Markets | NGI All News Access | NGI The Weekly Gas Market Report

NatGas Prices to Average $3.95/MMBtu in 2016, BNP Says

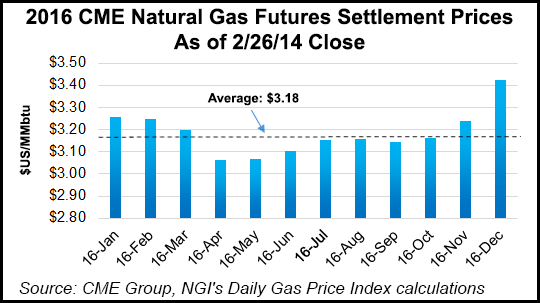

In a decidedly bullish projection, Teri Viswanath, senior natural gas strategist at BNP Paribas, said U.S. natural gas prices could reach $3.95/MMBtu by 2016, well above recent Energy Information Administration (EIA) forecasts.

BNP is also forecasting U.S. natural gas prices to average $3.20/MMBtu this year, down a dime compared with the firm’s Jan. 19 forecast. Prices will be moderately soft the first half of the year, but the analysts have said for some time that they expect prices to firm in 2H2015.

“We see the $3.20 rising to $3.95,” Viswanath said on a conference call Friday morning. “That’s much higher than the Street current consensus of $3.15,” and higher than EIA’s Jan. 13 estimate of $3.88. In a more recent forecast, EIA said monthly average natural gas spot prices at the Henry Hub are likely to average $3.05/MMBtu in 2015, and average $3.47/MMBtu in 2016 (see Daily GPI, Feb. 10).

Demand-side balancing is expected to not only establish a floor for natural gas prices in coming months, but is likely to enable significant price recovery by the end of the year, Viswanath said.

“2015 will inaugurate the first of several years of structural demand growth for natural gas. This year, the electric power industry is poised to become increasingly dependent upon natural gas, with large scale coal retirements serving as a primary catalyst for increased coal-to-gas fuel switching,” she said.

The variability of weather this winter “has been unprecedented,” with mild conditions in December and January “limiting the call on storage and establishing a $3 ceiling for natural gas prices,” followed by unusually frigid temperatures across much of the country in February. “This late-breaking winter weather is draining natural gas inventories at a pace comparable to last year, with a significant deficit to the five-year average likely to emerge by the end of March,” Viswanath said.

“We now see storage at the end of March standing just at 1.48 Tcf. That’s the lowest level of storage we’ve experienced, if you skip over last year, since 2008, and about 175 Bcf below the five-year average. Fast forward, we don’t see a repeat of last year’s 2.7 Tcf summer injection level. We do see pretty strong injection, but only leading to something less than 3.8 Tcf by end October. We think this is a relatively constructive view for natural gas prices.”

Natural gas working inventories totaled 1,938 Bcf as of Feb. 20, which is 576 Bcf greater than at the same time in 2014 and 30 Bcf lower than the previous five-year (2010-2014) average. EIA has projected that end-of-March inventories will total 1,699 Bcf, 43 Bcf more than the five-year average.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |