NGI Data | NGI All News Access

Late Cold Helps Northeast NatGas Lift Weekly Market By Double Digits

At first glance weekly natural gas price movements looked quiet and unassuming. That is until you factor in the typically volatile Northeast and at that point everything changes. The NGI Weekly Spot Gas Average rose 30 cents to $2.79, paced by stout weather driven gains in New England, and the Mid-Atlantic.

Nearly all market points gained, and all other sections of the country showed gains of about a nickel, but the Northeast pulled up the average with a stout 99 cent advance to average $3.22. California had the smallest weekly gain, 3 cents to $2.65. The individual market point rising the most was the Algonquin Citygates with a $5.66 advance to average $9.53, as the winter’s chill refused to give way to spring during the week. Northwest Sumas showed the largest loss, 8 cents to $2.13.

South Texas and East Texas both rose 4 cents to $2.68, and South Louisiana and the Rockies added 4 cents as well to $2.73 and $2.37, respectively.

The Midwest and Midcontinent were both 6 cents higher to $2.88 and $2.55, respectively.

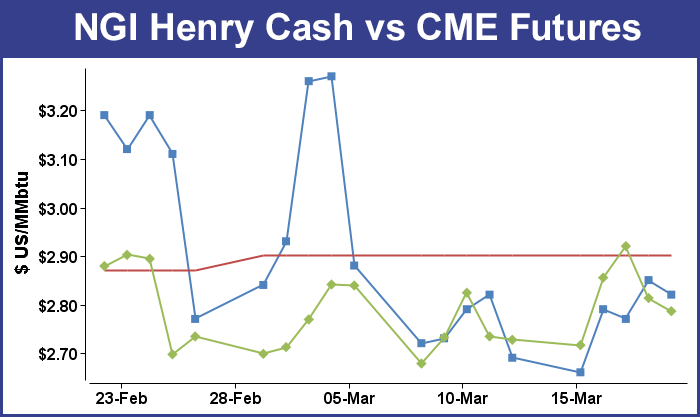

April futures for the week managed a gain of 5.9 cents to $2.786 with little help from weekly storage figures. The EIA storage report showed a withdrawal of 45 Bcf for the week ended March 13, a few Bcf less than what traders expected, and the market reaction was swift and sudden. April futures fell to a low of $2.792 after the number was released and by 10:45 EDT Thursday the April contract was trading at $2.803, down 11.7 cents from Wednesday’s settlement. At the close Thursday April futures had dropped 10.7 cents to $2.813.

Prior to the release of the data analysts were looking for a decrease in the 50 Bcf range. A Reuters survey of 23 traders and analysts showed an average 48 Bcf with a range of 30 Bcf to 60 Bcf. Analysts at United ICAP were looking for a 52 Bcf pull, and industry consultant Bentek Energy utilizing its flow model predicted a 55 Bcf withdrawal.

“We’re back to our $2.75 to $3.00 range, I don’t think $2.75 will be big support, but $3 has been there a while as a resistance level. It would have to close above that for a few days to maintain some substance,” said a New York floor trader.

Tim Evans of Citi Futures Perspective saw the report as moderately bearish but noted “in economic terms we note this result was an exact match with the five-year average for the date, and so the market is no better or worse supplied than a week ago on a seasonally adjusted basis.”

Inventories now stand at 1,467 Bcf and are 507 Bcf greater than last year and 225 Bcf below the 5-year average. In the East Region 37 Bcf were withdrawn and the West Region saw inventories decrease by 1 Bcf. Stocks in the Producing Region declined by 7 Bcf.

Futures traders remain undeterred in their bearish assessment in spite of recent setbacks. “Despite the fact that we were pushed to the sidelines from the previously suggested short trading idea given a close above the $2.89 level, we remain steadfast in a bearish opinion of this market as we still see high probability of a supply decline to the $2.50 area,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Thursday to clients.

“We are still viewing the $2.80-2.88 region as preferred sell region when referencing the nearby May futures contract. And despite some cool temps, we still see a weakening physical trade going forward that could prove accommodating toward widening carrying charges that should encourage renewed entry into the short side by the large noncommercial entities who have recently been exiting the market.

“[Thursday’s] strong bearish response to a storage miss of only about 4-5 Bcf attests to a continued weak fundamental undertone that will soon be featured by a record pace of production that will be outweighing the impact of some cold short-term temperature forecasts. The 45 Bcf supply draw was 3 Bcf more than we expected but less than Street ideas. As a result, the supply deficit against average levels was unchanged at 225 Bcf. We still see this shortfall being erased as early as next month as the production factor is apt to increase injections at a stronger than normal pace.”

In Friday’s trading gas for weekend and Monday delivery gained ground, but the market was split between broad gains at most market points from the Midwest east and weakness in the Rockies, Pacific Northwest and California.

Overall, the market added 6 cents to $2.83. Futures prices notched a second day of losses and went into the weekend with April off 2.7 cents to $2.786 and May down 2.6 cents to $2.803. April crude oil expired at $45.72/bbl, up $1.76.

Traders on the West Coast noted flush conditions and a return to more normal conditions following a heat wave last weekend. “This weekend its back to normal, and this weekend in the Pacific Northwest and California you will get some wind, and there is still some solar,” said Jeff Richter, principal with GPS Energy, a Portland, OR-based gas and power consulting firm.

“SoCal [Border and Citygates] is always on the offer on a weekend because there is not enough demand and there is so much renewable generation that gas just gets backhauled to the Rockies or the Desert Southwest or points east. Also, you have so much gas coming in from Canada and BC into Sumas, that it’s just a long market.

“Operators just don’t need the gas, since storage deficits are not low. SoCal, it seems, pushes out an OFO every other day saying not to nominate any more gas than necessary,” Richter said.

Long market indeed. Gas at Malin for weekend and Monday delivery shed a dime to $2.45, and gas at the PG&E Citygates fell 8 cents to $2.97. At the SoCal Citygates, parcels came in 18 cents lower at $2.52, and SoCal Border was quoted at $2.54, down 8 cents.

Deliveries on El Paso S Mainline shed 8 cents to $2.55, and gas at Northwest Sumas proved the exception to the rule adding a nickel to $2.23.

Forward prices at PG&E Citygates are quoted well above $3. According to the NGI’s Forward Look, PG&E April, May and June are $3.073, 3.102 and 3.144, respectively. Northwest Sumas is quoted at $2.264, $2.256 and $2.324, for April, May and June.

The Rockies felt the effects of plump West Coast supplies as well. Weekend and Monday deliveries to the Cheyenne Hub shed 2 cents to $2.43, and gas on CIG fell a dime to $2.33. Packages on Northwest Wyoming Pool changed hands 11 cents lower at $2.33, and deliveries to Opal skidded 10 cents to $2.42. Gas at El Paso non Bondad was down 7 cents to $2.45.

Prices for weekend and Monday gas at Northeast points exhibited their typical volatility posting multi-dollar gains as peak power prices rose. Monday peak power at the New York ISO’s western delivery point (Zone A) rose $7.17 to $44.67/MWh, and Monday peak power at the PJM West terminal gained a penny to $50.86/MWh.

Deliveries to Algonquin Citygates rose $2.98 to $10.49, and gas on Tennessee Zone 6 200 L gained $3.55 to $10.17. Gas on Iroquois Waddington came in a nickel higher at $3.51.

Forecasters see periods ahead of cooler than normal temperatures interspersed with episodes of moderate warming. MDA Weather Services in its Friday morning six- to 10-day outlook said, “The key feature in this period will be an area of low pressure tracking from the Midwest to off the East Coast by mid-period. This storm will aid in the deepening of a trough over the East in the second half, allowing for a resurgence of below-normal temperatures in the East.

“Temperatures, however, briefly moderate to slightly above normal levels along the East Coast on day seven prior to turning colder on day eight. The pattern amplifies during the second half, with a rebuilding of the upper levels over the West. This will bring a more intense coverage of ‘aboves’ to the West at that time.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |