No Timeline Yet For Mexico’s Shale Contracts, But More NatGas Pipelines Planned

The Mexican government says dozens of companies are interested in signing contracts to explore and extract oil and gas in the shallow waters of the Gulf of Mexico (GOM), but it has not yet set timelines for similar contracts in its shale formations, the deepwater GOM and onshore conventional drilling.

Meanwhile, after sweeping energy reforms enacted by President Enrique Pena Nieto, the head of Mexico’s state-owned electric utility said the country is planning a 75% increase in the total number of miles of its natural gas pipeline network by December 2018, when Nieto leaves office.

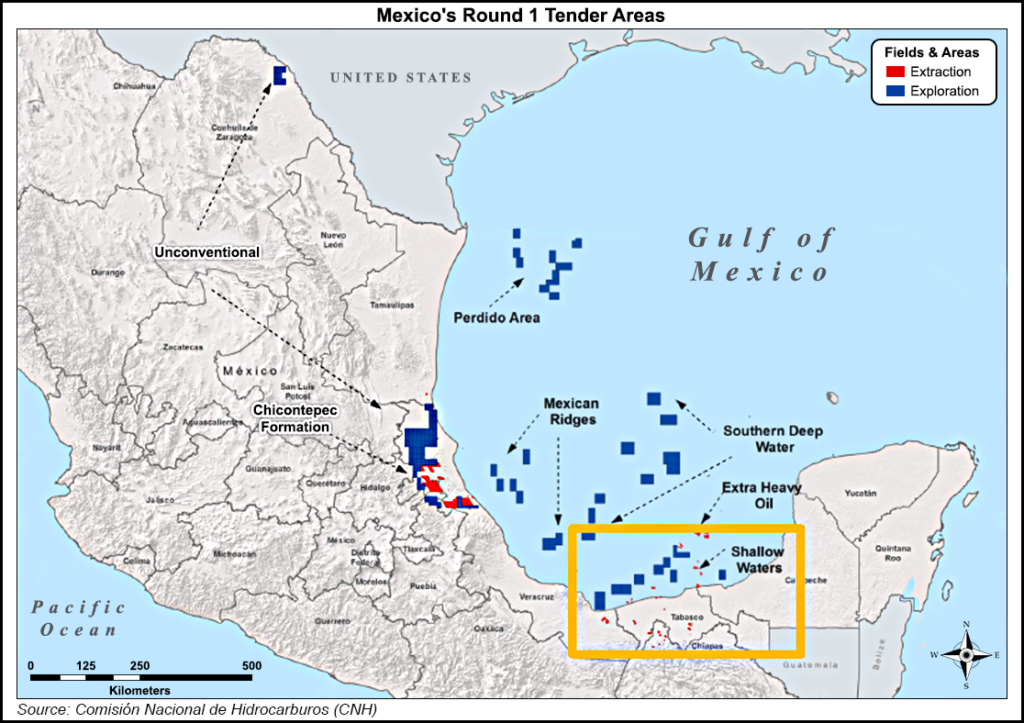

Last December, Mexico’s Comision Nacional de Hidrocarburos (CNH) launched what it has dubbed “Round 1” for bidding on the development of the country’s resources, inviting oil and gas companies to bid on 14 offshore exploratory blocks in the shallow GOM (see Daily GPI, Dec. 11, 2014). Two months later, CNH invited companies to bid on five contracts to extract oil and gas from nine fields in the shallow GOM.

According to slides by CNH President Commissioner Juan Carlos Zepeda Molina — which were presented during a keynote address at Rice University’s Baker Institute for Public Policy last Tuesday — as of April 23, 49 companies have expressed interest in the exploration contracts, and 34 have started the prequalification process. Also, 20 companies are interested in the extraction contracts, with seven having begun the prequalification process.

CNH will award the 14 exploration contracts on July 15 and the five extraction contracts on Sept. 30.

Molina’s slides indicate CNH will publish its bidding terms, including a model contract, for onshore conventional drilling in April, followed by the deepwater GOM and extra-heavy oil fields in May, and the Chicontepec Formation and other unconventional shale plays in June. The launch date for bids will take place in April, May and June, respectively.

Although CNH said last December that 69 blocks would be tendered during Round 1 — including 109 exploration areas and 60 production fields — Molina’s slides did not reveal a total number of blocks. A report by the Wall Street Journal said the Mexican government was considering reducing the number of shale blocks to offer, citing the collapse in world crude oil prices.

“They’re looking out months from now, and they’re saying ‘should we put raspberries or strawberries on the cake?'” George Baker, an energy consultant with Baker & Associates in Houston, told NGI’s Shale Daily on Wednesday. “They haven’t even invited the guests yet.

“They’re saying they have an ambitious project way out in the future, and that they’re going to have a large number of blocks. But prices are low and they haven’t received anything positive yet in the way of any commitment by any oil company to do any of this. It would be prudent for them to say ‘let’s be cautious and let’s not overextend our expectations or our ambitions.'”

During an interview at IHS CERAWeek 2015 in Houston on April 23, Enrique Ochoa Reza, director of Mexico’s Comision Federal de Electricidad (CFE), said that since 2012, Mexico has decreased its use of fuel oil for power generation by 43%.

“We need to substitute the use of fuel oil, which is a very expensive way to create electricity, and has been a very important source of power in Mexico for the longest time,” Ochoa Reza told IHS Senior Vice President Carlos Pascual. “We have been making a lot of progress.

“In addition to that, currently Mexico has enough of a supply of natural gas for their industrial and power purposes. Back in 2012, Mexico lacked enough natural gas to be able to supply the industrial and power sectors. We had critical alerts. Now we have had 22 months without critical alerts. We have enough natural gas to produce power, to reduce electricity tariffs and to supply the industry.”

Ochoa Reza said it was ironic that Mexico was rich in natural gas, and lies next door to the United States, one of the world’s most important gas producers.

“But we didn’t have enough natural gas pipelines to receive that natural gas, and we didn’t have the reforms that would allow us to extract that natural gas from our soil,” Ochoa Reza said. “Now we have both elements, and CFE is promoting the construction of more natural gas pipelines.

“We’re going to be increasing the processes that we have underway, and new priorities will be announced during second half of this year for a 75% increase in the number of miles of natural gas pipelines by the end of Nieto’s administration.”

Last year, Mexico’s Congress enacted legislation introduced by Nieto to reform the nation’s energy policies and break some of the monopolistic power of state-owned Petroleos Mexicanos (Pemex) (see Daily GPI, Aug. 7, 2014; May 2, 2014). Among the reforms was a directive allowing outside investment in Mexico’s energy sector.

In March, private equity firms BlackRock and First Reserve agreed to invest about $900 million for a 45% stake in the second phase of Pemex’s Los Ramones pipeline project, which will carry natural gas produced in the U.S. to markets in Mexico (see Daily GPI, March 27). First Reserve and Pemex then announced a separate $1 billion agreement earlier this month to build infrastructure across the country (see Daily GPI, April 7).

IEnova, a subsidiary of Sempra Energy, is also busy in the country, working on three separate gas pipeline projects, including Los Ramones and the Sonora Pipeline in the western part of Mexico, just south of Arizona. Sempra CEO Debra Reed said in March that CFE may have four additional pipeline projects, worth a combined $1.8 billion, for companies to bid on.

“The Mexican energy reforms — I want to emphasize, not only in the hydrocarbon sector but [also] in the electricity sector — I think are really important and open up much more [of a] chance for us to be integrated on infrastructure and on energy trade,” U.S. Department of Energy (DOE) Secretary Ernest Moniz said at an April 21 hearing before the Senate Committee on Energy and Natural Resources (see Shale Daily, April 28).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |