E&P | NGI All News Access | NGI The Weekly Gas Market Report

Patterson-UTI Onshore Rig Count Still Contracting

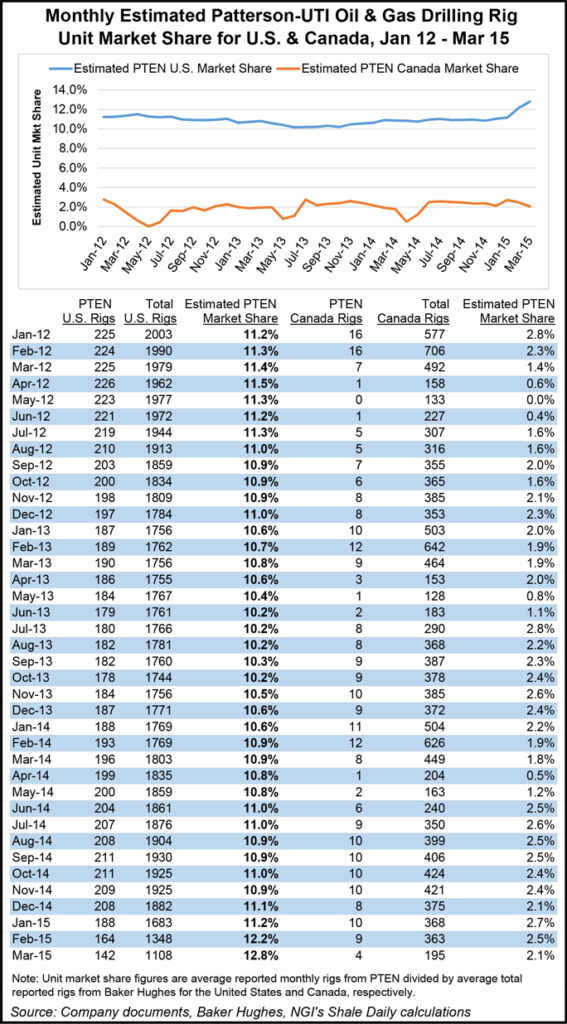

North America’s onshore drilling fleet continued to contract in March for Patterson-UTI Energy Inc. (PTEN), with fewer rigs running in the United States and Canada compared with February.

The Houston-based oilfield services company provides land rigs for oil and natural gas drillers across the United States and in Western Canada. Subsidiaries Universal Pressure Pumping Inc. and Universal Well Services Inc. also provide pressure pumping services primarily in Texas and the Appalachian region.

On average, PTEN’s domestic rig fleet averaged 142 rigs in March, versus 165 in February. In Canada, there were four rigs on average running last month, down by half month/month. The operating rigs reported in PTEN’s monthly announcements represent the average number of rigs that were working under a drilling contract.

At the end of March, the average rig count versus the number of rigs available by basin were Appalachia, 32 of 42; East Texas, 12 of 22; Midcontinent, 13 of 35; North Dakota, 14 of 20; Rockies, nine of 17; South Texas, 26 of 41; and West Texas, 31 of 58.

At the end of December, PTEN had term contracts providing for about $1.5 billion of future dayrate drilling revenue this year (see Shale Daily, Feb. 5). In January, the operator had 138 rigs under contract through March and 104 with terms this year. The decline has been deep: it had 188 rigs operating in North America’s onshore at the start of the year.

It’s been a “viciously precipitous” rig count decline, said analysts with Tudor, Pickering, Holt & Co. (TPH). PTEN has seen a 21% decline from 4Q2014. The brunt of PTEN’s declines, said analysts, were borne by the more expensive silicone-controlled rectifiers, without walking systems. Even though PTEN’s exit rate was high, “we believe the pace/magnitude of declines begins to slow from here.” The “trickier part of the go-forward equation will be calibrating the fleet average dayrate/margin, given the tug-of-war between declining spot rates and improving quality profile of PTEN’s operating rig count.”

TPH’s analysts had initially expected the total U.S. rig count to decline year/year by about 33%, but that number was too optimistic, analysts said last week (see Shale Daily, April 2). Analysts now expect the U.S. rig count to be about half of what it was in 2014, with a slower reduction in dropped rigs from April through December.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |