Markets | NGI All News Access | NGI Data

Cash Posts Small Loss as Louisiana Production Declines; Futures Shed 9 Cents

Physical natural gas for Friday delivery moved little in Thursday’s trading as traders hustled to get deals done prior to the release of Energy Information Administration (EIA) inventory data.

It was something of a divided market, with Northeast points dropping more than $1 at some points, but Midwest, Midcontinent, West Texas and California locations gained ground. Overall, the market eased 3 cents to $2.54.

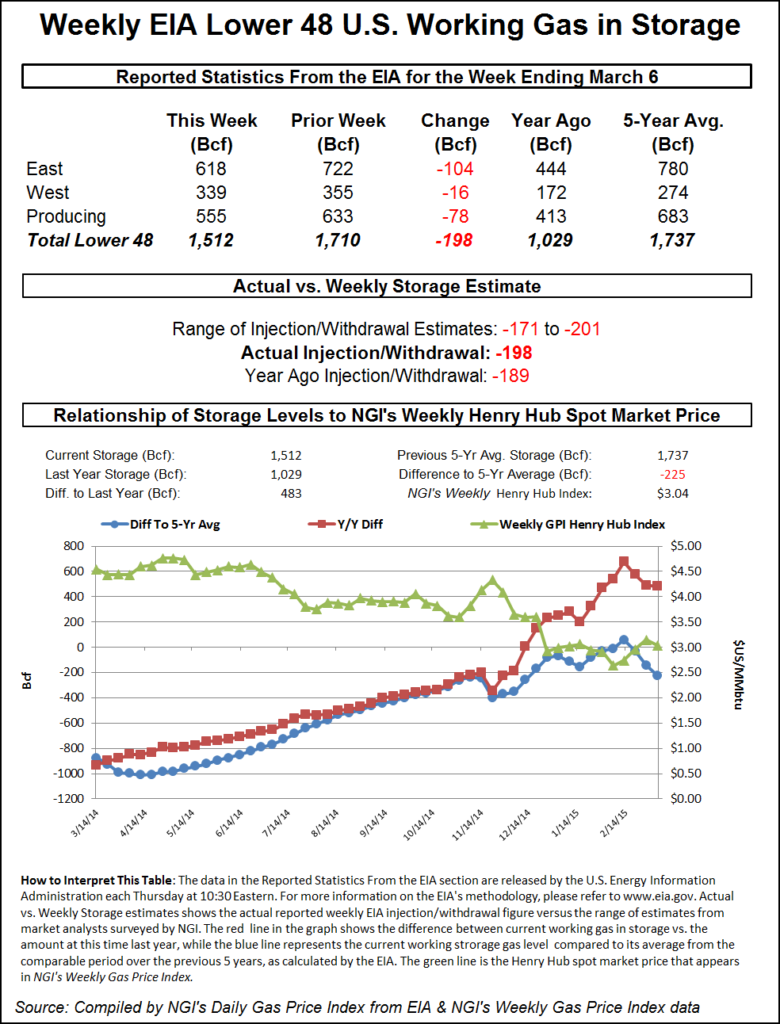

The EIA reported a withdrawal of 198 Bcf in its 10:30 a.m. EDT report, somewhat greater than industry estimates that were closer to 190 Bcf. Prices initially gained but soon turned tail and headed south. At the close, April had dropped 9.0 cents to $2.734 and May was off 8.5 cents to $2.765. April crude oil shed $1.12 to $47.05/bbl.

Weather forecasts for the Northeast called for temperatures to rise past seasonal norms, and that was enough to prompt a mixed reaction at Mid-Atlantic points and lower quotes across New England. AccuWeather.com forecast that Boston’s Thursday high of 37 would hold Friday and reach 43 on Saturday, one degree below normal. New York City was expected to see a high of 47 Thursday and Friday before climbing to 54 Saturday. The seasonal high in the Big Apple is 49. Washington, DC’s 59 high on Thursday was seen easing to 55 Friday before advancing to 63 on Saturday, 8 degrees above its seasonal norm.

Gas for delivery at the Algonquin Citygates shed $1.16 to $3.81, and gas into Iroquois Waddington skidded 24 cents to $3.08. On Tennessee Zone 6 200 L, Friday parcels were seen at $3.26, down $1.45.

Gas headed for southeast Pennsylvania and southern New Jersey on Transco (non NY North) Zone 6 added 3 cents to $2.79, but packages on Tetco M-3 fell 7 cents to $1.77.

Prices were lower in the Marcellus. Gas for Friday delivery on Millennium was flat at $1.45, and parcels delivered to Transco Leidy fell 1 cent to $1.39. Gas on Tennessee Zone 4 Marcellus lost 13 cents to $1.27, and gas on Dominion South was quoted a dime lower at $1.57.

Next-day peak power across the region was narrowly mixed. Intercontinental Exchange reported that peak power delivered Friday to the New York ISO’s Zone G (eastern New York) delivery point rose $1.80 to $42.00/MWh, and gas at the ISO New England’s Massachusetts Hub fell $1.07 to $43.92/MWh. Peak power at the PJM West terminal added $2.91 to $36.92/MWh.

Gas for delivery in the Midwest also rose even though temperatures there were seen above seasonal norms. AccuWeather.com forecast Chicago’s Thursday high of 54 would climb to 59 Friday and settle back to 50 on Saturday. The normal high in the Windy City this time of year is 45. Detroit’s Thursday maximum of 43 was expected to advance to 54 Friday and ease to 52 on Saturday. The normal high in Detroit is 41.

Friday gas on Alliance added 4 cents to $2.83, and packages at the Chicago Citygates added a 3 cents to $2.78. On Michcon, next-day gas added a nickel to $2.94, and gas delivered to Consumers changed hands 8 cents higher at $2.98.

Next-day gas at Gulf Coast locations rose, but analysts point to longer-term production trends that bode ill for the region. According to industry consultant Genscape production from Louisiana fields has fallen to a seven-year low, falling below 6 Bcf/d on Feb. 28.

Deliveries to Transco Zone 3 gained four cents to $2.78, and packages on ANR SE added 4 cents to $2.76. At the Henry Hub, Friday gas was seen at $2.82, up 3 cents, and on Tennessee 500 L next-day gas was quoted at $2.81, up a nickel. Gas at Katy added 7 cents to $2.73.

Genscape said, “Volumes during this decline since Feb. 20 have been averaging 367 MMcf/d below the prior 30-day average due to platform maintenance events in the Garden Banks area in the Gulf of Mexico. Longer-term declines, however, have been a product of weak returns due to the region’s relative lack of liquids. Production economics in the dry Haynesville combined with long-haul shipping costs and loss of market share in the Northeast have put Louisiana dry gas production at a cost disadvantage.”

Liquids-rich plays, however, are also experiencing challenges of their own resulting from collapsed crude oil prices. “There is some support for future Louisiana production coming from oil drilling, primarily at some large offshore fields like the Lucius, Hadrian and Tubular Bells plays. However, the collapse of crude prices and producer retraction of capex costs is likely to blunt the potential for future production growth in the region.”

Traders were not all that surprised by the initial non-response to what at first glance appeared to be supportive storage figures. Once the 198 Bcf figure hit trading screens, April futures rose to the high of the day at $2.864 after the number was released, but by 10:45 a.m. April was trading at $2.824, unchanged from Wednesday’s settlement.

Prior to the release of the data analysts were looking for a decrease in the low 190 Bcf range. A Reuters survey of 23 traders and analysts showed an average 191 Bcf with a range of 171 Bcf to 201 Bcf. Coming in right on the money were analysts at IAF Advisors looking for a 198 Bcf pull, and Bentek Energy’s flow model predicted a 198 Bcf withdrawal as well.

“We were looking for a 191 Bcf draw, but I had seen anywhere from the low 170s to 211 Bcf or so,” said a New York floor trader. “It looks like traders were waiting for a move to the upside like this to sell. They took advantage of the rally and just hit it. There is no indication that the market can hold higher prices. If it couldn’t make $3 with this number, what is it going to take?”

Others see a more bullish tone to the report. “The 198 Bcf drop in storage was near the top end of the range of market expectations, a bullish surprise. As a second consecutive bullish miss, this suggests that the background supply-demand balance may be somewhat tighter than anticipated,” said Tim Evans of Citi Futures Perspective. “There’s not a great deal of seasonal heating demand still ahead of the market, but we continue to see potential for a short covering rally to the $3.10-3.20 area and today’s data gives the market a push in that direction.”

Inventories now stand at 1,512 Bcf and are 483 Bcf greater than last year and 225 Bcf below the five-year average. In the East Region 104 Bcf was withdrawn, and the West Region saw inventories decrease by 16 Bcf. Stocks in the Producing Region declined by 78 Bcf.

Weather models overnight Wednesday still called for longer-term cooling, but the forecasts became less intense. Commodity Weather Group in its Thursday morning outlook said, “This morning’s forecast confidence was reduced as the overnight weather model guidance collectively pulled back on the strength of Alaskan ridging next week as well as the downstream impacts over North America. The big picture concept of a transition from a warm one- to five-day to a cooler to colder six- to 15-day in the East remain intact, but the intensities of that cooling lessened on most recent modeling, with the coldest anomalies more frequently focused over the Northeast instead of the Midwest and South as much.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |