Markets | NGI All News Access | NGI Data

Most Physical Points Rise; Northeast Losses Dominate as Futures Deflate

Physical gas for delivery Friday rose at most points Thursday, but outsize losses at a few Northeast points skewed the overall average into the loss column as most traders attempted to get their deals done ahead of the Energy Information Administration (EIA) inventory report.

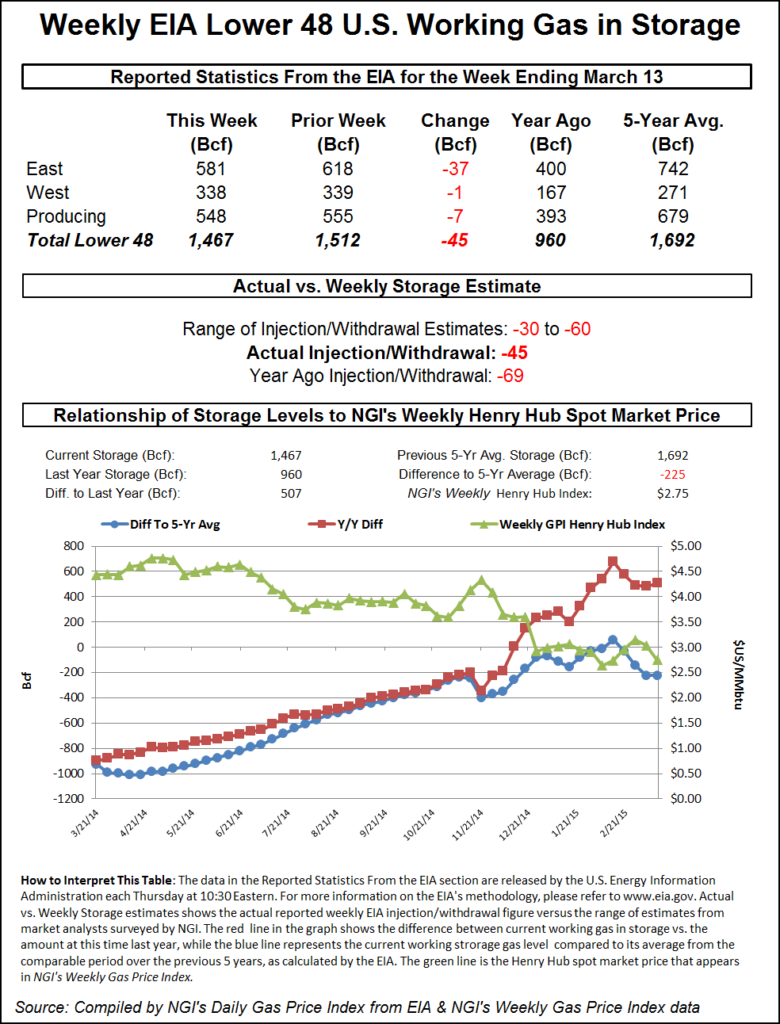

Gains of a few pennies to a nickel or more were seen in the Gulf Coast, Midcontinent, Midwest, Rockies and California, but those advances were not enough to offset the multi-dollar losses at New England locations. Overall, the market dropped 11 cents to $2.77. The EIA storage report revealed a withdrawal of 45 Bcf for the week ended March 13, a few Bcf less than what traders expected, and the market reaction was swift and sudden. At the close, April futures had dropped 10.7 cents to $2.813 and May was down 10.7 cents as well to $2.829. April crude oil dropped 70 cents to $43.96/bbl.

Next-day gas in the Midwest posted moderate advances as temperature forecasts called for readings to pop above seasonal norms for Friday. Forecaster Wunderground.com predicted that Thursday’s high in Milwaukee, WI, of 42 would jump to 59 Friday before sliding back to 49 on Saturday. The normal high for Milwaukee is 44. Chicago’s 46 high on Thursday was expected to climb to 57 on Friday before dropping 10 degrees Saturday. The seasonal high in the Windy City is 48. Detroit’s high of 41 Thursday was expected to make it to 53 Friday and then ease to 52 on Saturday. The normal mid-March high in Detroit is 45.

Next-day gas on Alliance added three cents to $2.83, and deliveries to the Chicago Citygates were quoted 3 cents higher at $2.79. Packages on Consumers were seen 3 cents higher at $2.95, and gas on Michcon rose 2 cents as well to $2.95. At Demarcation gas changed hands at $2.65, up a penny.

In the Midcontinent quotes were mostly higher. Gas on ANR SW for Friday delivery slid a penny to $2.49, and parcels on NGPL TX OK were higher by 7 cents to $2.72. At Northern Natural Ventura, next-day gas changed hands at $2.67, up 1 cent, and gas on Panhandle Eastern rose 3 cents to $2.48. On OGT next-day gas came in 6 cents higher at $2.57.

With physical gas at the Henry Hub quoted at $2.85, and deliveries to the Chicago Citygates at $2.79, the traditional movement of gas north from the Gulf to Midwest markets has changed. “The Utica is going to start delivering more gas there, but not so much Marcellus,” said a Houston-based industry veteran.

“People with gas in the southwest Utica and the Marcellus are going to start moving that over with upcoming expansions. They will start backhauling it on REX [Rockies Express Pipeline] or [Energy Transfer Partners] Rover Pipeline.”

According to sources, the most useful pricing point for Utica gas currently is Tennessee Zone 4 200 L, and that was quoted at $2.10, up 2 cents.

Midwest weather forecasters called for a cold front to work its way through southern Michigan. The National Weather Service in Detroit said an “upper low over the western end of Hudson Bay will slowly drop through St James Bay and into northwest Quebec by Sunday morning. This will slowly push a trough down across the Great Lakes Friday night through Saturday…with a trailing cold front also working its way down across Southeast Michigan in this timeframe. Warm air will precede the front Friday and Friday night…with temperatures rising up to around 4c near the Ohio border by noon Saturday. This should translate to maximum temperatures tomorrow in the low 50s…and overnight lows Friday night only falling into the middle 30s.”

Next-day prices in New England showed the greatest change. Gas at the Algonquin Citygates dropped $4.40 to $7.51, and packages on Iroquois Waddington shed 13 cents to $3.46. Packages on Tennessee Zone 6 200 L were seen lower by $4.60 to $6.62.

Marcellus gas was mostly lower. Gas on Millennium rose 9 cents to $1.70, and deliveries to Transco Leidy were seen off 6 cents to $1.48. Packages on Tennessee Zone 4 Marcellus fell a penny to $1.46, and next-day gas on Dominion South changed hands 7 cents lower at $1.98.

The 10:30 a.m. EDT release of storage data by the EIA showed a withdrawal of 45 Bcf, a hair more than what traders were expecting. April futures fell to a low of $2.792 after the number was released and by 10:45 a.m. April was trading at $2.803, down 11.7 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease in the 50 Bcf area. A Reuters survey of 23 traders and analysts showed an average 48 Bcf with a range of 30 Bcf to 60 Bcf. Analysts at United ICAP were looking for a 52 Bcf pull, and Bentek Energy’s flow model predicted a 55 Bcf withdrawal.

“We’re back to our $2.75 to $3.00 range, I don’t think $2.75 will be big support, but $3 has been there a while as a resistance level. It would have to close above that for a few days to maintain some substance,” said a New York floor trader.

Tim Evans of Citi Futures Perspective saw the report as moderately bearish but noted “in economic terms we note this result was an exact match with the five-year average for the date, and so the market is no better or worse supplied than a week ago on a seasonally adjusted basis.”

Inventories now stand at 1,467 Bcf and are 507 Bcf greater than last year and 225 Bcf below the five-year average. In the East Region 37 Bcf was withdrawn and the West Region saw inventories decrease by 1 Bcf. Stocks in the Producing Region declined by 7 Bcf.

Early estimates of the storage report for March 20 range from a draw of 21 Bcf to a build of 6 Bcf, according to Reuters.

Overnight, near-term weather forecasts moderated and estimates of heating requirements were also tempered. WSI Corp. in its Thursday morning six-to 10-day outlook said Thursday’s “forecast is warmer than the previous forecast across much of the nation due to the day shift and model trends. As a result, period GWHDDs are down 1.7 to near 82.8 for the CONUS. Forecast confidence is about average today as medium-range models are in reasonably good agreement with the timing and progression of the large-scale pattern. As usual, there are timing and technical differences late in the period.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |