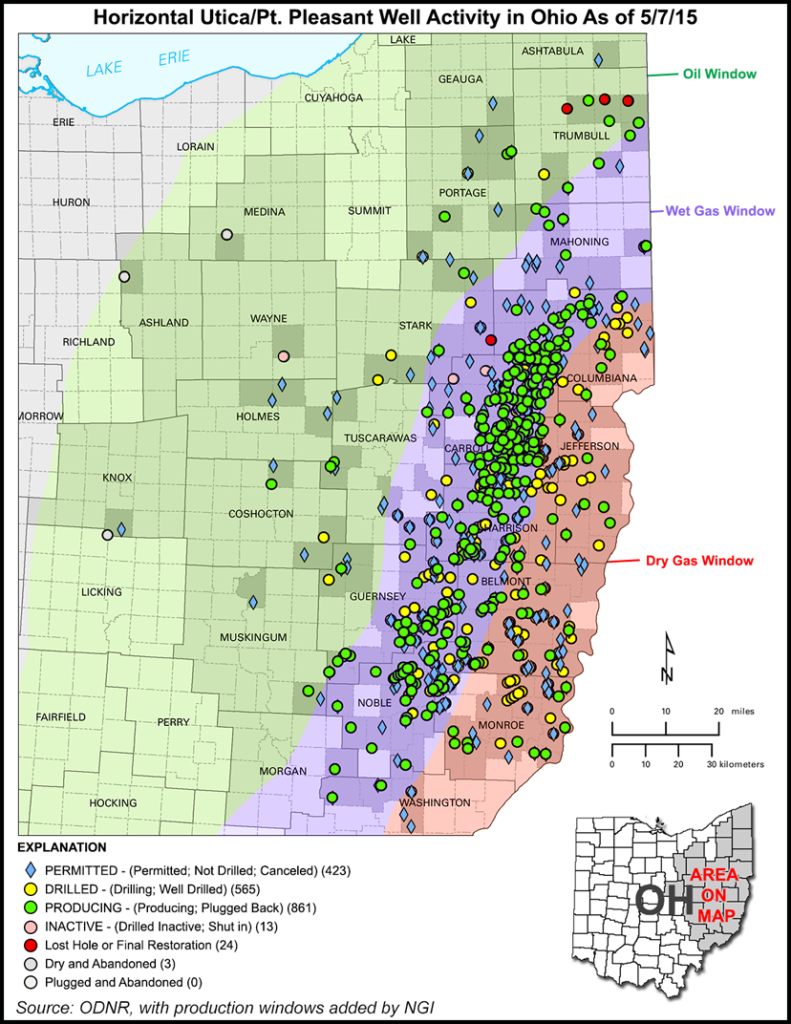

The waterless frack was the latest effort to crack the code of the Utica Shale’s volatile oil window, where EVEP estimates up to 30 million bbl of oil are in place across more than 70,000 acres in Stark, Tuscarawas and Guernsey counties (see Shale Daily, Dec. 11, 2014).

“The Nettles well was drilled and completed to test a theory that the water which is used in drilling or completion fluid causes risk or damage which in turn reduces well productivity,” said Chairman John Walker during a recent conference call with financial analysts. “This phenomenon was theorized to have a more significant impact in the volatile oil window as a result of the complex fluid flow mechanics, specifically the oil molecules that are about 1,000 times larger than a gas molecule.”

The Nettles well was drilled in partnership with eight other industry participants to learn more about the window’s rock mechanics. The Nettles test came after EVEP’s joint venture partner, Chesapeake Energy Corp., drilled its own volatile oil well in Tuscarawas County last year with encouraging results. Chesapeake’s Parker well was super fracked using more water and proppant than an average horizontal well, Walker said.

“The Nettles well production is about half that of the Parker well,” he added. “We are continuing to perform additional testing on the Nettles well and in addition, Chesapeake plans to drill about six more wells in the area.”

EVEP used a mixture of 75% liquid butane and 25% mineral oil to stimulate the Nettles well. Management also said the rock on its property was different from what Chesapeake’s data showed at the Parker well. EVEP plans to continue additional tests at the well to learn more about the area’s rock quality.

Low formation pressures and extremely impermeable rock are thought to make it difficult for oil to flow in the Utica’s volatile window (see Shale Daily, June 27, 2014). Minimizing reservoir damage has also been difficult.

EVEP said the Nettles well cost nearly $22 million, compared to a typical Utica well cost of about $6-8 million. The industry partnership was formed to handle the high costs of testing the well and the price was shared among those participants.

“We will eventually conquer the raw mechanics to be able to get at this 30-plus million bbl of oil in place,” said CEO Mike Mercer. “But it just takes some time and money and we are not going to be the primary company that leads the way there either.”

EVEP will be participating in Chesapeake’s six other volatile oil wells this year. At least one of those wells is expected to utilize the waterless fracking technique again.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |