Smarter, Fewer Shale Plays to Pay Off for Encana, Execs Say

Concentrating on four principal shale plays — two on each side of the U.S.-Canada border — Calgary-based Encana Corp. anticipates sustained production growth in a $50/bbl environment after taking a $1.7 billion financial hit in the first quarter from an impairment charge tied to oil and natural gas price declines and a foreign exchange loss.

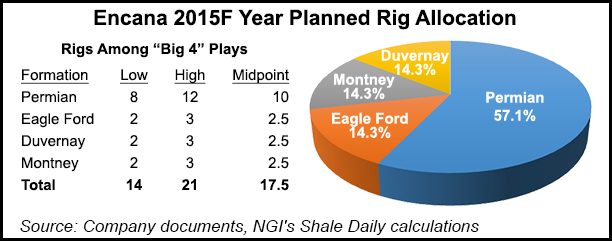

Encana has 20 rigs still operating, 19 in the four areas. It has a single rig working in the Denver-Julesberg (DJ) Basin. Six months earlier, Encana had 44 rigs running throughout the company.

De-emphasizing the 1Q 2015 financial results, Encana CEO Doug Suttles talked bullishly about results and future prospects in the four shale areas — Permian, Eagle Ford, Montney and Duvernay, which collectively represent 10,000 identified drilling locations. Suttles said collectively the foursome represents 1.5-2.4 billion boe in reserves.

In the fourth quarter this year, Suttles said the collective natural gas liquids (NGL) output from acreage in the Permian, Eagle Ford, Montney and Duvernay will increase 35%. “These four assets have some of the lowest supply costs in North America and are delivering attractive margins through this part of the commodity cycle.”

Based on first quarter results in which natural gas production was down 34% (1.8 Bcf/d vs. 2.8 Bcf/d for 1Q2014) and NGL were up by 78% (120,000 b/d vs. 67,900 b/d in the same period last year), Suttles and COO Michael McAllister said the company expects collective production from the four plays to be about 270,000 b/d at year-end, or a 35% year-over-year improvement.

“We believe we are positioned in the best rocks, a pillar of our strategy, and that we are consistently drilling better wells, lowering our cost and increasing the well inventory in these high quality resources.”

Encana stressed its major leaps forward in production equipment and techniques, along with continually improving well completion work. But it also revealed a quarterly noncash, after-tax ceiling test impairment ($1.2 billion) and a nonoperating foreign exchange loss ($500 million).

Nevertheless, company officials said they were considering a capital budget of around $2 billion next year.

McAllister said Encana is “extremely pleased” with recent well results in parts of its Permian play with initial production rates of 2,000 boe/d after flowback. He attributes a lot of the success to the deployment of what Encana calls “resource play hub (RPH),” a means to slashing well costs by up to 25% with six multi-well pads operating simultaneously.

“Company wide, we are focused on cost and Eagle Ford is doing its part,” McAllister said. “We have a line of sight to more than 20% reduction in well costs due to operational efficiencies and supply chain initiatives.”

“Places like the DJ and San Juan Basin have very good margins; they are very profitable plays, but we had to make tough choices on our spending [by concentrating on only the four].”

In responding to an analyst’s question, Suttles said challenges in the DJ and San Juan basins are different than its own areas of operation. “It is not an issue of margins or returns,” he said. “It’s a scale issue, and then of course, we hold this interesting option in TMS [Tuscaloosa Marine Shale].”

For the industry, Suttles was slightly less bullish on looking at the rest of this year, telling one analyst in response to a question that he thinks there will be some uptick in M&A and A&D activity as exploration/production companies try to optimize their portfolios in a longer-lasting low-price environment. But that increased activity still may be “slightly less than people have been anticipating.”

For 1Q2015, Encana saw a sharp drop in cash flow to $495 million, or 65 cents/share, compared to $1.1 billion ($1.48) for the same period last year. Operating earnings were $9 million (1 cent), compared to $515 million (70 cents) in the same quarter in 2014. Sharp declines in oil and gas prices were attributable to the big declines.

A year ago, Encana sold its stakes in Wyoming’s Jonah Field to TPG Capital for $1.8 billion, cutting loose its Green River Basin play in Sublette County, where Jonah is located in one of the largest natural gas discoveries in the 1990s (see Shale Daily, March 31).

In total, Encana Oil & Gas (USA) had a productive area in Jonah of 24,000 acres and more than 1,500 active wells. Estimated year-end 2013 proved reserves totaled 1.493 Bcfe. The transaction with TPG also includes more than 100,000 undeveloped acres adjacent to Jonah known as the Normally Pressured Lance (NPL) area.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |