Bears Rattled by Lean NatGas Storage Data

Natural gas futures jumped after the release of government inventory figures showing an increase in working gas storage that was less than expectations.

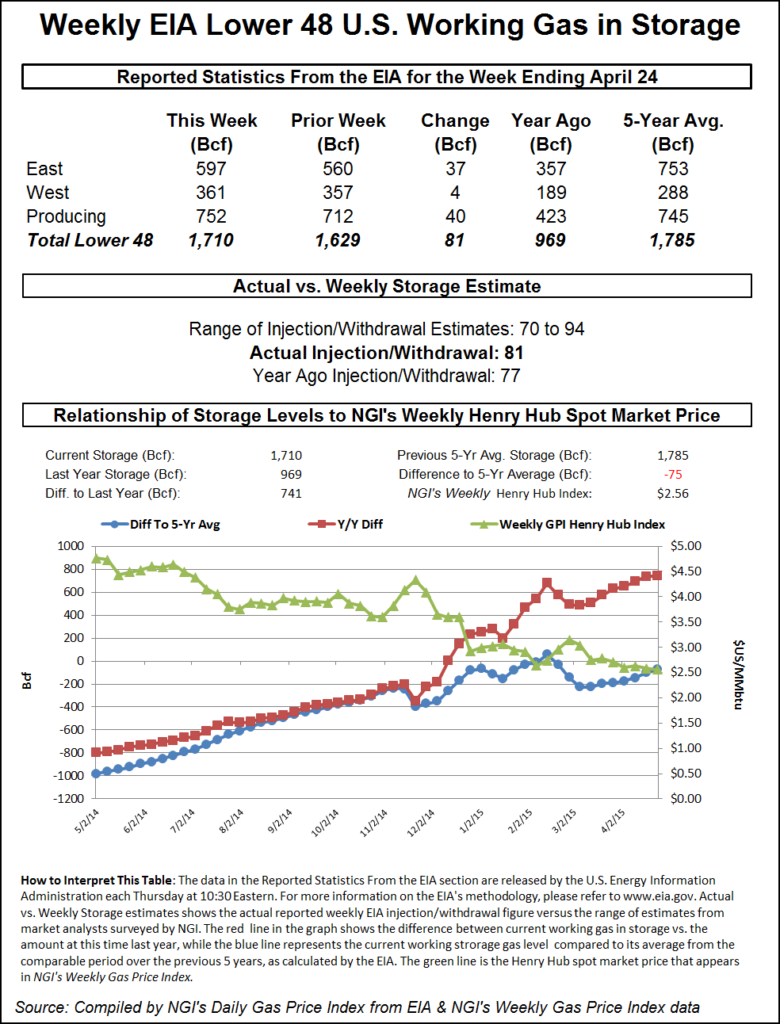

For the week ended April 24, the Energy Information Administration (EIA) reported an injection of 81 Bcf in its 10:30 a.m. EDT release. June futures rose to a high of $2.713 after the number was released, and by 10:45 a.m. June was trading at $2.692, up 8.6 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase just under 90 Bcf. A Reuters survey of 24 traders and analysts showed an average 85 Bcf build with a range of 70 Bcf to 94 Bcf. ICAP Energy calculated an 89 Bcf increase, and Citi Futures Perspective was looking for a build of 82 Bcf.

“We had heard a number anywhere from 85 Bcf to 90 Bcf and we were trading 3 cents lower when the number came out,” said a New York floor trader. “Volume-wise, we are above average at almost 80,000 [June] contracts, and usually we are at 55,000 when the number comes out.

“We’ve only settled below $2.50 one day, so I think we may have seen the lows for a while, but we are still within the $2.50 to $3 range. There is no weather to speak of.”

Tim Evans of Citi Futures Perspective said the report should “provide at least a short-term boost to market sentiment. While still more than the 56 Bcf five-year average, the report should at least count as less bearish than anticipated, in our view.”

Inventories now stand at 1,710 Bcf and are 741 Bcf greater than last year and 75 Bcf less than the five-year average. In the East Region 37 Bcf was injected, and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region rose by 40 Bcf.

The Producing region salt cavern storage figure was up by 18 Bcf to 209 Bcf, while the non-salt cavern figure increased 23 Bcf to 543 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |