Natural Gas Forward Markets Look to May and Beyond

Traders in the natural gas forward market eyeing May, June and the remainder of the summer strip don’t seem to be expecting much in the way of surprises. Some obvious considerations seem to be the degree to which reductions in industry capital expenditures will reduce production, the usual hurricane forecasts and the weather in general.

It seems that traders in Gulf Coast markets feel pretty confident about where May pricing should be thus far, according to NGI‘s Forward Look. Prompt month pricing at Transco Zone 3 has remained mostly flat over the course of April trading, hovering around a two-cent discount to the futures contract, while Southern Natural has remained within a two- to three-cent discount range as well.

The summer contracts at these points have also held pretty steady as forecasters at WSI have pointed to another mild hurricane season. The forecasters said they expect a total of only nine named storms, five being hurricanes, and only one of them major (Category 3 or higher), to form during the 2015 Atlantic hurricane season, which runs from June 1 to Nov. 30 (see Daily GPI, April 21).

Regardless, the market has been caring less and less about hurricanes and the Gulf of Mexico in general as of late because, as NGI’s Patrick Rau, director of strategy and research, said in a recent webinar, there has been a large swing in where gas is produced in the United States (see Daily GPI, April 8).

Traders seeking volatility have been looking north to the demand centers of Boston and New York, as well as the new production centers in the Marcellus. Transco Zone 6 NY forward pricing for both May and June has climbed up a few rungs over the course of April. While still negative to the Henry Hub, the May contract has gained 14.1 cents from its April 1st trading; June has done likewise up 15.7 cents over the period.

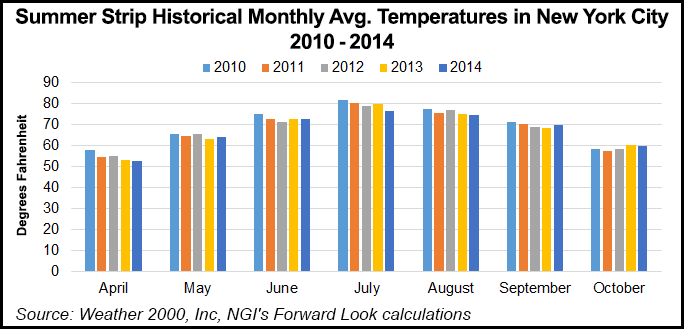

May average daily temperatures in New York will likely be somewhere around 65 degrees this year which is where they have averaged over the past five years according to Weather 2000 data. NGI’s Bidweek Alert issued Friday April 24 shows a bidweek basis range of minus $0.17 to minus $0.165 for Transco Zone 6 New York; May bidweek basis in Boston at the Algonquin Citygates currently stands at about minus 22 cents.

Over the course of April, prices at Dominion, which tends to be influenced by the Marcellus Shale, have fallen from a May basis of minus $1.096 to minus $1.206; June looks little better for producers having fallen 5.2 cents since April 1 trading to a basis of minus $1.049.

In the first day of the May bidweek, NGI’s Bidweek Alert is showing a Dominion basis currently ranging between minus $1.23 and minus $1.20. Tennessee Zone 4 Marcellus is even deeper in the negatives with a bidweek basis range of minus $1.56 to minus $1.55.

Injection season is off to a strong start, with the EIA’s reported injection for the week ended April 17 showing caverns in the Lower 48 adding a total 90 Bcf, which is double the figure of the year-ago week. “It will be interesting to see whether the capex reduction by the industry will dampen injections this summer. If not we may end the season above the five-year average,” said NGI Markets analyst Nathan Harrison.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |