Kinder Mulling Deals; ‘Tremendous Opportunity’ in NatGas Growth

Midstream giant Kinder Morgan Inc. will be active in the mergers and acquisitions (M&A) market in the coming months, but right now, potential sellers of some attractive assets are holding on to them after being propped up by “cheap money” that has been flowing into the energy sector, CEO Rich Kinder told analysts during a conference call.

Kinder cited the recent buys of Bakken Shale-focused Hiland Partners for $3.1 billion (see Shale Daily, Jan. 21) and a recent acquisition of terminal assets for about $160 million. “So we’ve not been sitting on the sidelines. With that said, we continue to look for things, but obviously they have to be a fit both in terms of accretion to our shareholders…” Kinder said. “[T]here’s a lot of cheap money out there chasing deals right now. It’s pretty common knowledge how much money’s been injected into the energy patch just in the last few weeks.”

Capital has been flowing into the upstream sector, propping up struggling producers that otherwise might need to let go of some of their midstream assets for cash to cover for weak oil prices. Kinder Morgan would be interested in buying some of those assets if/when they become available, the CEO said.

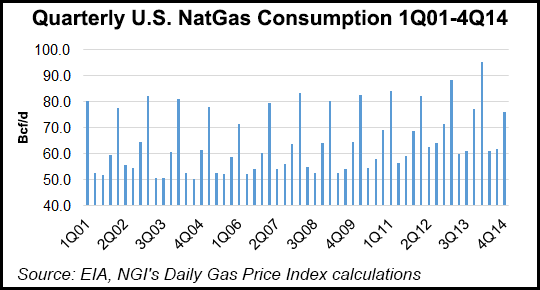

Integrating new assets on the natural gas side would play to the long-term growth Kinder sees in natural gas demand. “Long term, we expect it to go from 74-75 Bcf/d today to 110 Bcf in the next 10 years,” he said. “That’s being driven by demand pull, supply push, but [there is] tremendous opportunity for the largest midstream player like us. And we’re just seeing indications of that…” For instance, he said, the company has experienced an increase in natural gas capacity signings for its midstream assets.

As for his own company, Kinder said commodity prices caused “some headwinds,” but most of the Kinder Morgan’s assets are fee-based and are immune to commodity price fluctuations.

Kinder Morgan natural gas transport volumes were up 6% compared to the first quarter last year, driven by expansion projects that came online during 2014, primarily at Tennessee Gas Pipeline, as well as higher power generation load on Southern Natural Gas pipeline due to lower natural gas prices, the company said. Sales volumes on the Texas Intrastate system were also up by 6% compared to the first quarter of last year.

Since Dec. 1, 2013, Kinder Morgan has entered into new and pending firm transport capacity commitments totaling 7.3 Bcf/d, and its pipelines currently move about one-third of the natural gas consumed in the United States. “Future opportunities include the need for more capacity in the Northeast, demand for gas-fired power generation, LNG [liquefied natural gas] exports and exports to Mexico,” the company said. KMI currently has a project backlog of about $5.3 billion.

The company reported first quarter distributable cash flow before certain items of $1.24 billion versus $573 million for the comparable period in 2014. The increase was primarily attributable to merger transactions completed last November to roll the company’s master limited partnerships into the corporate entity. Distributable cash flow per share before certain items was 58 cents compared to 55 cents for the first quarter last year.

First quarter net income before certain items was $445 million compared to $624 million for the same period in 2014. Certain items after tax in the first quarter totaled a net gain of $14 million compared to a net loss of $23 million for the same period last year. Net income was $459 million compared to $601 million for the first quarter last year. The decrease was driven by higher interest expense, book taxes and DD&A expense.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |