Sanchez Smitten With Catarina, Targeting Three Vertical Zones in Eagle Ford

Sanchez Energy Corp. said it is targeting three separate vertical zones in a project area of the Eagle Ford Shale, after production from its first stacked development in the area exceeded expectations.

Meanwhile, the Houston-based company said its estimated average daily production for the first quarter of 2015 was above initial guidance and it expects the trend to continue for the full year. However, capital expenditures (capex) are expected to decline and finish the year near the low end of its guidance.

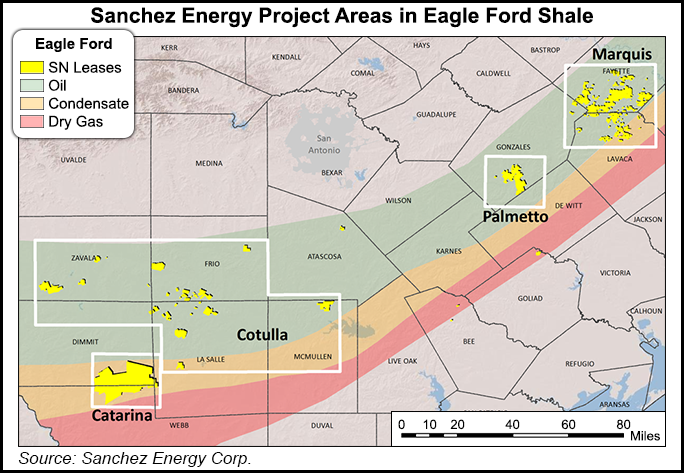

Sanchez management said Wednesday said it continues to remain focused on Catarina, one of four project areas the company has in the Eagle Ford (see Shale Daily, March 4). Operational efficiencies and service cost reductions were providing “substantial savings,” and average well costs in Catarina had fallen below $4.5 million per well.

Specifically, the company said it had deployed a spudder rig in Catarina, and employed other unspecified process and design initiatives, which collectively have resulted in savings of $150,000 per well. Drilling operations in Catarina, from spud to total depth, have fallen to a low of nearly seven days, and averaged about nine days per well for the last 10 wells Sanchez drilled there.

According to CEO Tony Sanchez III, results from a 10-well pad on the western side of Catarina that targeted three separate vertical zones — the Upper, Middle and Lower Eagle Ford — had exceeded the company’s initial expectations.

“While still in initial stages of flowback, all zones have exhibited strong initial rates,” Sanchez said. “Additionally, we have seen strong rates and pressures in conjunction with our Lower Eagle Ford infill program, and have successfully drilled Lower Eagle Ford wells that have been landed in between producing Upper Eagle Ford wells.

“These initial results support our belief that the Upper and Lower Eagle Ford are distinct reservoirs that can be developed independently of one another.”

The company is continuing to appraise its holdings on the eastern side of Catarina, drilling and completing six wells on three different pads since it acquired the area in 2014. It said the most recent wells drilled in the southern region of Eastern Catarina showed signs of being similar to wells drilling in Western Catarina. Sanchez said it plans to bring an additional two-well pad in the southern region of Central Catarina online during 2Q2015.

Sanchez’s three other project areas in the Eagle Ford are Cotulla, Marquis and Palmetto. It also has a presence in the Tuscaloosa Marine Shale (TMS). The company said it currently has 544 gross producing wells, with 24 in various stages of production. Catarina topped the list of producing wells (224), followed by Cotulla (137), Marquis (98), Palmetto (72) and the TMS (13). Thirteen wells are awaiting completion in Catarina, followed by five in Marquis, four in Palmetto and two in Cotulla.

During 1Q2015, estimated average daily production was 4.07 million boe (45,217 boe/d), a 141% increase from the 1.69 million boe (18,784 boe/d) produced in 1Q2014. The production figures for 1Q2015 include 6.99 Bcf of natural gas, 1.78 million bbl of crude oil and 1.12 million bbl of natural gas liquids (NGL). Natural gas production increased 429% from 1Q2014, when it totaled 1.32 Bcf, while NGL production rose 345% (from 252,000 bbl) and oil production went up 46% (from 1.21 million bbl).

Sanchez reaffirmed its full-year production guidance of 40,000-44,000 boe/d, but it expects capex to decline. “Based on 1Q2015 operating results and the substantial service cost reductions realized to date, the company currently anticipates that capital spending will trend toward the lower end of the range provided for its 2015 capital plan.” The range was $600-650 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |