Delaware Judge Awards $171M to El Paso MLP Investors

In a decision that could impact the future of master limited partnerships (MLP), a judge in Delaware ruled that an affiliate of El Paso Corp. was liable for breach of contract after overpaying for a pipeline deal, and awarded damages of $171 million to MLP investors.

Court of Chancery Judge Travis Laster ruled Monday that El Paso Pipeline Partners LP (MLP) paid too much when it agreed, on two separate occasions in 2010, to buy stakes in subsidiaries of its parent company, El Paso Corp.

According to the complaint, the parent company sold two of its subsidiaries — Southern LNG Co. LLC and Elba Express LLC — to the MLP. At the time, the parent company controlled the MLP through its ownership of another entity, El Paso Pipeline GP Co. LLC, which served as the MLP’s sole general partner (see Daily GPI, March 26, 2010).

Southern LNG owned a liquefied natural gas (LNG) terminal on Elba Island, GA. Meanwhile, Elba Express owned a 190-mile natural gas pipeline that connects the Elba Island terminal to four major interstate gas pipelines.

The complaint said the parent treated Southern LNG and Elba Express as a single entity, Elba. The parent sold the MLP a 51% interest in Elba in March 2010, then followed with a sale of the remaining 49% stake of Elba to the MLP that November, plus a 15% interest in another parent subsidiary, Southern Natural Gas LLC (Southern).

But investors challenged the March and November transactions. According to the complaint, a limited partnership agreement (LPA) governing the MLP allowed the general partner to engage in transactions involving a conflict of interest, but those types of moves required special approval from a conflicts committee, whose members include the general partner’s board of directors.

“The only contractual requirement for special approval was that the committee members believe in good faith that the transaction was in the best interests of [the MLP],” Laster wrote in his opinion. “I expected that at trial, the committee members and their financial advisor would provide a credible account of how they evaluated the [November] dropdown, negotiated with [the] parent, and ultimately determined that the transaction was in the best interests of [the MLP].

“It turned out that in most instances, the committee members and their financial advisor had no explanation for what they did…the plaintiff’s expert demonstrated at trial that [the MLP] paid $171 million more for a 49% interest [in] Elba than it would have if the general partner had not breached the LPA.”

Laster also leveled criticism at Tudor, Pickering, Holt & Co., a Houston-based firm specializing in the oil and gas industry that served as the committee’s financial adviser. For every dropdown, Tudor received a $500,000 fee, the complaint said.

“Tudor manipulated the deal process through malfeasance,” Laster wrote. “It is often said that valuation is more art than science, but this aphorism reflects the need for professionals to make case-specific judgments. For the dropdowns, Tudor practiced a different kind of art: the crafting of a visually pleasing presentation to make the dropdown of the moment look as attractive as possible.

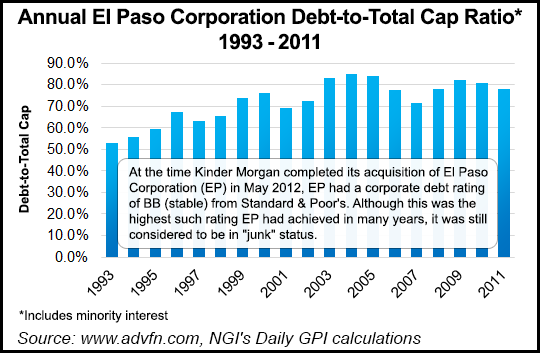

The MLP had completed nine dropdowns by 2012, the year Kinder Morgan Inc. (KMI) acquired El Paso Corp. in a $38 billion deal (see Daily GPI, May 25, 2012).

KMI spokesman Richard Wheatley told NGI that the company was currently reviewing Laster’s ruling.

“KMI is disappointed in the result of the decision and continues to believe that the transaction was appropriate and in the best interests of [the MLP],” Wheatley said Tuesday. “There are numerous issues which remain unresolved in the case and which must be resolved before any final decision is rendered.”

Wheatley added that KMI was “evaluating all options, including a possible appeal to the Delaware Supreme Court once a final decision is issued. At the present time, KMI does not believe that an ultimate award, if any, will have a material financial impact on KMI.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |