Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

WPX Cutting 8% of Workforce, Moving Most Staff Back to Tulsa

WPX Energy Inc. is cutting its workforce by 8% and moving most of its regional office staff in Denver to the Tulsa headquarters.

Eighty-three employees are being fired, including 44 in Tulsa, 25 in Denver, 11 in Parachute, CO, two in New Mexico and one in North Dakota. About 120 people in the Denver office were offered jobs in Tulsa.

“These are tough decisions that impact good people, people who have worked hard and done their best for WPX,” CEO Rick Muncrief said. “We do not take that lightly.”

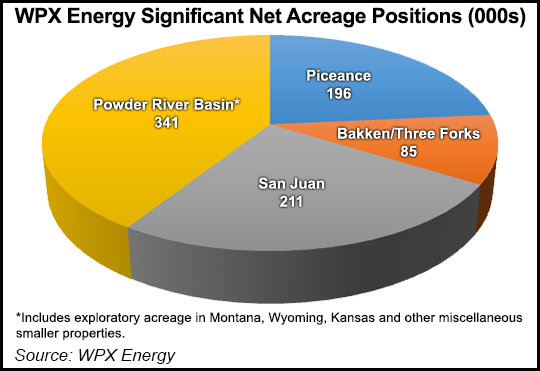

The company’s decisions come in response to the dramatic drop in the price of oil and from no relief in the price of natural gas, its main focus. WPX drills for gas and oil in Colorado, North Dakota and New Mexico, and it operates more than 5,800 wells in the onshore.

“We’ve evaluated many options to adjust our cost structure, and no solution is perfect,” said the CEO. “Decisions are especially difficult when they affect people’s lives.”

Following the reductions, WPX’s staffing to support primary operations stands at 900. It also has employees in Wyoming and in Pennsylvania who are supporting properties targeted for sale. A staff of fewer than 15 people in Denver would be maintained to support legal, environmental compliance, safety and government affairs functions.

To manage costs, WPX also offered a voluntary early exit program in mid-2014 that was accepted by about 100 people. Additionally, WPX, which was spun off from Williams, reduced its general and administrative expenses by 11% year/year in the fourth quarter.

During 4Q2014, oil and natural gas liquids (NGL) sales accounted for half of WPX’s product revenues and 28% of total production volumes. Diversifying the company’s historically gas-weighted production has been part of its long-term, multi-year strategy. Overall production for full-year 2014 was 170,500 boe/d, or 1,023 MMcfe/d. Oil and NGL volumes accounted for 25% of full-year production.

Natural gas volumes in 4Q2014 were down 6% from the year-ago period, to 742 MMcf/d from 790 MMcf/d. Gas volumes fell 5% in 2014 from 2013 to 768 MMcf/d from 811 MMcf/d. The biggest drop-off in gas volumes was from the Piceance Basin, with a 10% decline in the quarter, while gas output from the Appalachian Basin was down 2%. Appalachia assets have been sold to Southwestern Energy Co. (see Shale Daily, Dec. 3, 2014). Gas production from the San Juan Basin jumped 11% during 4Q2014 but it was down 6% overall for the year.

“We executed extremely well last year, delivered on our word and took timely action to start the transformation of the company,” Muncrief said. “We divested noncore operations, sharpened our geographic focus, boosted oil production, increased cash flow, put a new credit facility in place and launched a long-term strategy to expand margins and profitably grow the company…Being successful in this environment means staying proactive and opportunistic.”

Net income was $219 million ($1.06/share) in 4Q2014, compared with a net loss in the year-ago period of $973 million (minus $4.85). The latest results included the benefit of $453 million in hedging gains, while last year’s losses totaled $1.2 billion. Excluding the mark-to-market gains, adjusted income in 4Q2014 was $7 million (3 cents/share), from $73 million (36 cents). Profits from continuing operations totaled $227 million net ($1.10), versus a loss of $878 million (minus $4.37) in 4Q2013.

WPX received $3.55/Mcf for its natural gas in the fourth quarter, versus a price of $3.28 in 4Q2013. It sold its oil for $61.09/bbl, versus $87.76 in the year-ago period, while NGLs sold for $33.68 compared with $43.32.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |