Markets | NGI All News Access | NGI Data

Winter Waning, But Lingering Cold Propped Up Northeast Natural Gas Forwards Values Last Week

Natural gas forwards basis markets were generally lower the first week of March as forecasts for warmer weather trumped strength in Nymex gas futures.

The Nymex April gas futures contract jumped 14.3 cents between Monday March 2 and Thursday March 5 amid ongoing frigid conditions in the Northeast and a larger-than-expected withdrawal from storage. The April contract settled at $2.841/MMBtu Thursday.

But forwards basis prices brushed off the Nymex strength as longer-term weather outlooks called for a warming trend, not only over the West and central U.S., but also over the Midwest and Northeast beginning early in the week, with temperatures moving well above the freezing levels now being experienced.

Forecasters with NatGasWeather warned, however, that a weather system tracking across southern Canada during the middle of the week would provide a glancing blow of sub-freezing temperatures late Thursday into Friday over the Great Lakes and Northeast. There are still details that need to be resolved with this system, though, that would indicate just how much heating demand is required for these high-population regions.

“After this systems sweeps through, the weather data really begins struggling on whether additional cold blasts will follow into the northern U.S., and also how successful Pacific weather systems will be crashing into the West Coast,” NatGasWeather said. “It appears there will be a little bit of both, and this will likely lead to fairly seasonal temperatures over much of the U.S. That’s not to say there won’t be areas of cooler- or warmer-than-normal temperatures, but right now, the data is inconclusive on exactly what will set up over high natgas demand regions of the eastern U.S.”

The current chill and continued uncertainty over long-term weather was enough to keep forward basis prices in New England strong last week.

At the Algonquin Gas Transmission citygates, April basis jumped 14.9 cents between Monday and Thursday to reach plus 81 cents/MMBtu, according to NGI’s Forward Look. At the same time, cash prices at the volatile market hub jumped about $2.

Meanwhile, projections from Genscape show demand in New England hitting 3.99 Bcf/d on March 6 before sliding to 3.03 Bcf/d by March 13 and to 3.00 Bcf/d by March 19.

Algonquin May basis fell 6 cents to minus 40.4 cents/MMBtu, while the balance-of-summer (May-October) package edged up 3.8 cents to minus 10.6 cents/MMBtu.

Further out the curve, Algonquin’s winter 2015-2016 strip jumped 39 cents to plus $6.74/MMBtu, and the winter 2016-2017 surged 43 cents to plus $4.52/MMBtu.

“Don’t worry. It will come off,” a Northeast trader said. “The Gulf was much weaker today. Give it a few days.”

Elsewhere in the Northeast, prompt-month prices were up about 5 cents, even as Appalachian demand was projected by Genscape to fall from 21.74 Bcf/d on March 6 to 14.15 Bcf/d by March 13 and to 13.70 Bcf/d by March 19.

At Transco zone 6-New York, April basis climbed 4.7 cents to minus 34.7 cents/MMBtu, and May rose 7.1 cents to minus 26.3 cents/MMBtu. The balance of summer was up 10.3 cents to minus 46.2 cents/MMBtu.

TETCO-M3 April was up 5 cents to minus 73.6 cents/MMBtu, May was relatively flat at minus $1.009/MMBtu, and the balance of summer was up just 1.2 cents to minus 94.3 cents/MMBtu.

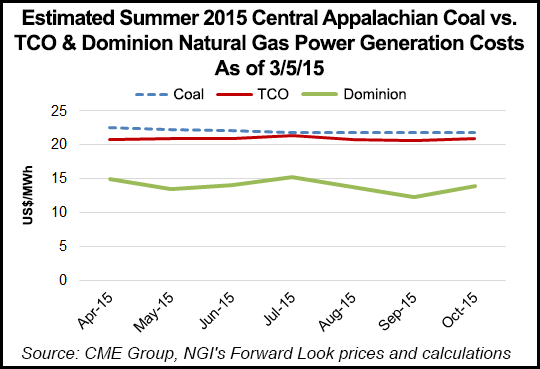

The low prices are expected to attract power generators this summer, analysts have said, which could then provide some support to these markets.

Over in the West, it appears that fundamentals may be beginning to work their way into the markets as California points posted gains, albeit modest, against the rest of the region’s overall weakness.

At the Pacific Gas & Electric citygates, April basis climbed 2 cents to plus 23.8 cents/MMBtu, and May basis picked up 3.7 cents to reach plus 24 cents/MMBtu. The balance of summer was up 3.1 cents to plus 27.2 cents/MMBtu.

Southern California Border tacked on 2.2 cents for April to hit minus 13.2 cents/MMBtu, while May and the balance of summer also were up about 2 cents.

“Snowpack continues to significantly lag, which is bullish for gas in the May-June period,” said Genscape’s Rick Margolin, senior natural gas analyst. “However, the Pacific Northwest and Northern California have actually been getting a decent amount of moisture lately this winter. Temperatures haven’t been cold enough to convert that to snowpack, but the precipitation has been able to boost present hydro generation numbers. So that’s something interesting to watch in terms of being a bearish influence on current gas demand.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |