NatGas Traders Kept Busy With Short Two-Day Trading Week

The abbreviated Thursday-Friday physical trading week overall didn’t see much price movement as the NGI Weekly Spot Gas Average rose just a penny to $2.39, but there was plenty of activity to go around. With the exception of the Northeast and Midwest, prices rose anywhere from a nickel to a dime.

The week’s top performing market point was Northwest Sumas, with a rise of 29 cents to $2.19, and the week’s bottom dwellers were Algonquin Citygates, with a loss of $1.60 to $1.80, followed closely by Tennessee Zone 6 200 L with a decline of $1.39 to $1.84. Regionally, the Northeast proved to be the greatest loser, dropping 18 cents to $1.92, and the week’s top dog was California, with a rise of a dime to $2.66.

The Midwest slipped 2 cents to $2.71 but the Midcontinent and East Texas each rose 4 cents, to $2.46 and $2.54, respectively.

South Texas added a nickel to $2.53, South Louisiana climbed 6 cents to $2.57 and Rocky Mountain points averaged 9 cents higher at $2.38.

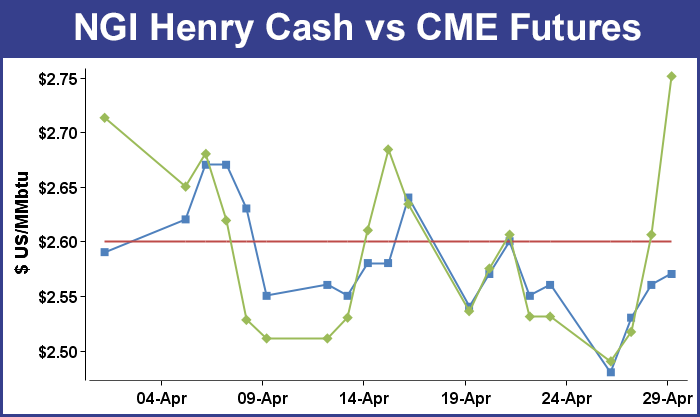

Bolder action was seen in the futures market with the June contract adding 17.0 cents to $2.776 over just the two-day span.

Although a one-cent move in the broader weekly physical average might seem uneventful, Thursday-Friday activity in both futures and cash trading kept traders hopping. Thursday saw most physical traders getting their deals done prior to the release of weekly storage data from the Energy Information Administration (EIA). The 10:30 a.m. The report caught a number of traders by surprise, as the 81 Bcf addition to storage came in less than what many had expected. Natgasweather.com calculated a 92 Bcf injection and ICAP Energy was looking for an 89 Bcf build. A Reuters survey of 24 traders and analysts revealed an average 85 Bcf with a range of 70 Bcf to 94 Bcf.

Some suspected even higher. The folks at Energy Metro Desk (EMD) said, “We see our Survey Index this week came in at 87 Bcf, and we have a sense that the EIA will come in higher than that number by 5 or more. The range is way too wide, and the spread between the three categories we track came in above the 3 Bcf watermark. So something is amiss.” John Sodergreen, EMD editor, estimated a 90 Bcf build.

Prices lost no time reacting to the lower than expected figure. June futures rose to a high of $2.713 after the number was released and by 10:45 EDT June was trading at $2.692, up 8.6 cents from Wednesday’s settlement.

“We had heard a number anywhere from 85 Bcf to 90 Bcf and we were trading 3 cents lower when the number came out,” said a New York floor trader. “Volume-wise, we are above average at almost 80,000 [June] contracts, and usually we are at 55,000 when the number comes out.

“We’ve only settled below $2.50 one day, so I think we may have seen the lows for a while, but we are still within the $2.50 to $3 range. There is no weather to speak of.”

Tim Evans of Citi Futures Perspective said the report should “provide at least a short-term boost to market sentiment. While still more than the 56-Bcf five-year average, the report should at least count as less bearish than anticipated in our view.”

Short term boost indeed. June futures ended the day up 14.5 cents to $2.751.

Inventories now stand at 1,710 Bcf and are 741 Bcf greater than last year and 75 Bcf less than the 5-year average. In the East Region 37 Bcf were injected and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region rose by 40 Bcf.

For the two days June futures added a healthy 17 cents, but top traders suggest waiting for a market correction to add to any long futures positions. “While this market saw another strong advance [Thursday] that was larger than we had expected, the magnitude of the 20-cent price pop over the past two sessions reinforces our assumption that the funds are almost fully allocated to the short side and are looking for even minor reasons to accept partial profits,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Thursday. “The price action also reinforces our opinion that a $3 price handle will be established come June, probably within the late summer contracts.

“While an argument can be made that the response to the reported 81 Bcf storage injection was an overreaction, given proximity to our expected 85 Bcf build, we feel that this market is set up for a strong finish to this week’s trade. We also believe that the natural gas scooped up some bullish spillover form the oil price strength. However, another increase in the gas rig count, regardless of magnitude, could trigger a significant amount of selling that could eventually open the door to another round of fresh lows across the month of May. Any investment-type positions established within the June contract below the $2.50 mark seen earlier this week would represent a hold. But any additions to longs should await another price pullback to below the $2.50 level.”

In Friday’s physical trading buyers for weekend and Monday gas lost no time submitting their bids as temperatures in eastern markets were expected to reach above 80 degrees by Monday and on-peak power posted double-digit gains. But, as some traders focused on the heat, reports were coming in of increased price-related production shut-ins clouding the horizon.

The overall market added 7 cents to $2.43, but some Gulf, Midwest and Midcontinent points were up by more than a dime on average. Futures continued to advance and made it four straight days of gains. At the close June had advanced 2.5 cents to $2.776 and July was up by 2.9 cents to $2.831.

Physical prices in the Gulf, Midwest and some eastern points rose as on-peak power quotes posted solid gains, and temperatures in New York and Philadelphia were forecast to be above 80 degrees by Monday. Intercontinental Exchange reported that on-peak Monday power at the ISO New England’s Massachusetts Hub rose $3.31 to $26.76/MWh and on-peak power at the New York ISO’s Zone G delivery point (eastern New York) added $4.29 to $32.29/MWh. Monday on-peak power at the PJM West Hub jumped $14.42 to $45.11/MWh.

Gas for weekend and Monday delivery on Transco Zone 6 into New York City rose 4 cents to $2.65, and packages to southeasternmost Pennsylvania and southern New Jersey on Transco non-New York North added 5 cents to $2.65.

Marcellus points were not so fortunate and some began flirting with sub $1 quotes. Gas on Millennium shed 10 cents to $1.30, and parcels on Transco Leidy were seen 31 cents lower at $1.11. Gas on Tennessee Zone 4 Marcellus fell 28 cents to 96 cents, and gas on Dominion South fell a dime to $1.39.

Sub $1 gas in the Marcellus may become more prevalent as major construction and associated curtailments get under way. In a report, industry consultant Genscape said, “Transco plans to initiate construction on its Leidy Southeast Expansion project on May 1st and continue through June 12th. The expansion will add 510 MMcf/d of new capacity on the Leidy Line to help move Marcellus gas to Mid-Atlantic and Southeast markets.

“Transco has noted it will have limited flexibility to transport gas from Leidy and associated receipt locations to the Station 210 pool area and other markets east of Transco Leidy Station 505. During the event, capacity through Leidy Station 505 will be reduced to 2,225 MMcf/d, a [drop of] 524 MMcf/d of capacity from the normal design capacity of 2,749 MMcf/d.”

That capacity may not be missed. New reports of price-related shut-ins were confirmed last week. Williams CEO Alan Armstrong said Thursday customers including Cabot Oil & Gas Corp. plan to curtail 300-500 MMcf/d for five or six months (see Shale Daily, May 1a).

Management with National Fuel Gas Supply Corp. said the exploration arm Seneca Resources Corp. curtailed 150 MMcfe/d in the fiscal second quarter after shutting in 200 MMcf/d early this year (see Shale Daily, May 1b). Through this year Chesapeake Energy Corp. has said it would curtail 250 MMcf/d from Appalachia.

If available, that Marcellus gas may look pretty attractive by early next week as temperatures are forecast to warm considerably. Forecaster Wunderground.com predicted that Friday’s high of 64 in New York City would rise to 67 by Saturday and reach 82 Monday. The normal high in the Big Apple in early May is 67. Philadelphia’s Friday high of 63 was anticipated to climb to 73 Saturday and jump to 84 by Monday. The normal high in Philadelphia is 67.

The National Weather Service in suburban Philadelphia said by Sunday and Monday “a substantial warming trend expected heading into the new work week with a building southeast U.S. Ridge. Temperatures climb toward the double-digit mark by Monday, with a more pronounced return flow setting up with the surface high sitting offshore. Temperatures both days are expected to be above normal, with Monday flirting with the 80 F mark. Things should be pretty well capped so expect a dry period during this time frame.”

Gulf and Midwest points firmed. Deliveries to ANR SE were quoted 14 cents higher at $2.62, and packages on Columbia Gulf Mainline added 13 cents to $2.63. Gas at the Henry Hub rose 10 cents to $2.67, and gas at Katy was quoted 11 cents higher at $2.63.

Deliveries to Alliance and the Chicago Citygates both rose a dime to $2.65 and $2.67, respectively, and gas on Consumers gained 16 cents to $2.89. Parcels on Michcon changed hands at $2.89, up 15 cents.

Gas buyers over the weekend across the PJM power grid may need to be on their toes as the contribution from renewable energy sources is expected to be low. WSI Corp. in its Friday morning forecast said, “An upper-level system and an area of low pressure off the East Coast will continue to bring mostly cloudy skies and showers across the Mid Atlantic today, but mostly sunny skies are expected across western PJM.

“Light and variable wind generation is expected during the next couple of days. A mild south-southwest breeze ahead of a cold front should cause wind gen to increase during Saturday night into Monday. Output may occasionally climb back into the 2-3 GW range.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |