Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

TransCanada Mainline Needs Checkup Before Partial Oil Conversion, Regulator Says

TransCanada Corp. has been directed to submit to a safety checkup before regulatory review begins on its Energy East proposal to switch part of its natural gas Mainline over to 1.1 million b/d of oil deliveries.

Rather than start the clock ticking on a legislated 15-month deadline for a decision on the C$12 billion (US$9.6 billion) project by accepting the application as complete, the National Energy Board (NEB) requested an inventory of effects of the conversion on the majority of the Mainline network that would still transport gas.

The request arises from a statement in the 30,000-page application that segments of the 56-year-old system, which are currently treated gently by running at reduced capacity, would resume working at maximum operating pressure to satisfy demand for gas service.

The safety standard followed by Canadian pipelines and regulatory agencies includes “need for an engineering assessment to be conducted when a company intends to operate a pipeline at a pressure significantly higher than the established operating pressure,” said the NEB’s information request.

But the conversion project “has not committed to undertake or provide an engineering assessment for the Mainline assets that would remain in gas service,” NEB said. “The engineering assessment will be necessary to confirm that the assets that would remain in gas service can safely operate at the higher pressure.”

In regulatory theory — and likely in practice during less pipeline safety-sensitive times a generation ago — TransCanada could speed up the Energy East project review by voluntarily accepting an approval condition requiring an assessment in the future.

But the NEB indicated that the easy-going approach has faded into history. The board requested “a list of all of the pipeline segments and facilities of the Mainline assets that would remain in gas service and would need to be operated at a higher pressure after the transfer of assets in order to meet commercial obligations.”

The list is likely to be long. In Ontario and Quebec, where the Mainline is fully used and additions are in the works to increase access to imports of shale gas from the United States, the system has five pipelines and arrays of facilities of varying vintages. When the network runs at full strength, high-powered compressors pack jumbo pipe up to 48 inches in diameter with gas at about 1,200 psi.

The NEB requested clear identification of all parts that are affected by plans to restore operating pressures, their original ratings, how far below maximum they have been working, reasons for the reductions, and how much strain would be restored in each case.

The board further directed TransCanada to provide the engineering assessment required by the national pipeline safety standard, or at least a date for completing a report based on current conditions.

Gas transportation safety has been a priority item for Canadian regulators and pipelines alike since the mid-1990s, when NEB completed a national inquiry into a plague of metal fatigue known as stress-corrosion cracking (SCC).

The inquiry documented 22 SCC ruptures and leaks in the 1977-1995 period. The cases included spectacular explosions and fires near populated areas but no injuries or fatalities. The failures occurred mostly in pipelines installed in the 1960s and 1970s and primarily on gas rather than oil systems. The inquiry resulted in years-long, multimillion-dollar inspection and repair programs and development of advanced-technology pipe flaw detection tools.

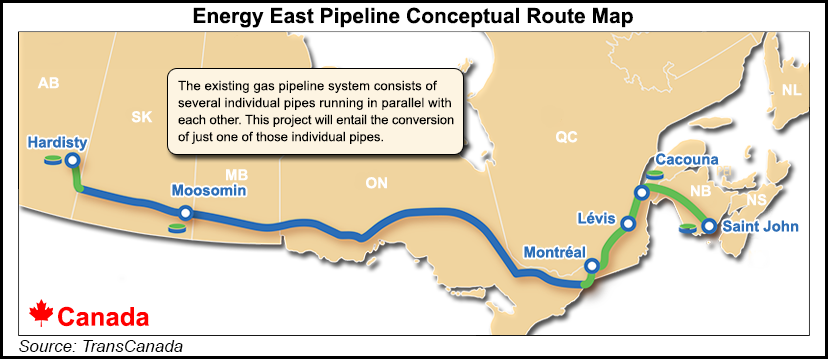

The Energy East project calls for conversion of about 3,000 kilometers (1,800 miles) of pipeline to carry oil. The plan arouses little controversy in the West where the Mainline currently runs well below capacity, but it attracts intense attention in the East where the system is full and traffic is expected to grow.

Canada’s biggest gas distributors — Union (Spectra Energy) in southern Ontario, Enbridge in Toronto and eastern Ontario, and Gaz Metro in Quebec — are urging the NEB to make TransCanada and oil shippers cover full costs of the conversion. Disputes over payment for a proposed C$1.5 billion (US$1.2 billion) replacement gas line remain unresolved, with the distributors demanding a solution as a prerequisite for beginning the Energy East approval proceeding.

The Ontario Energy Board has hired international engineering and risk management firm DNV GL (Det Norske Veritas) to provide thorough scrutiny of Energy East as a starting point for provincial government participation in the regulatory approval review.

In addition to a full account of plans for Mainline operating pressures, the NEB has requested details of maintenance programs, needs for new electric power, and associated digging or other disturbances that the proposed oil conversion would generate.

The Energy East schedule calls for oil deliveries from Alberta to the St. Lawrence Seaway and the Atlantic Coast to start in two stages, in 2017 and 2018. TransCanada been awaiting acceptance of the project application as complete since last October. NEB has made no promises of a date for the turning point. While 2012 federal regulatory reform legislation set a 15-month deadline for decisions on major projects, disclosures and queries defined as qualifications to enter the formal review and approval process are not under the timing gun.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |