Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Lay It All Down; Rig Count Continues Decline

Conventional business wisdom continues to prevail in unconventional plays; that is to say, producers are going where the money is and pursuing the most economical oil/gas opportunities in the low-price environment.

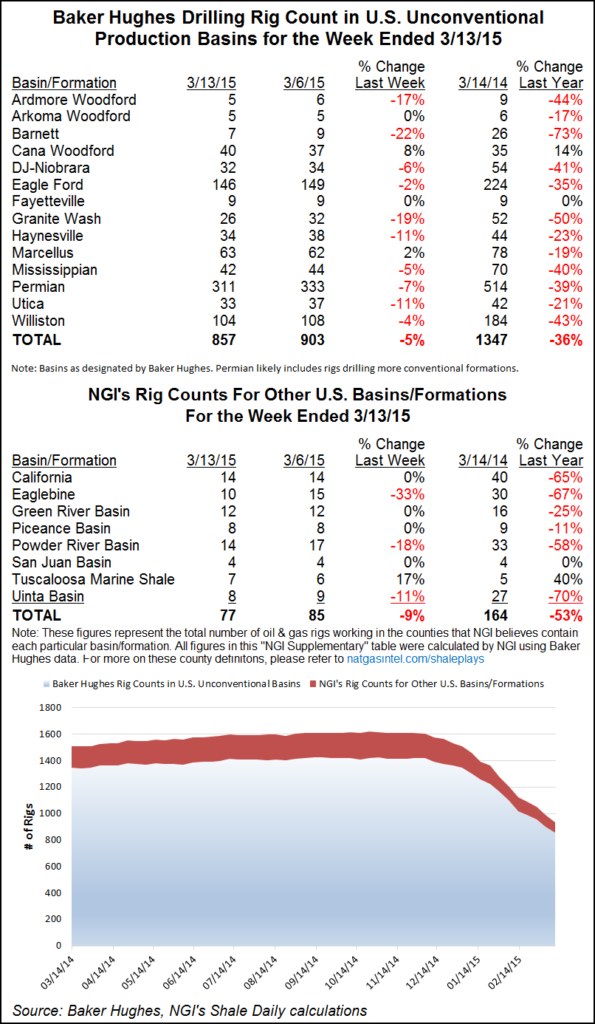

While the Eagle Ford Shale, Permian and Williston basins all lost rigs week to week, the decline on a percentage basis was relatively modest given the volume of drilling activity in the liquids-rich trio, according to Baker Hughes data and NGI assessments for the week ending March 13.

The emerging Tuscaloosa Marine Shale (TMS) actually gained a rig. Goodrich Petroleum Corp. recently said it might sell up in the Eagle Ford to focus on the TMS where the company has been a pioneer (see Daily GPI, March 2). The Cana-Woodford, a stacked play featuring the oily SCOOP and STACK formations, offers producers the opportunity to steer into more than one payzone as payoff for the trouble of making the trip down.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |