NatGas Price Rebound Unlikely Anytime Soon, EOG Exec Says

Natural gas prices are likely to stay low until there is some significant U.S. demand side growth, and that is not likely to happen until after 2017 when liquefied natural gas (LNG) exports and an expansion of the petrochemical sector kick in, an EOG Resources Inc. senior executive, Billy Helms, told financial analysts Tuesday at the Citi 2015 Global Energy and Utilities Conference in Boston.

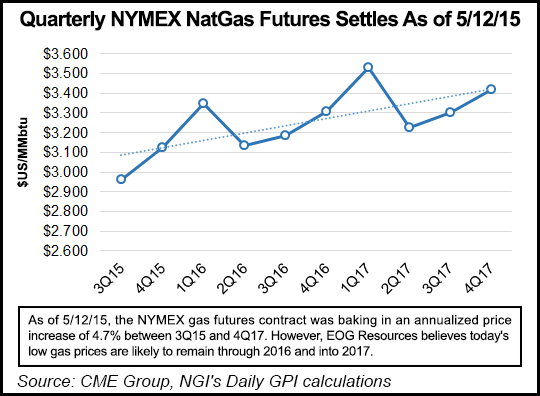

Noting that EOG is sitting on a “deep inventory” of natural gas reserves, Helms, who runs the company’s exploration/production (E&P) operations, said he remains “bearish” on gas at today’s low prices, which he thinks will stick around at least through next year and into 2017.

“Long term, we think it is going to take some extra demand in the way of LNG exports and petrochemicals, which is coming, and the pace of that [new demand] development is going to dictate when prices improve and are sustainable,” Helms said in response to questions about what price would prompt EOG to ramp up its gas drilling program.

“We want to maintain that option [of increased gas production] because eventually we do think it will be very accretive to the company in the future.”

For the past four years, EOG senior officials have said the company had little interest in developing its onshore gas reserves at prices from $2 to $4/Mcf (see Daily GPI, Nov. 12, 2012; Nov. 3, 2011).

Overall, low commodity prices had a significant impact on the company’s first quarter financial results, ending in a 1Q2015 loss of $169.7 million (see Shale Daily, May 5).

EOG’s leaders are convinced that fundamentally it is going to take what Helms called “a change in the demand side of the equation to make a big sustained price improvement for natural gas.” He said there are plentiful gas supplies in the United States, so with any “small price improvement” EOG has the ability to bring a lot of gas to market to respond to any short-term increases in demand.

Helms reiterated that EOG plans to hang on to its “optionality” with gas, so it can ramp up activity when prices go up on a sustained basis, but for now the company remains “bearish” toward gas. “We’ll maintain this inventory so we have the option to move when prices improve.”

He stressed for the financial audience that EOG remains a E&P with a culture that emphasizes exploration. “We’re looking for plays that we can add to our inventory that will be very competitive with existing plays, and we are seeing lots of opportunities out there to do that,” Helms said.

“We’ve always grown organically, and we try to get out ahead of most of competition and pick up what we think are the sweet spots of acreage. We’re seeing no limit in our ability to do that as shown by last year when we doubled our inventory over what we drilled.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |