Marcellus | E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access | Permian Basin | Utica Shale

Consider Efficiency, ‘Fracklog’ When Forecasting From Rig Count, Analysts Say

Rig count might be the headline number in the shale patch, but when it comes to estimating future production from rig census, increasing rig efficiency and well productivity can make the calculation complicated.

Analysts at Bank of America Merrill Lynch said in a note Thursday that they estimate a 50% increase in well productivity has occurred over the last five years. Combined with shorter drilling and completion times thanks to pad drilling, the overall efficiency gains “are likely to dampen a shutdown of the industry,” they said.

“More importantly, operators are now increasing the backlog of drilled but not completed wells to take advantage of the announced price recovery, also referred to as the ‘fracklog.'” With the fracklogged wells in mind, the analysts revised their 2015 profile for U.S. shale production.

“On an annual basis, we now see U.S. shale growth averaging 460,000 b/d in 2015, and we project a sequential decline from 2Q,” the analysts wrote. “By the end of the year, shale output should be declining by 200,000 b/d year over year. The higher price elasticity of supply thus warrants a bounce in WTI oil prices to $57/bbl by 4Q14 and a narrower Brent-WTI spread by year-end.

“Yet as productivity improves and costs come down further, the price recovery may be rather shallow, so we still see WTI averaging $57/bbl in 2016 in line with the forward [curve].”

Bank of America noted that the Bakken was the first of the shale oil plays to pull back on horizontal drilling, with the Permian and Eagle Ford close behind.

Citing research by the bank’s exploration and production equity analysts, they said at a wellhead price of $40/bbl or less, half of incremental production is still profitable. Given that, the oil rig count should continue to decline during the second quarter before rebounding to 943, on average, in the fourth quarter, they said.

“For shale production to be flat in 2015 versus 2014, we we estimate that oil rigs would have to decline by 55%, which is equivalent of falling to 550 rigs and remaining there for the rest of the year, on our estimates.”

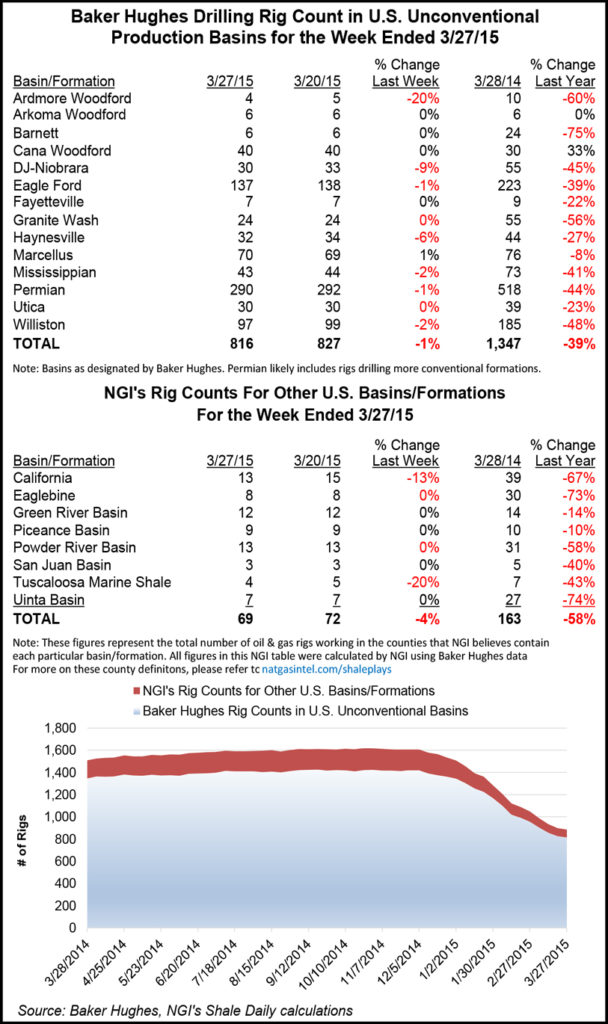

In the most recent Baker Hughes Inc. rig count, the rate of decline in operating drilling rigs seems to have slowed. Big-name shale plays held their own, with modest numerical declines in the Eagle Ford, Haynesville and Permian. The Marcellus gained a rig while the Utica held steady with the previous week’s tally.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |