Markets | E&P | NGI All News Access

Low NatGas Prices Come Down Hard on Escalera Resources

Hit hard by faltering natural gas commodity prices, independent exploration and production company Escalera Resources Co. (ESCR) expects that the borrowing base available under its credit facility will be reduced, and its “ability to continue as a going concern is uncertain,” the company said Wednesday.

If gas and oil prices don’t recover this year, ESCR “would expect significant negative revisions to our estimated proved natural gas and oil reserves,” the company said in a 10-K filing with the Securities and Exchange Commission (SEC).

Management “is pursuing certain short-term strategies, simultaneously, in order to maintain liquidity,” the company said. Last month, ESCR suspended dividends on its Series A preferred stock in order to preserve capital. In addition, the company is focused on identifying potential merger candidates; maintaining production while efficiently managing, and in some cases reducing, operating and general administrative costs; and evaluating asset divestiture opportunities to reduce debt.

In an earnings release Wednesday, ESCR said its average realized natural gas price in 2014 was $3.76/Mcf, a 4% decrease compared with $3.91/Mcf in 2013. Production in 2014 was 8.2 Bcfe, an 11% decrease from 2013. Nearly all — 98% — of 2014 production volume was natural gas.

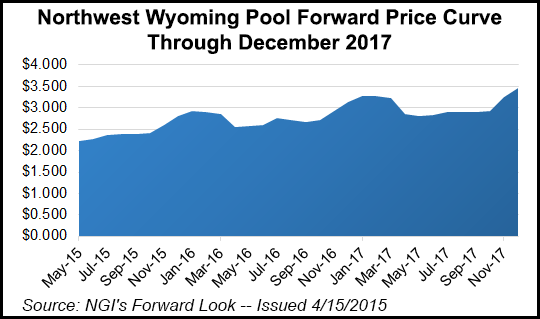

Denver-based ESCR is active primarily in the Rocky Mountains, where it explores and develops gas from two core properties in southern Wyoming. The company has coalbed methane reserves and production in the Atlantic Rim area of the eastern Washakie Basin, and tight gas reserves and production on the Pinedale Anticline in the Green River Basin of Wyoming. ESCR also holds acreage with exploration potential in the Greater Green River Basin of Wyoming and the Huntington Basin of Nevada.

At the end of 2014, estimated proved reserves were 87.3 Bcfe, almost all natural gas. Proved reserves at the end of 2014 had a present value discounted at 10% (PV-10) of about $99.9 million.

ESCR incurred a net loss of $11.3 million (minus 83 cents/share) in 2014, compared with a net loss of $16.8 million (minus $1.48/share) in 2013. Shares, which have traded as high as $3.15/share in the past 52 weeks, were trading just above 37 cents/share Wednesday morning.

Last year, Double Eagle Petroleum Co. changed its name to Escalera Resources Co. to reposition beyond domestic, onshore natural gas production (see Shale Daily, March 25, 2014).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |