Marcellus | E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report

Marcellus, Eagle Ford Lead EIA’s Reserves Field Rankings

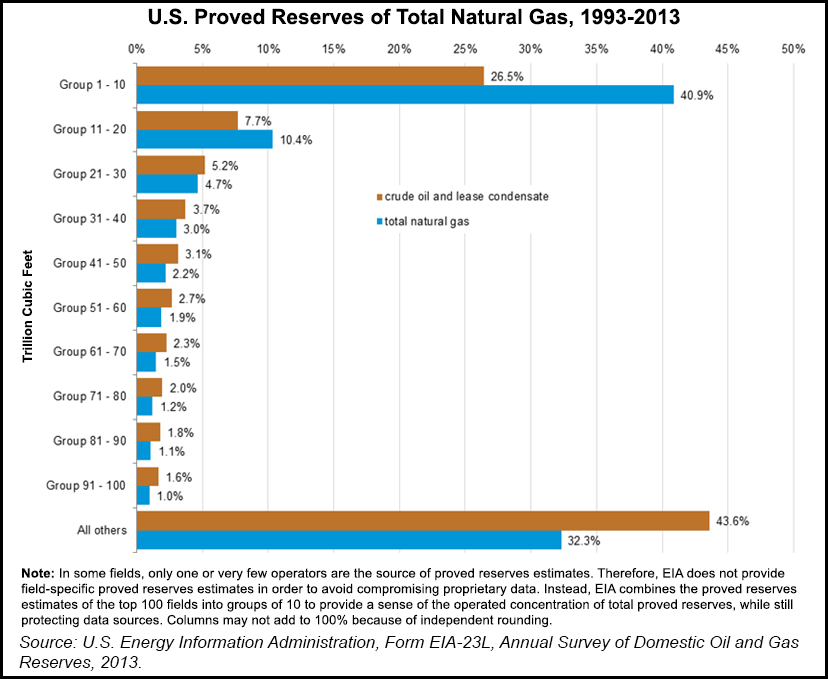

U.S. oil and natural gas reserves increased substantially from 2009 to 2013, according to government data. While the concentration of oil reserves among the country’s top 100 fields declined, the concentration of gas reserves among the top 100 fields increased.

Oil and lease condensate proved reserves grew to 36.5 billion bbl from 22.3 billion bbl over the period, according to the U.S. Energy Information Administration (EIA). The top 100 plays accounted for 56.4% of proved reserves in 2013, down from 62.3% in 2009.

The natural gas story was a bit different. In 2013, proved reserves were 354 Tcf, up from 283.9 Tcf in 2009. In 2013 the top 100 fields accounted for 67.7% of the total, increasing their share from 60.8% in 2009, EIA said Monday in a supplement to its 2013 proved reserves report.

Field pack leaders based on size also changed during the period, EIA said. On the oil side, the Eagle Ford Shale contributed two additions to the top 10 fields: the Eagleville at No. 1 and No. 5 Briscoe Ranch, where Rosetta Resources Inc. has been an active player (see Shale Daily, Aug. 6, 2014).

The top 10 oil fields are Eagleville (Eagle Ford Shale, Texas), Spraberry Trend Area (Texas), Prudhoe Bay (Alaska), Wattenberg (Colorado), Briscoe Ranch (Eagle Ford Shale, Texas), Kuparuk River (Alaska), Mississippi Canyon Block 778 (Thunder Horse in the federal Gulf of Mexico), Wasson (Texas), Belridge South (California) and Green Canyon Block 699 (Atlantis in the federal Gulf of Mexico).

On the natural gas side, the Marcellus Shale Area overtook the venerable Barnett Shale based on estimated proved reserves, EIA said.

The top 10 natural gas fields are Marcellus Shale Area (Pennsylvania and West Virginia), Newark East (Barnett Shale, Texas), B-43 Area (Fayetteville Shale, Arkansas), San Juan Basin Gas Area (Colorado and New Mexico), Haynesville Shale Unit (Louisiana), Pinedale (Wyoming), Carthage (Texas), Jonah (Wyoming), Wattenberg (Colorado) and Prudhoe Bay (Alaska).

EIA defines a field as “an area consisting of a single reservoir or multiple reservoirs all grouped on, or related to, the same individual geological structural feature and/or stratigraphic condition. There may be two or more reservoirs in a field that are separated vertically by intervening impervious strata or laterally by local geologic barriers, or by both.” Not all states use the same criteria for compiling their data. What one state considers to be individual fields might be combined in EIA’s tables, the agency said.

“Particularly in the case of unconventional shale plays for both crude oil and natural gas, multiple areas or fields may have been combined into one entry within these ranking tables. The resultant field entry in the table is labeled as an area or unit, e.g., Marcellus Shale Area, Haynesville Shale Unit, Spraberry Trend Area, and Hugoton Gas Area,” EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |