Antero Switching Focus to Utica Liquids For Remainder of Year

Antero Resources Corp. managed to reduce the impact of declining commodity prices through its hedge book last quarter, while an 89% increase in production helped to prevent the steep slide in revenue and profits that some of its peers have recently reported.

That growth is expected to slow for the remainder of the year, however, as a previously announced plan to defer the completion of 50 Marcellus Shale wells this quarter is expected to cut into daily production volumes (see Shale Daily, Feb. 27). The company completed and placed into sales 41 Marcellus wells last quarter.

CFO Glen Warren said that most of the company’s activity in the play will be finished by the end of the second quarter before it switches more attention to Ohio’s Utica Shale, where production reached a record 274 MMcfe/d in the first quarter.

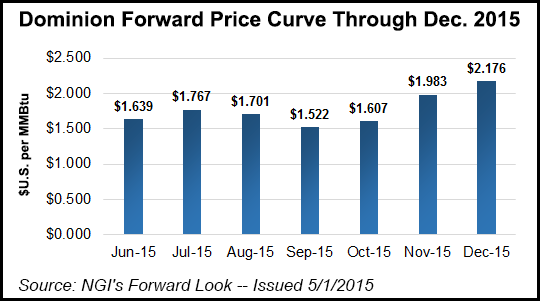

“The timing of the [Marcellus] deferrals was designed to limit our exposure to Dominion South and [Texas Eastern Transmission Co. (TETCO)] M-2 pricing during the summer months, where strip prices are trading at a $1.12 and $1.05 discount, respectively, for the remainder of 2015,” Warren said.

Antero turned inline 16 Utica wells in the first quarter and plans to run four rigs and five completion crews in the play for much of the year to place another 45 wells into sales, CEO Paul Rady said.

Still, unlike others in the Appalachian Basin, Rady said the company is not switching its focus to dry gas (see Shale Daily, April 29; April 28; April 23).

“We are aware and certainly see others in the industry talking about how dry gas is becoming more competitive with the liquids rich wells — of course it’s because the liquids prices are down,” he said. “We really like our dry gas areas, but we still give the edge to liquids rich. I think others are starting to turn to the deep dry Utica, and we’re keeping an eye on that. We need a better feel of well costs and actual decline curves. So, we’ll watch others and possibly do some ourselves in the future, but right now, the edge still goes to liquids rich.”

Rady said Antero would not likely drill a deep dry gas Utica well in West Virginia until sometime next year or after, as the company awaits more takeaway capacity.

Antero produced about 1.5 Bcfe/d in the first quarter, up from 786 MMcfe/d in the year-ago period and about 1.27 Bcfe in the fourth quarter. Production consisted of 1.2 Bcf/d of natural gas, 36,006 b/d of natural gas liquids (NGL) and 4,068 b/d of crude oil. Production for the remainder of the year is expected to average roughly 1.4 Bcfe/d.

The company has reduced its rig count from 21 to 11 in recent months, incurring contract termination fees of $9 million in the first quarter. But Rady said the company recently started to achieve roughly 10% savings on oilfield services, which equates to about $1 million per well.

Including hedges, the company earned $4.42/Mcfe for its Oil, NGLs and natural gas, down from $4.68/Mcfe in the fourth quarter and down from $5.79/Mcfe in the year-ago period. But the company realized $185 million in cash settled hedges during the quarter. Revenue was $1.2 billion, up from $168 million in 1Q2014 and down slightly from $1.5 billion in the fourth quarter.

The company recorded net income of $394 million ($1.49/share), up from a net loss of $95 million (minus 36 cents/share) at the same time last year. First quarter net income was down from $607 million ($2.32/share) in the fourth quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |