Low Oil Prices Spur Questar E&P, Pipeline Projects

While slashed global oil prices have had a negative impact on recent earnings results, they have encouraged Salt Lake City-based Questar Corp. to look for acquisitions for its exploration and production (E&P) business and to continue pursuit of a converted natural gas pipeline for oil deliveries into Southern California.

During a conference call with analysts last Thursday, Questar CEO Ron Jibson said there are at least two confidential, third-party utility deals pending for the E&P unit, WexPro, and Questar’s pipeline unit is finding continued market interest in a gas-to-oil pipe conversion that would bring up to 120,000 b/d of U.S. crude oil into refineries in and around the ports of Long Beach and Los Angeles.

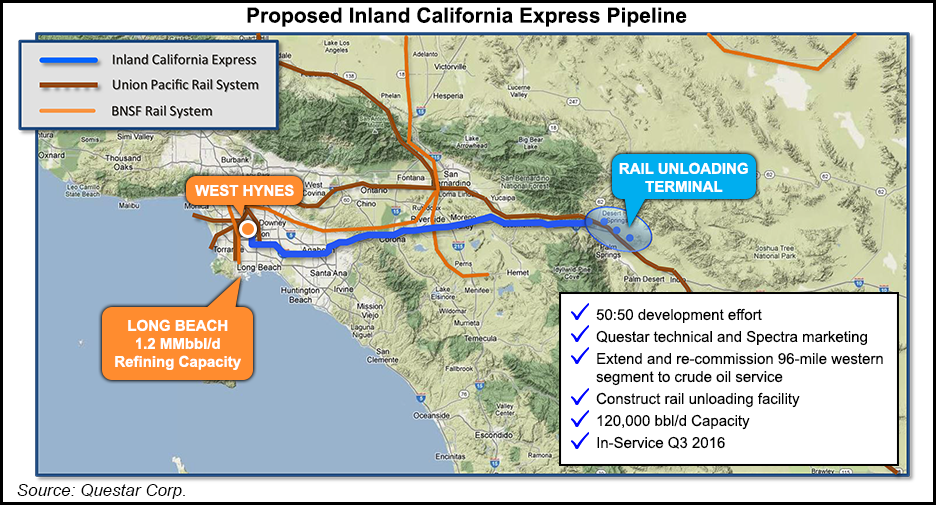

Questar Pipeline and partner Spectra Energy are developing the gas-to-oil Inland California Express project, recommissioning the 96-mile western segment of Southern Trails Pipeline to transport crude oil from Whitewater, CA, to Long Beach. Jibson said the partners are developing an optimized crude oil rail terminal design before finalizing a preferred uploading site near Whitewater.

“This project continues to attract interest from prospective customers,” said Jibson, although he acknowledged that current oil prices and narrower price differentials could impact the targeted in-service date.

Questar Pipeline Co. CEO Allan Bradley said the entire pipeline corridor has been surveyed, and “we think the market is still very supportive of this project,” and the preliminary agreement with the anchor anchor shipper has been extended, “which is a very positive sign.” The engineering and environmental work continues to be refined for a regulatory application. “We still anticipate a go/no-go decision in the middle of this year, shooting for an end-of-2017 start.”

Details about WexPro’s reserve agreements with two unnamed utilities remain confidential, Jibson said, but the regulatory processes would be entirely different for each of the prospective agreements.

“Now we are focused on the [reserve] acquisition with the first major utility, and once we get that in place we should be able to disclose more information,” he said.

The natural gas utility operation last week asked Utah state regulators to cut annual retail charges by $52.2 million, citing a continuing plunge in wholesale gas prices. In September 2013, the utility also reduced its retail charges (see Daily GPI, Sept. 9, 2013).

If the rate decrease is approved by the Utah Public Service Commission, typical residential customers would see their annual bills drop by about $32.

Questar reported 1Q2015 earnings of $84.6 million (48 cents/share) compared with $85.1 million (48 cents) for the same period in 2014. Questar Pipeline’s 1Q2015 profits were down year/year to $13.9 million from $15.7 million on lower natural gas liquids prices and hedging adjustments.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |