Black Hills Adds Rigs to Accelerate Mancos Shale Development

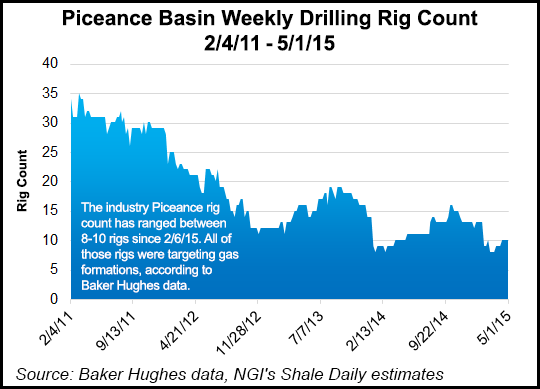

Black Hills Corp.’s exploration/production unit added two rigs in the Mancos Shale of the southern Piceance Basin during the first quarter, taking advantage of lower rig and service costs to accelerate its developmental drilling even as overall first quarter income stayed flat, the company said Tuesday.

The Rapid City, SD-based firm now has three wells producing in the Mancos and expects to have as many as 10 online by the end of this year, with long-range reserve projections of about 10 Bcf/well, CEO David Emery said on an earnings conference call.

“We had a couple of added rigs made available to us at pretty economical rates, so that allows us to accelerate our overall evaluation program of the Mancos,” where the firm now has three operating rigs, Emery said. “It is probably more important for us to do that rather than drill other wells farther to the east.” Black Hills expects a little more liquids-rich gas supply to the west of its current drilling, he said.

In today’s low commodity price environment, Black Hills is taking advantage of the lower service and rig costs in an effort to continue to drive down the completion cost for each well, Emery said. “We also may elect to pump a few more frack stages if costs are cheaper rather than just have absolute low well costs,” he said. “This is part of trying to optimize our overall completions.”

Three horizontal natural gas wells were placed on production early in the first quarter with what Emery characterized as “strong production results to date that have exceeded our expectations.” Black Hills plans to drill up to 10 more wells on three separate pads this year, and the current long-term reserve projections are for 10 Bcf/well, he said in response to questions from analysts.

Oil and natural gas prices were down 26% and 34%, respectively, during the period, which adversely affected profits, said CFO Richard Kinzley. Black Hills reported net income of $48 million ($1.07/share), compared with $48 million ($1.08) in the same period last year.

The three new Mancos wells contributed to a 28% increase in natural gas production in 1Q2015, Kinzley said. “While low commodity prices will likely continue to hamper our oil and gas results in 2015, we are pleased with the momentum we have in proving up our Mancos Piceance Basin shale play,” he said. With the added rigs, Black Hills has increased its oil/gas capital spending budget to $167 million this year from a previous $123 million.

Emery noted that Black Hills will expand drilling in the Mancos beyond this year if commodity prices begin rising on a sustained basis and/or if the company moves ahead with its multi-state utility cost-of-service gas reserves program (see Daily GPI, Feb. 5).

Calling the utility gas supply program a significant growth opportunity, Emery said Black Hills’ proposed direct investment in gas reserves “will provide longer term price stability for customers while also providing increased earnings for shareholders.” He called it “truly a win-win situation.” The company continues to talk with regulators and stakeholders in seven states and evaluate prospects for reserves, including the Mancos shale properties.

Oil and gas generally continues to offer “good upside potential” for Black Hills, and the company’s strategy in this sector has not changed, Emery said. “But due to the low commodity price levels, our focus for 2015 will primarily be on completing our 2014-15 Mancos appraisal program,” he said.

In response to a request for more detail on the results of the first three Mancos wells, Emery noted that Black Hills holds back some of the initial production of the wells, which are estimated to be about 8 MMcf/d, keeping them in the 6-6.7 MMcf/d range. There is also the consideration on the capacity limits of its processing plant in the area.

“There is increasing evidence that we’re better off restricting flow a little bit early in the life of these horizontal wells to get better ultimate reserve recovery,” he said. “Even if we had more planned processing capacity, we probably would not exceed 8 MMcf/d on any of those wells.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |