EIA Crude Rail Stats Deconstructed; North Dakota Adds Inspectors

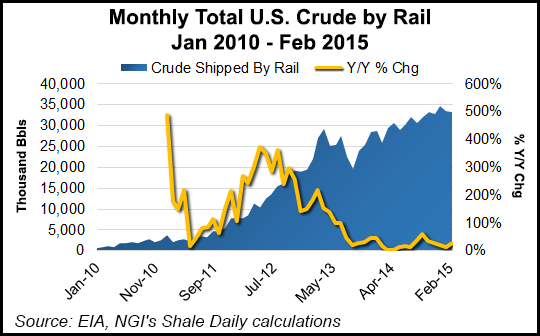

The transportation of more crude oil by rail nationwide continues to draw attention, which likely will continue, according to both the U.S. Energy Information Administration (EIA) and North Dakota legislators.

EIA data provides insights into the volumes and direction of crude-by-rail (CBR) shipments, which are destined to increase and change geographical area of focus, according to analyst Sandy Fielden, who tracks CBR for consultant RBN Energy Inc.

“CBR is not going away; we anticipate continued growth in shipments to the West Coast refineries and steady, if not growing, movements to the East Coast,” Fielden said. He based his estimates on EIA data, and despite the current “squeezing” of crude from trains, given the growth in pipeline buildouts, safety/environmental rules and low oil prices.

Fielden told NGI’s Shale Daily that CBR shipments to the West Coast would continue to increase unless pipelines are built.

“The pace of growth will be slowed by regulation and permitting, but as long as crude is being produced, then it makes sense to process it nearer to the wellhead. So if crude is produced closer to the West Coast (North Dakota or in the Rockies), it makes sense to process it at existing West Coast refineries,” he said.

“Crude production in Alaska is declining, as it is in California, so West Coast refineries need new sources. It’s either imports or domestic. Domestic crude is going to be more competitive as long as there is an export ban on U.S. crude.”

Between January 2012 and January 2015, EIA data indicate that CBR grew 18-fold in the Rockies region, defined as Montana, Wyoming, Colorado, Utah and Idaho, similar to the types of rail transport growth in North Dakota and Western Canada in the past, Fielden said.

Several large takeaway pipelines are set to begin this year and next in the Rockies to alleviate recent constraints, and Fielden said rail has “taken up the slack and helped crude get to market in 2014.”

That mirrors additional rail crude-loading facilities built in Wyoming, which has added five terminals with 400,000 b/d capacity collectively since the end of 2013. Colorado also added three rail-loading terminals with 130,000 b/d capacity over the same period, Fielden said.

In the EIA data, the origin and destination of crude shipments is not identified, but Fielden is convinced that the rise in Gulf Coast rail shipments is because of Permian Basin production, which he said is not experiencing takeaway capacity constraints as significant as in other regions.

“However, the location that has experienced the greatest congestion due to lack of pipeline capacity has been the Permian in West Texas,” he said. “That congestion led to the building of a small number of CBR loading terminals to move stranded crude to market with roughly a 140,000 b/d load capacity.”

On Monday, North Dakota lawmakers created a crude rail safety program, adding two safety inspector positions to implement the state’s role in overseeing crude rail transport by the Public Service Commission (PSC).

Lawmakers authorized $523,000 for the program, although the PSC had asked for nearly $1 million over the next two years to supplement inspections by the Federal Railroad Administration, which has two inspectors for the state. The new program is the result of a conference committee compromise that was approved by the state Senate and the House.

In North Dakota, crude rail traffic increased by 233% between 2000 and 2012, according to PSC Commissioner Julie Fedorchak. The PSC has tallied 75 accidents related to track and equipment problems and more than $30 million in damages during the last five years.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |