Markets | NGI All News Access | NGI Data

NatGas Cash Eases, But Futures Pop Higher Following Supportive EIA Data

Natural gas futures action cast shade on the physical gas market Thursday as a larger than expected storage withdrawal report had some price bulls licking their chops, while other marketwatchers remained unimpressed.

Physical gas prices for deliveries over the extended holiday weekend were mostly lower as little in the way of market-moving weather combined with soft demand and falling power prices to keep buyers on the sidelines. Overall, the market shed 2 cents to $2.37, and steady pricing in the Gulf Coast, Midwest and Midcontinent was unable to counter weakness in the Northeast, Rockies and California.

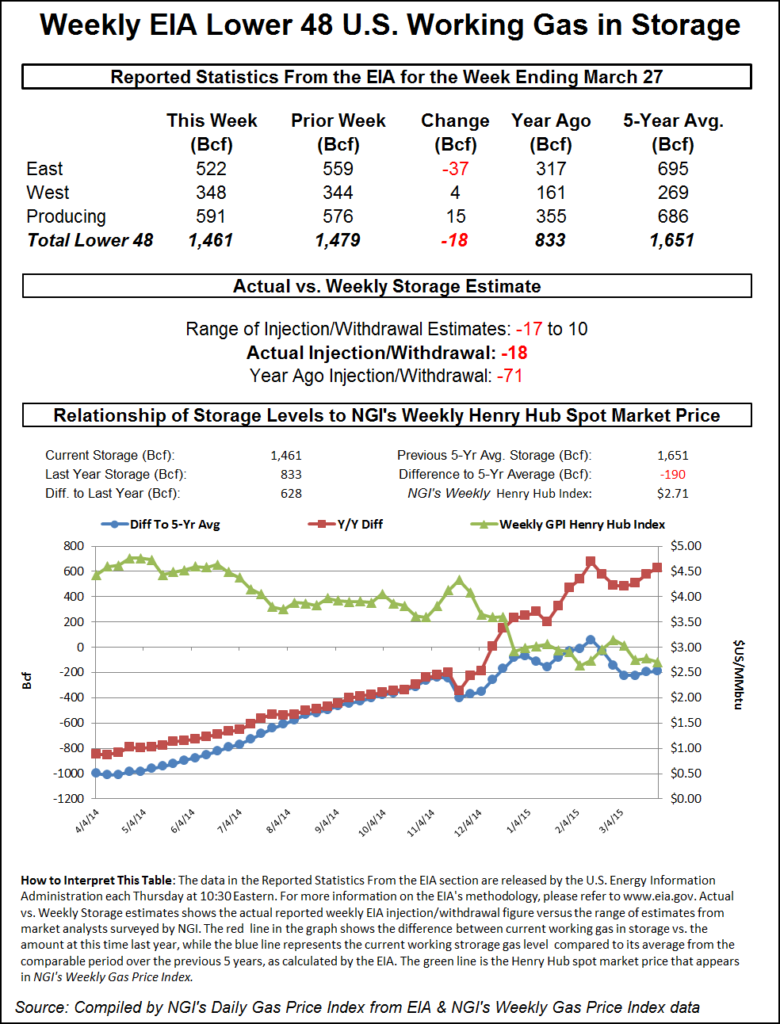

The Energy Information Administration (EIA) reported a withdrawal of 18 Bcf in its weekly assessment of natural gas inventories, somewhat higher than what the market was expecting, and futures scooted higher. At the close, May had added 10.8 cents to $2.713 and June was up by 10.8 cents as well to $2.762. May crude oil retreated 95 cents to $49.14/bbl.

Weekend and Monday gas on the West Coast fell on weak demand and mild weather. According to a West Coast consultant, renewable energy and backhauled gas from the Rockies or the Desert Southwest keeps putting pressure on California prices during weekends. “You have so much gas coming in from Sumas and BC that it is just a long market,” he said.

Friday-Monday deliveries at the PG&E Citygates slid 5 cents to $2.81, and gas at the SoCal Citygates shed 2 cents also to $2.48. Deliveries to SoCal border points lost 2 cents to $2.35, and gas on El Paso S Mainline changed hands 2 cents lower at $2.36.

Consultant Genscape reported that for April 2 demand in California fell from 5.2 Bcf/d to 5.17 Bcf/d, while imports were pegged at a stout 6.35 Bcf/d.

AccuWeather.com meteorologists said, “Above-normal temperatures and sunshine will continue across much of Southern California this week, providing excellent conditions for holiday outings. Bright sunshine will be the rule through Saturday, with an offshore flow keeping the marine layer at bay.”

AccuWeather.com Meteorologist Brian Edwards said, “High temperatures will continue to climb into the upper 80s for the first half of the weekend. It will be a bit cooler on Sunday with more in the way of morning low clouds. Residents can expect highs on Sunday to be around the seasonal average of 71 F.”

Mid-Atlantic and Marcellus points also came under pressure as on-peak power prices weakened. New York ISO reported that Friday peak power delivered to Zone G (eastern New York) fell $12.85 to $30.50/MWh and at ISO New England’s Massachusetts Hub on-peak power slid $5.56 to $30.02/MWh. At the PJM West Hub Friday peak power fell $3.15 to $30.43/MWh.

Gas for the extended weekend and Monday bound for New York City on Transco Zone 6 skidded 20 cents to $2.16, and deliveries on Tetco M-3 were quoted 26 cents lower at $1.70.

Parcels on Millennium were seen 17 cents lower at $1.60, and gas on Transco Leidy fell 13 cents to $1.59. Gas on Tennessee Zone 4 Marcellus gave up 13 cents to $1.48, and gas on Dominion South changed hands 16 cents lower at $1.54.

Futures bulls got something of a surprise with the release of EIA inventory data. The withdrawal was not only greater than what the market was expecting, but also outside of survey ranges. For the week ended Mar. 27, the EIA reported a decrease of 18 Bcf. May natural gas futures rose to a high of $2.700 after the number was released and by 10:45 a.m. May was trading at $2.674, up 6.9 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for a decrease averaging about 10 Bcf. A Reuters survey of 25 traders and analysts showed an average 10 Bcf draw with a range of -17 Bcf to +7 Bcf. Analysts at First Enercast were looking for a 12 Bcf decline, and Bentek Energy’s flow model predicted a 13 Bcf decrease.

Tim Evans of Citi Futures Perspective noted that the number was greater than expectations and “closer to the 22 Bcf five-year average level, so bullish relative to expectations but more neutral in seasonally-adjusted economic terms. The figure does also suggest that the market supply-demand balance may also be a little bit tighter than some of the prior data had implied.”

Inventories now stand at 1,461 Bcf and are 628 Bcf greater than last year and 190 Bcf below the five-year average. In the East Region 37 Bcf was withdrawn and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region rose by 15 Bcf.

In spite of the day’s 11-cent futures gain, traders were not impressed. “I think we are headed right back to $2.50. I think the number was a little bigger than what they expected and that scared some people out of the market,” said a New York floor trader.

“[Friday] was just another opportunity to sell the market. I think we are headed to $2.45 to $2.50 over the next 2 to 4 weeks. If the market got above $2.85 and forced more shorts to cover then you would have to step back and take a look at the market, but I think we come in lower Monday and grind lower to $2.50 over the next two weeks.”

Thursday gas buyers had to deal with typically turbulent springtime conditions, but temperatures were seen fluctuating around seasonal norms.

“Severe thunderstorms may develop across the Midwest and Ohio River Valley on Thursday as a low-pressure system advances eastward over the Great Lakes,” said Wunderground.com meteorologist Kari Strenfel. “Flow around this system will continue creating a warm front that will lead the system eastward, while also creating a cold front that will extend southward down the Mississippi River Valley. Moisture pouring in from the Gulf of Mexico will feed energy into these systems, allowing for showers and thunderstorms to develop between these frontal boundaries across the Mississippi River Valley.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |