Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Natural Gas Forwards Quiet Last Week on Spring Anticipation

It was yet another quiet week for natural gas forwards basis markets as seasonal temperatures ranging from the 60s to 80s are forecast for most of the U.S. over the next couple of weeks.

Only a handful of market hubs moved five cents or more at the front of the forward curve last week, driven lower by returning production following shut-ins and moderating weather after a few more weather systems sweep through parts of the country in the near term.

Spring Rock’s Daily Pipe Production Data shows Lower 48 production has just about recovered from freeze-offs that occurred in late February and early March. Texas production hit an all-time high Feb. 19 at 20.28 Bcf before it hit a low of 18.76 Bcf due to freeze-offs on March 5, according to Genscape’s Cory Madden, research manager for natural gas.

Oklahoma, the Permian Basin and the San Juan Basin also were impacted by the freeze-offs, but they have since recovered. East production has grown by about 0.3 Bcf over the past 30-day average (18.85 Bcf/d) with daily production of 19.16 Bcf on March 17, Madden said.

“There are still some company-induced shut-ins, but production is close to where it was before the winter,” he said.

Meanwhile, forecasters with NatGasWeather had called for surges of cooler air spilling into the northern U.S. through Monday, but high pressure was to quickly follow into the Midwest and East Tuesday, allowing temperatures to warm well above freezing for several days and resulting in much lighter heating demand.

“We still believe how a cold blast plays out next weekend and into the first few days of April will be important,” NatGasWeather said. “We do expect at least modest amounts of cooler Canadian air to spill into the U.S., and if weather systems tracking across the northern U.S. are able to tap more impressive doses of frigid temperatures, conditions will likely be cold enough to prevent supplies from making up ground on deficits.”

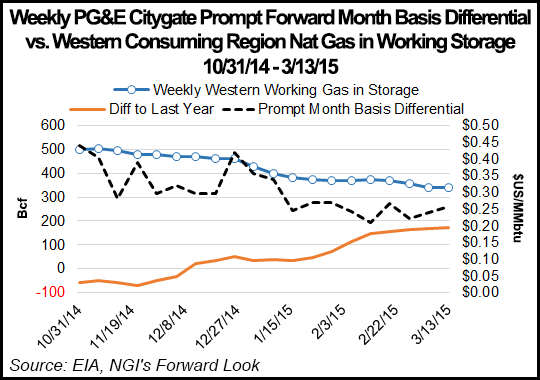

As reported in the latest storage report from the U.S. Energy Information Administration, natural gas inventories now sit at 1,467 Bcf, which is 13.3% below the five-year average of 1,692 Bcf but 52.8% above last year’s level of 960 Bcf.

Despite the overall weakness in the market, New England prices remained strong at the front of the curve as temperatures this past week plunged once again, driving up demand and leading to a sharp uptick in cash prices.

At the Algonquin Gas Transmission citygates, April basis climbed 6.9 cents between Monday March 16 and Thursday March 19 to reach plus 79 cents/MMBtu, according to NGI’sForward Look. The strength came on the heels of a volatile week for the market hub, with prices more than doubling in Tuesday trading to $12.16/MMBtu but eventually sliding back to $7.51/MMBtu in Thursday’s session.

Further out the Algonquin curve, modest declines were seen as May slipped 1 cent to minus 39.9 cents/MMBtu and the balance of summer (May-October) fell 1.3 cents to minus 10.6 cents/MMBtu.

Prices were lower across the rest of the country as well.

At Dominion South point, April dropped 5.9 cents from Monday to Thursday to reach minus 99 cents/MMBtu, and May eased 3.4 cents to minus $1.17/MMBtu. The balance of summer was down 4 cents to minus $1.171/MMBtu.

Similarly, at Texas Eastern Transmission zone M3, small decreases were seen as April shed 5 cents to reach minus 86 cents/MMBtu, and May fell 3.1 cents to minus $1.079/MMBtu. The balance of summer slid 4.9 cents to minus $1/MMBtu.

In the Pacific Northwest, Northwest Pipeline-Sumas saw April basis drop 6.1 cents to minus 54.9 cents/MMBtu and May slide 2.2 cents to minus 57.3 cents/MMBtu. The balance of summer was essentially flat at minus 51.4 cents/MMBtu.

While basis appears to be taking a breather this week, the Sumas market is not immune to the effects that a weak hydro season is expected to have on prices this summer.

The Northwest River Forecast Center is expecting flows at The Dalles Dam in Oregon to be just 81% of normal during the discharge season, which runs from April through September, making this year the fourth worst in the last 50 years.

The decline in hydro supplies is expected to prop up gas demand, and it appears prices are beginning to reflect this trend.

The Sumas balance-of-summer strip has gained 6.2 cents since the start of the month.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |