NatGas Cash, Futures Diverge In Weekly Trading

The NGI Weekly Spot Gas Average managed a gain of 6 cents to $2.38 for the week ended April 24. Northeast locations had the greatest range with individual points in the region trading as low as 92 cents and as high as $4.00 during the week, but overall regionally the Northeast fell to the bottom of the stack with an average $2.10, up 13 cents from the previous week’s average.

Most individual points moved within a dime of unchanged, but the point posting the greatest gain was Tennessee Zone 6 200 L with a rise of 70 cents to average $3.23. At the other end of the scale was Texas Eastern M-2 30 Delivery with a loss of 39 cents to $1.96. Northwest Sumas was right behind with a decline of 33 cents to $1.90 as extraordinary Pacific Northwest wind generation prompted lower power generation requirements and less need for gas-fired generation.

The Rocky Mountains and the Midcontinent didn’t do all that much better with averages of $2.29 — up 4 cents — and $2.42 — up a nickel, respectively. South Texas was seen flat at $2.48.

East Texas averaged $2.50, down a penny, and South Louisiana was unchanged at $2.51.

California weekly gas came in at $2.56, up 4 cents. The Midwest rose to the top of the leader board with a weekly posting of $2.73, up 6 cents over the previous week’s average.

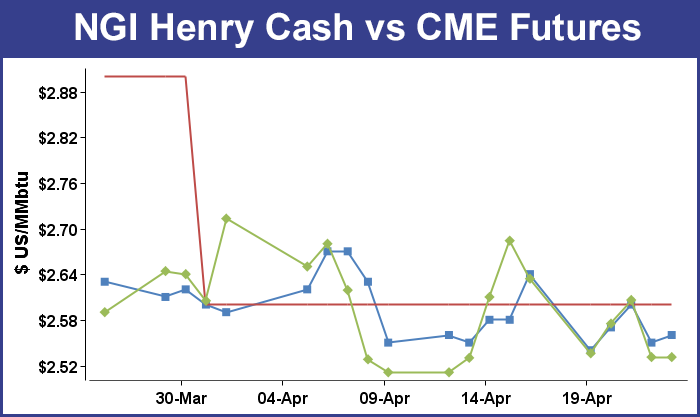

May futures for the week fell 10.3 cents to $2.531, and much of that was due to the 7-cent drop on Thursday following an ever-so-slightly bearish Energy Information Administration (EIA) inventory report. The EIA reported a build of 90 Bcf, and that was just 2 Bcf higher than market expectations, but it was enough to keep futures pinned to the mat. May futures fell to a low of $2.520 after the number was released and by 10:45 EDT May was trading at $2.549, down 5.7 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for an increase just under 90 Bcf. A Reuters survey of 22 traders and analysts showed an average 88 Bcf build with a range of 80 Bcf to 100 Bcf. ICAP Energy calculated an 86 Bcf increase, and industry consultant Genscape utilizing its flow model estimated an 89 Bcf increase.

“It was really a non-event. We have traded about 55,000 May contracts which is about normal for this time on a report day,” said a New York floor trader shortly after the figure was released. “We are still in the range of $2.50 to $2.75, and this market is going nowhere fast.”

Despite just a 2 Bcf miss the number was considered bearish, according to Drew Wozniak, vice president at United ICAP.

Inventories now stand at 1,629 Bcf and are 737 Bcf greater than last year and 101 Bcf less than the 5-year average. In the East Region 41 Bcf were injected and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region rose by 45 Bcf.

In Friday’s trading weekend and Monday natural gas went begging as temperature forecasts remained moderate, making it less attractive for buyers to commit to three-day deals.

Declines were deep and pervasive. The East was down about 25 cents, the Midwest and Midcontinent fell close to a nickel, and California tumbled 8 cents. The overall market fell 8 cents to average $2.33.

Physical natural gas prices had some amount of direction, but that was not the case with futures. At the close, May was unchanged at $2.531, and June was down 0.1 cent to $2.568. June crude oil fell 59 cents to $57.15/bbl.

Baker Hughes in its weekly tabulation of rig count data showed a mixed picture with total U.S. rigs down on the week by 22 to 932 and lower year over year by 929. Gas rigs, however, showed an increase of 8 to 225, but remained well off the pace of a year ago when 323 were operating. Horizontal rigs, the kind most typically associated with the active shale plays, fell 21 to 720.

Rig counts are often used as a proxy for future production, and market bulls point to the sharp declines in rig counts as ultimately being a market driver for higher prices. The problem, however, is timing, and the figures are often viewed with skepticism. In the words of one Miami-based broker, “I wouldn’t trade your money with the rig count data.”

A better proxy might be the number of wells awaiting connection.

An example that may give bulls pause for thought is data from the Ohio Department of Natural Resources. Industry consultant Genscape said, “There was a large movement of wells from Drilling to Drilled (inventory) status, with Antero completing 16 wells, American Energy completing 16 wells, Chesapeake completing four and Rex finishing up two wells. This is a total of 38 wells going into inventory in Ohio alone in the last week — a significant uptick in activity feeding the size of the inventory pool, which stands at 380 wells across the state. A majority of this week’s wells were completed in Noble County, which usually doesn’t see this much activity from operators.”

Gas for weekend and Monday delivery at eastern points fell as power loads were projected sharply lower. ISO New England forecast that peak power Friday of 14,130 MW would drop to 13,160 MW Saturday before rising to 13,550 MW Sunday. The New York ISO estimated Friday’s peak load of 18,064 MW would fall to 16,590 MW Saturday and 16,357 MW Sunday.

Gas for weekend and Monday delivery to New York City on Transco Zone 6 fell 37 cents to $2.21, and parcels on Tetco M-3 were off 32 cents to a lean $1.58.

At the Algonquin Citygates, packages changed hands at $2.95, down 85 cents, and on Tennessee Zone 6 200 L was quoted at $2.93, down 67 cents.

Prices in the Midwest and Marcellus tumbled as temperatures were forecast to work toward seasonal norms. AccuWeather.com reported that the high Friday in New York City of 50 would reach 60 by Saturday and 58 on Monday. The normal high in New York in late April is 65. Chicago’s Friday maximum of 58 was expected to fall to 49 Saturday and climb to 53 on Monday. The seasonal high in the Windy City is 63.

Deliveries on Alliance fell 3 cents to $2.61, and gas at the Chicago Citygates shed a penny to $2.60. Gas at Demarcation was seen lower by 6 cents to $2.46, and on ANR SW weekend and Monday packages fell 4 cents to $2.31.

Double-digit losses were common in the Marcellus. Gas on Millennium changed hands 2 cents lower at $1.27, but gas at Transco Leidy skidded 19 cents to $1.34. Gas on Tennessee Zone 4 Marcellus was quoted 14 cents lower at a thin $1.15, and on Dominion South gas came in 26 cents lower at $1.43.

In early bid week trading Algonquin Citygate basis was 22.5 cents under to 22 cents, and Dominion South basis was seen at $1.23 under to $1.20. Tennessee Zone 4 Marcellus basis was quoted at $1.56 under to $1.55 under.

According to early forecasts, the summer weather outlook appears mild. Teri Viswanath, director of natural gas strategy at BNP Paribas, noted that during recent weather discussions the “takeaway from the conference was that the early guidance suggested a mild summer ahead. This week’s weather forecasts for May indicate that this outlook remains on track. The current 11-15 day forecasts reflect below-normal temperatures in Texas, a trend that is expected to persist through the month. As Texas typically accounts for 18% of total summer utility gas demand, a year/year reduction in cooling demand will likely require additional price-induced demand growth for balancing. Consequently, the prospect of mild weather ahead this summer will likely extend the discount window for natural gas prices.”

Thursday’s 7-cent drop following a modestly bearish EIA storage report did little to change the technical outlook. “Despite the slide, not much changes,” said Brian LaRose, a technical analyst at United ICAP. “Bears still need to crack both $2.475 and 2.426-2.409 to signal the down trend is intact. Bulls need to push natgas above $2.655 and 2.759-2.777 to signal a bottom has the potential to take hold. In the meantime, we are stuck in neutral territory. Suggest sitting on our hands until we have some clarity,” he said in closing comments Thursday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |