Weekly NatGas Futures, Cash Diverge; Market Turnaround In Sight?

Physical natural gas prices for the week ended April 17 limped lower, but a curious response to the weekly storage report has some thinking a longer term market bottom might be forming. The NGI Weekly Spot Gas Average fell 11 cents to $2.32, led by larger-than-average declines in the Northeast.

Although only a handful of points were positive on the week, trading for the most part was somewhat tranquil with most points dropping a dime or less. The market point with the greatest gain was Texas Eastern M-2, 30 Delivery with a rise of 11 cents to average $2.35. The week’s greatest loser was Tennessee Zone 6 200 L with drop of $1.49 to $2.53, followed closely by the nearby Algonquin Citygates with a loss of $1.37 to $2.80. Regionally East Texas lost the least with a decline of just 2 cents to average $2.51 and the Northeast took the biggest hit falling 31 cents to average $1.97.

The Midwest slid 7 cents to $2.67 followed closely by South Louisiana with a decline of 6 cents to $2.51.

South Texas was off 5 cents to $2.48, and the Rocky Mountains eased 4 cents to $2.25.

Both California and the Midcontinent retreated 3 cents to $2.52 and $2.37, respectively.

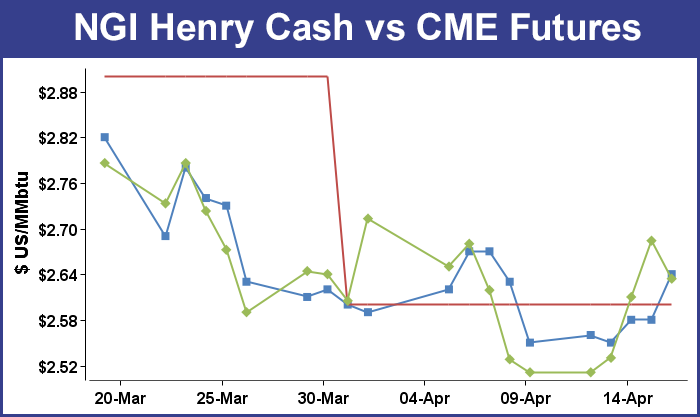

May futures, on the other hand, added 12.3 cents on the week to $2.634 in large part aided by a counterintuitive market response to a Energy Information Administration (EIA) report on Thursday of a build of 63 Bcf, somewhat greater than market expectations. At the close May had risen 7.4 cents to $2.684 and June was higher by 7.7 cents to $2.726.

The EIA storage report was at first thought to be bearish. May futures fell to a low of $2.545 after the number was released and by 10:45 a.m. May was trading at $2.565, down 4.5 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase of about 60 Bcf or less. A Reuters survey of 24 traders and analysts showed an average 53 Bcf build with a range of 37 to 66 Bcf. ICAP Energy calculated a 60 Bcf increase, and Bentek Energy’s flow model estimated a 59 Bcf increase. Teri Viswanath, director of natural gas trading strategy at BNP Paribas was looking for a 57 Bcf injection.

“With this higher build, we did come off a little bit, but nothing dramatic. We are still stuck above $2.50 and we’ve never really gotten below $2.50, but that’s the big number from what we can see,” said a New York floor trader.

“The data continues to show relatively easy seasonal builds, outpacing market expectations for a second week in a row,” said Tim Evans of Citi Futures Perspective. “This implies some weakening of the background supply-demand balance, with bearish implications for the weeks ahead.”

Inventories now stand at 1,539 Bcf and are 692 Bcf greater than last year and 145 Bcf less than the five-year average. In the East Region 15 Bcf was injected, and the West Region saw inventories decrease by 2 Bcf. Stocks in the Producing Region rose by 50 Bcf.

Analysts studying Thursday’s initial futures retreat and subsequent rebound suggested it might be a sign of a pending market turnaround. Steve Mosley, an Arkansas-based commodity trading adviser and publisher of SMC Natural Gas Price Forecasting and Advisory Services, said Thursday “The strong positive reaction in the face of a bearish storage report is a very typical signal that a seasonal low of some type has been achieved and that a seasonal recovery has become operational.

“We had mistaken a sharp upward market move back in mid March as signaling such a transition even though it was occurring a little earlier than our late March/early April target. [Thursday’s] move is more typical as it came after some significant bearish news. If we are in fact reading today’s activity correctly, the market should work at least somewhat higher again on Friday and then hold gains in the coming week (thus breaking the four- to five-week pattern of downwardly biased choppiness).

“Seasonal timing greatly favors a recovery at this point as our current winter seasonal low of $2.475 from last Monday (April 13th) occurred just six days ahead of the very historically late low of April 19th from 2012. Basically, a winter low was about to become seasonally overdue. Looking ahead, while we only anticipate a lackluster and brief pre-summer rally this spring, it should have a tendency to last at least until May 1st.”

In Friday’s trading natural gas for weekend and Monday delivery on balance fell nominally as double-digit declines at eastern points were unable to offset broader gains in the Gulf, Midcontinent and Midwest.

Overall, the market slipped a penny to $2.30, and the Midwest and Midcontinent rose about 6 cents as a shot of cool air was expected to invade major markets. Futures prices retreated ahead of the weekend with May sliding 5.0 cents to $2.634 and June dropping 4.7 cents to $2.679.

Weekend and Monday deliveries in the Midwest added more than a nickel as temperatures were expected to drop close to 20 degrees at some locales. Forecaster AccuWeather.com predicted Friday’s high in Chicago of 76 would drop to 63 Saturday and fall further to 59 by Monday. The normal mid-April high in the Windy City is 60. Minneapolis’ Friday high of 73 was seen slipping to 70 Saturday before plunging to 46 on Monday.

Gas on Alliance rose 6 cents to $2.60, and deliveries to the Chicago Citygates added 8 cents to $2.61. On Consumers, packages were quoted at $2.85, up 5 cents, and on Michcon gas rose a nickel as well to $2.81. At Demarcation, gas for the weekend and Monday changed hands at $2.48, up 6 cents.

Buyers were socking away gas more in response to a favorable price environment than to a cool weekend forecast. “We’ve continued to buy on a daily basis. The price is decent, and we paid $2.88 and $2.865 on Consumers,” said a Michigan marketer.

“We are thinking layer it in, and we’ve got seven months to get our customers’ storage filled. We’ll add one-seventh each month over and above their daily usage, but we could buy more if prices go even lower.”

The Michigan marketer may have started none too soon as forecasters are calling for periodic incursions of cold air to grind through the Midwest. AccuWeather.com meteorologists said, “A weather pattern favoring waves of progressively cooler air will set up across much of the Midwest and Northeast next week and could continue into early May. The cooler weather will arrive after a storm impacts the area then moves eastward.”

According to AccuWeather.com’s Paul Pastelok, long range expert, a southward dip in the jet stream will develop and will be centered around the Great Lakes much of the time during the latter part of the month. “The pattern will deliver several days of cooler-than-normal air and unsettled weather from the Midwest to the East Coast to end the month,” Pastelok said.

New England points were the day’s biggest losers as transportation became more freely available. Algonquin Gas Transmission (AGT) said Thursday on its website that it had “scheduled and sealed [all] nominations sourced from points west of its Cromwell Compressor Station (Cromwell) for delivery downstream of Cromwell. No increases in nominations sourced upstream of Cromwell for delivery downstream of Cromwell, except for Primary Firm No-Notice nominations, will be accepted.”

By Friday those restrictions had eased somewhat with AGT restricting “100% interruptible and approximately 56% secondary out of path nominations that exceed entitlements sourced from points west of its Cromwell Compressor Station for delivery to points east of Cromwell.”

Gas for weekend and Monday delivery at the Algonquin Citygates fell 84 cents to $1.82, and deliveries on Iroquois Waddington skidded 25 cents to $2.54. On Tennessee Zone 6 200 L gas changed hands 69 cents lower at $1.78.

Buyers for weekend power generation across the MISO footprint pondering whether to commit to three-day deals were factoring in stout renewables generation by early next week. WSI Corp. in its Friday morning report said, “Weak high pressure may support partly cloudy and mild conditions today into tonight [Friday]. A complex storm system may spread rain across the power pool as the weekend progresses. There is a chance of thunderstorms across Lower Mississippi Valley, which may be strong, [but] the bulk of the showers should depart by Monday, and it will become breezy and cooler in wake of this storm. However, there may remain a chance of a little light rain and even snow across parts of the Upper Midwest and Great Lakes early next week. Rainfall amounts may range 0.25-1 inch-plus, while a few inches of snow may accumulate across northern Minnesota.

“Light wind generation is expected today. The next storm system may cause wind generation to increase during the weekend and become strong early next week. A brisk northwest wind may support output as high as 8-10 GW during Monday and Tuesday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |