Only One NatGas Rig Lies Down; Supply Has Staying Power

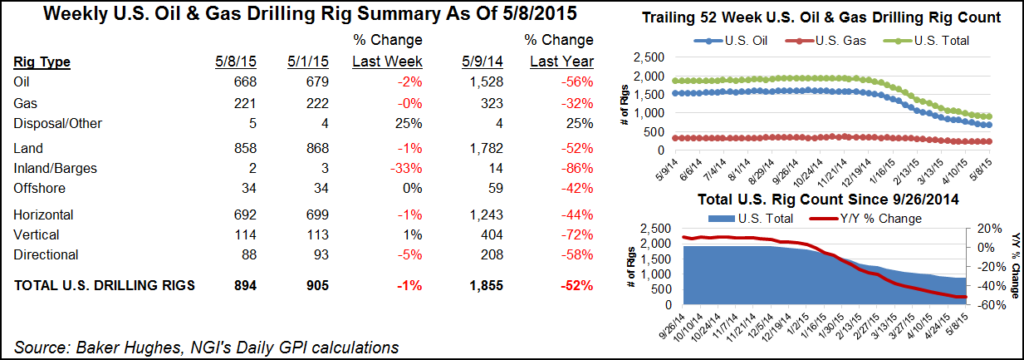

Only one U.S. natural gas-directed drilling rig packed it in during the last week, according to the Friday (May 8) Baker Hughes Inc. rig count, while Canada saw the pullback of three gas-directed rigs amid overall all declines that were more modest than those seen in recent weeks.

Natural gas production remains strong, analysts said in notes published in the last week.

“Domestic production is averaging between 72.5-73 Bcf/d this week, which is slightly softer than what was seen last week but continues to be higher than our low 72 Bcf/d base case summer level,” Societe Generale said in a Thursday note. “We see anything in the 71.5-72.5 range as pretty neutral to our base case. Sustained averages outside that range [are] something to talk about.”

Barclays analysts cited expectations for a cooler-than-normal summer, as well as the belief that infrastructure constraints will be letting loose more natural gas production in the months ahead.

“…[T]he well backlog in the Marcellus should begin to clear once the REX [Rockies Express Pipeline] reversal [see Shale Daily,March 2] is fully ramped up in Q2,” Barclays said. Also expected is more gas out of the Gulf of Mexico (GOM), Barclays analyst Michael Cohen wrote.

“In the GOM, maintenance on the Garden Banks Auger and Enchilada platforms has only just recovered after being offline for several weeks and cutting pipeline receipts onshore by 20% in March and 15% in April,” he said. “With two platforms, Lucius and Hadrian South, ramping up, GOM flows are expected to increase in the months ahead.”

All of this will be happening at about the same time the Midwest and Texas are enjoying temperatures that are expected to be not as hot as normal, Barclays said. Additionally, Producing Region storage levels are expected to become more “overweight” in the next couple of months as long as production continues to increase, he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |