NatGas Physical and Futures Score Modest But Opposite Moves; Futures Add 4 Cents

Next-day physical natural gas prices eased in Wednesday’s trading as weather forecasts proved uninspiring to either bulls or bears and power prices held steady.

The overall natural gas market was lower by 2 cents to average $2.64, and eastern points proved to be the biggest losers, with a number of individual points declining by a dime or more. The rest of the country also experienced losses, but mostly by a cent or two, and certainly less than a nickel.

Futures traders were not surprised when peak prices for the day backed off as they approached $3, and at the close June had managed to gain 3.8 cents to $2.935 and July was higher by 3.9 cents to $2.984. June crude oil retreated 25 cents to $60.50/bbl.

Short-term traders sense some upward momentum should the market successfully breach $3. “Prices were trying to push $3 but failed; $2.98 to $3 is a good resistance area,” said a New York floor trader. “If it breaks though there, you could see $3.12 very quickly, but I don’t know if there is enough push to do that.”

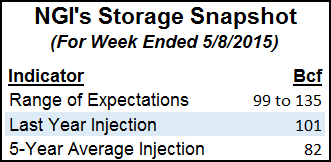

Pushing through $3 is certainly a possibility given the wide range of estimates of Thursday’s Energy Information Administration (EIA) storage report. Estimates range from a low of 99 Bcf to as high as 135 Bcf and with a range that high it would not be hard for actual data to come in off industry expectations of about 116 Bcf.

“Some people are saying that’s kind of bearish, but the prices are already lower than they were a year ago,” said Tom Saal, senior vice president at FCStone Latin America LLC in Miami.

“The level of storage, the expectations of triple digits are one of the reasons we are still below $3. Natural gas is at a relatively low price compared to the last five years, but I don’t know how much upside there is. Prices aren’t the lowest in the last month, but they are low compared to where we have been in the last year or so.

“I had someone tell me once that markets will do everything they can to prove you wrong. One of the fundamental reasons I was hearing for this rally were maintenance outages during the shoulder months and extra demand. If you have a little bit more demand, then the market could go a little higher.”

In his work with Market Profile, Saal said there have been numerous non-trend days, days when the market does not trade outside of the range established in the first hour. “That is a very impressive development because it shows where people are positioned in this market. Sellers stopped selling. Who are the sellers in this market? Professional speculators stopped selling and who is left to sell? It takes more sellers than buyers to move the market lower.”

On the high side of Thursday’s estimates is Tim Evans of Citi Futures Perspective, who is looking for a plump build of 135 Bcf, and following that a continuation of triple-digit builds. By May 29 the current 67 Bcf five-year deficit turns to a 90 Bcf surplus under his scenario.

Normally a falling deficit or rising surplus means declining prices over the intermediate term. “However, as has been demonstrated over the past two weeks, it may only be reducing the upside potential rather than keeping an absolute cap on valuations. In particular, after some 14 months of falling prices and a year-long bearish storage trend, we think the market had been oversold, and at least arguably undervalued.”

Evans is keeping a sharp eye out for a slowing in production growth in Short Term Energy Outlook reports. “The DOE does have production topping out at just over 75 Bcf/d this year, not much above either the 74.57 Bcf/d estimate for April or the peak in dry gas production of 74.69 Bcf/d set in December.

“On the demand side of the market, we continue to see power sector demand as a potential bullish storyline, with the retirement of some coal-fired plants and reduced hydroelectric potential in the far West cutting down on the competition in the sector. We see potential for summer demand to run 3-5 Bcf/d higher than a year ago, even with relatively normal temperatures.”

Last year 101 Bcf were injected and the five-year average is for an 82 Bcf increase. IAF Advisors of Houston is expecting a 116 Bcf build, and industry consultant Genscape forecasts a 119 Bcf build. A Reuters survey of 26 traders and analysts resulted in an average 116 Bcf increase with a range of 99 Bcf to 135 Bcf.

In the physical market, next-day prices in the Northeast eased as temperatures were forecast to be fair and mild. Wunderground.com predicted that Wednesday’s high in New York City of 68 would rise to 73 Thursday and reach 75 by Friday. The normal high in New York City is 70. Boston’s Wednesday high of 65 was seen making it to 69 Thursday and 71 by Friday. The normal mid-May high in Boston is 65.

Next-day gas at the Algonquin Citygates tumbled 26 cents to $1.91 and on Iroquois Waddington gas was up a penny at $3.08. Thursday parcels on Tennessee Zone 6 200 L fell 31 cents to average $2.05.

Gas bound for New York City on Transco Zone 6 fell a nickel to $2.86, and gas on Tetco M-3 shed 13 cents to $1.59.

Next-day gas at major hubs eased. Thursday deliveries to the Chicago Citygate fell a nickel to $2.87, and gas at the Henry Hub changed hands flat at $2.86. Packages on El Paso Permian eased a penny to $2.64, and gas at the SoCal Citygate was quoted at $2.95, down a penny.

Gas buyers in Texas focused on power generation will be juggling a healthy dose of renewable generation for Wednesday’s purchases. Forecaster WSI Corp. forecast that “an upper-level disturbance will lead to the development of areas of heavy rain and thunderstorms [Wednesday] into tonight. It will trend more humid, but remain on the cooler side of average with highs in the 70s to mid 80s. A warm and humid southerly flow is expected during the end of the week into the weekend, though this may result in a daily chance of scattered showers and storms. Storms may be locally strong. This active pattern may lead to additional rainfall amounts in excess of one to three inches, which may lead to flooding.

“Modest wind generation is expected [Wednesday] into most of Thursday with output ranging 4-7 GW. A variable south-southwest flow may develop during the remainder of the week into the start of the weekend. [ERCOT] output may occasionally top out in excess of 8 GW. Wind gen may relax during Sunday.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |