Devon’s Onshore Cost Initiatives Spur Capex Cuts, While Output Soars

With the commodity crunch biting into first quarter earnings and growth plans, Devon Energy Corp. implemented cost reduction initiatives during the first quarter that pushed operating costs down by 9% from a year ago.

CEO John Richels told analysts during a conference call on Wednesday that several initiatives underway this year should favorably impact results.

“Our focused drilling activity has generated production growth that exceeded our guidance for the third consecutive quarter, our capital programs benefited from substantial service cost savings and we did an exceptional job controlling operating expenses,” he said.

However, the Oklahoma City-based operator, like its peers, was unable to overcome huge impairments to the bottom line in the first quarter. Gas, oil and liquids sales fell to $1.34 billion, versus year-ago sales of $2.56 billion. The latest results included an asset impairment of $5.46 billion before taxes.

Making do with what it had on its plate, Devon was able to reduce overall field operating costs by 9% year/year to $10.73/boe. Most of the significant savings were in lease operating costs (LOE), the largest field-level expense. LOE fell by 7% to $8.97/boe and was 7% below guidance. The cost savings were realized across all of the onshore basins.

Based on year-to-date cost savings, the midpoint of full-year LOE is forecast to decline to around $9.30/boe in 2015. Compared with previous guidance, this implies a full-year cash cost savings of around $170 million. With the cost initiatives in place, the exploration and production capital program now is expected to be $3.9-$4.1 billion, $250 million less than previous guidance.

While costs are coming down, “we are also beginning to see improving economics in our core basins from both lower industry costs and efficiency gains,” Richels said. “In fact, service and supply costs for the industry have come down considerably from peak rates last year. Current market rates for our largest capital costs, drilling and pressure pumping, have experienced price reductions in excess of 20% from the fourth quarter of last year.

“While the magnitude of the decrease is not a surprise to us, the speed of realization of these better rates has exceeded our expectations and the assumption in our original 2015 capital guidance.”

COO Dave Hager, who will take over as CEO with Richels’ retirement in July, said “from an operations perspective, the first quarter was arguably one of the best in the company’s 40-year-plus history.”

The big highlight was the prolific Eagle Ford Shale, which produced 122,000 boe/d net with one operated rig. Production was 23% higher sequentially and almost 140% more than in March 2014, Devon’s first full month of ownership (see Shale Daily, Nov. 20, 2013).

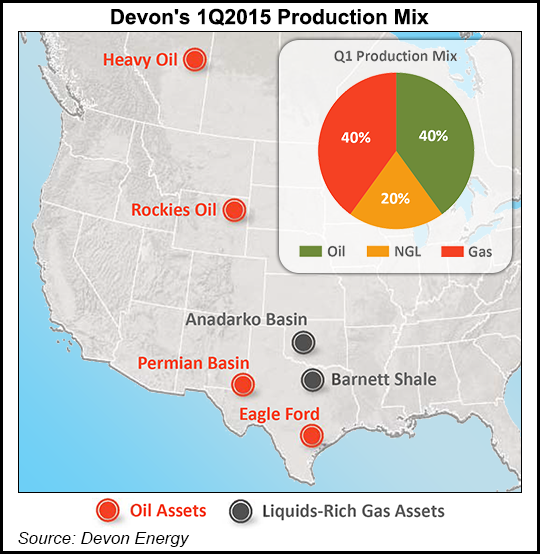

Gains were made across the onshore, including the Permian Basin, which saw production reach 102,000 boe/d using 15 operated rigs. In the Anadarko Basin, Devon produced 88,000 boe/d of natural gas-weighted production using eight rigs, while the Barnett Shale, still the biggest gas asset, provided 191,000 boe/d with 931 MMcf/d of gas, and no rigs in operation. The Rockies assets, also gas-weighted, provided 51,000 boe/d using two rigs.

Overall, total output from a year ago averaged 685,000 boe/d, 22% higher year/year and exceeding guidance by 12,000 boe/d. Natural gas accounted for 40% of output, matching that of oil, with liquids responsible for 20% of the mix.

North American gas output from the retained assets climbed to 1.65 Bcf/d from 1.61 Bcf/d. Devon sold 585 MMcf/d since the year-ago period. U.S. gas carried the load, with output reaching 1.62 Bcf/d versus 1.59 Bcf/d a year ago. Canada gas production climbed by 8 MMcf/d year/year to 28 MMcf/d.

Because of its improving outlook for oil production, Devon raised its top-line production growth guidance in 2015 to a range of 5% to 10%.

During 1Q2015, net losses totaled almost $3.6 billion (minus $8.88/share), versus year-ago profits of $324 million (80 cents). Operating losses in 1Q2015 soared to nearly $5.5 billion from year-ago income of $560 million. Net cash from operating activities increased to $1.65 billion from $1.41 billion.

The midstream division recorded operating profits of $193 million, a 6% gain from a year ago. The profits were driven by growth from Devon’s ownership in the EnLink Midstream partnership.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |