Marcellus | E&P | NGI All News Access | Utica Shale

Slowing, But No Decline, Expected in U.S. Natural Gas Output Through 2015

U.S. natural gas production should peak in May or June, but summer output is going to be higher than it was a year ago, analysts with Genscape Inc. said Wednesday.

Randall Collum, managing director of supply side analytics, discussed the summer gas outlook during a webinar with senior natural gas analyst Rick Margolin. Overall, production is expected to be 3.3 Bcf/d higher this summer, with some supply diminished by 0.2 Bcf/d of lower imports from Canada. Genscape is forecasting Canada imports to average 4.8 Bcf/d this summer, down from 5 Bcf/d a year ago. On the demand side, 2.4 Bcf/d of incremental growth should come from overall gains in coal plant retirements and hydropower generation, as well as 2.42 Bcf/d of exports to Mexico, a 0.3 Bcf/d year/year increase. That would total 2.7 Bcf/d of demand, “which basically means we continue to remain a long situation this summer,” Margolin said.

The rig count, said Collum, probably will bottom in August “and we actually think they will start rebounding from there as the contango in the crude market, prices go up, which will in turn drive the economics up for oil drilling.” Reductions in service costs “will also will help motivate the rigs to get out there and start drilling again. We actually think in 4Q2015 we’ll see a decent little ramp in oil rigs.”

Genscape’s outlook for U.S. gas production is well below what it was last August, all because of the decline in crude and gas prices. “April 2015 crude is trading about $50 lower than it was back in August. And natural gas is trading almost $1.00 down,” Collum said. “The one thing that keeps production propped up even as rigs have already been dropping is the deferred inventory that’s already been built up from pad drilling over the last year or so,” the drilled but uncompleted wells. “It takes a while before that price actually impacts the production. Right now we’re seeing about a five- to six-month lag between a price impact and a rig impact, and then another two- to three-month, sometimes four or five, before you a actually see a production impact on that.”

Genscape now is calling for gas production overall to peak in the May-June period. “That’s about a seven-month lag between when the rig count peaked at the end of October 2014. For this summer, we’re thinking we’re going to see around a 3.3 Bcf/d year-on-year increase. It’s slightly lower than last year’s summer increase, where we had a 4.3 Bcf/d year-on-year increase.”

Northeast production has begun to slow from its frenetic pace. Earlier this month Collum told NGI’s Shale Daily that Appalachian Basin gas output, however, was on pace to increase even with lower capital spending (see Shale Daily,March 20). By Genscape’s estimate, gas output in the Marcellus/Utica shales has increased only around 1% since December, he said Wednesday. “At this point last year, we were closer to 9% or so…More than likely, we think production will peak this summer” as the inventory that had built up is eaten away.

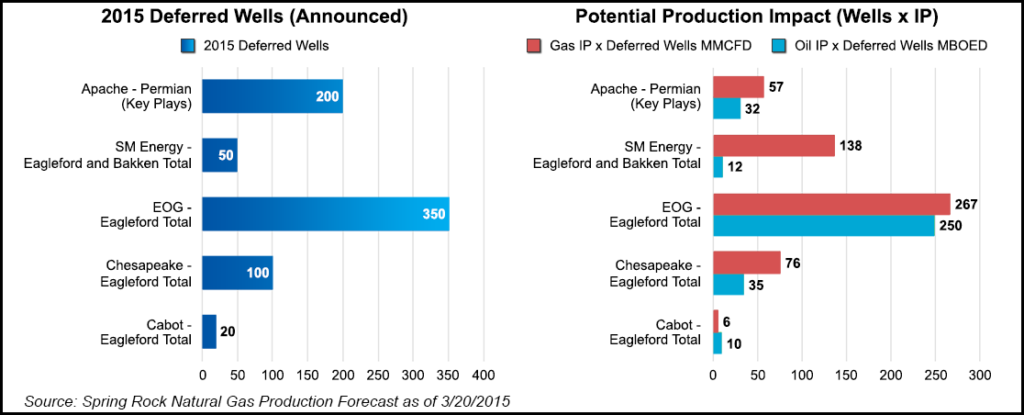

A potential risk to the downside are more drilled wells being deferred, i.e. drilled but uncompleted wells, or DUCs. Based on exploration and production (E&P) company announcements to date, Genscape is estimating that there are around 720 wells that have been drilled but intentionally deferred “because of the contango in the oil market.”

Collum compared the rig declines today to the last downturn during the 2008-2009 financial crisis. October 2008 was the peak rig count previously and last October was the peak rig count today.

“They followed quite the same path” on a percentage basis. “Last time around, prices rebounded so quickly that the rig count decline ended at about 30 weeks. Now we think the rig count declines will end about 41 weeks, so another two-and-a-half to three months” from the last time this occurred in 2008-2009. If prices were to rebound over the next month or two, the rig decline could possibly reverse. For the week ending March 20, two rigs were added, the first gain in a period of 13-14 weeks when on average almost 75 rigs per week were laid down.

“Lower 48 production has not hit a peak in the last several years. It just keeps going up and up. The reason we think this time is different is because even though in 2009 when Texas production started declining, we had the Haynesville Shale for the next three years pick up the pace. In 2008, operators were spending crazy amounts of money on leases, $30,000 an acre. They were signing two to three year leases, typically they were five to 10 year-type leases, so the producers had to go out and drill those wells. They ramped up production quite a bit because they had to hold those leases by production.”

The Haynesville “kept Lower 48 production propped up through 2011, when the Marcellus and Utica were discovered,” and since then, gas production has never slowed. “Now we’re starting to see Marcellus and Utica rigs drop,” down by more than 30 rigs year/year. “Recently, we started to see some processing plants get delayed in several regions across the country. We think all of this is adding up. There’s no new production sources that are going to help keep production from declining at some point this year, we believe.”

Even if Appalachia gas output surprises to the upside, “next year we are calling for about 1.5 Bcf/d of production declines. We think absolute upside will still decline about 400-500 MMcf/d year-on-year. There’s a high probability we’ll have declines next year.”

Deferring wells in the onshore in the oily plays like the Eagle Ford and Bakken shales should improve the investment rate of return (IRR) for impacted E&Ps, all things being equal. When E&Ps defer wells, “combined with a $10 contango in the oil market over the next 10 months, and assuming completion costs come down 20%, it actually improves the IRR on these wells. When these producers have rigs under contract, they have to run the rigs, so they go ahead and drill these wells and they will complete them when the economics suggest they should. They do not have these [completion] crews locked in under long-term contracts like they do on the drilling side.”

The 720 wells alone being deferred “equates to about 450 MMcf/d of gas if all those were brought online in one month, and it equates to about 370,000 b/d of oil. Basically, these deferred wells…are acting as storage,” Collum said. As the Cushing, OK, oil hub is filled, and with little allowance to export domestic oil, these deferred wells have become “a type of storage, and it actually improves their economics.” If more wells are deferred, “you could see lower production over the next few months.”

Contrary to some energy experts, who cite better drilling efficiencies, the rig count is important, said Collum. “We’re a firm believer that they do matter.” He cited Texas as an example, comparing the peak rig count data and how long it took to reach peak production levels. “In 2008-2009, there wasn’t as much pad drilling going on, but we saw the rigs peak in Texas in October, and production peaked in January before it started to decline, and then actually declined about 2 Bcf/d over the next year.

“This time around, we saw rigs peak at the beginning of November in Texas, and we’re calling for about a six-month lag between the rig peak and production peak. This time around, we do have pad drilling, which has built up a natural kind of deferred inventory. Those wells will have to be completed as part of the manufacturing process so you will have production lasting longer than what we saw previously.

And the Haynesville still is producing lots of gas. Chesapeake Energy Corp. moved more of its capital out of Appalachia to the Haynesville, where on a point forward basis, it offers the company its best economics today, said Collum. The operator now is running seven rigs there. Genscape is forecasting that there should be, on average, about 20 rigs running in the Haynesville through this year, which should keep gas production “relatively flat” at about an 80 MMcf/d year/year decline for the summer.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |