E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Texas Rig Count, Permitting, Completions Falling

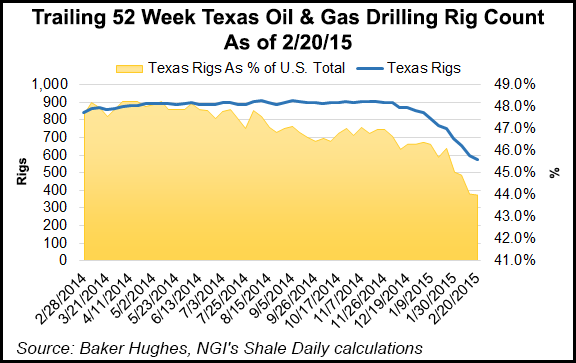

Not long ago, Texas could boast about half of the nation’s operating drilling rigs. The Lone Star State’s slice of the drilling pie — a shrinking pie at that — is now down to 46% as producers drop rigs in a low-price environment. January well completions were down almost 45% from a year ago, according to the Railroad Commission of Texas (RRC).

In January, operators reported to RRC 1,450 oil, 344 gas, 198 injection and five other completions. This is compared to a year ago when they reported 3,131 oil, 398 gas, 72 injection and six other completions. Oil well completions are down by nearly 54% from a year ago while gas well completions are off by almost 14%. Injection well completions are up by 175%.

Overall, well completions for January were 1,997, down almost 45% from 3,607 recorded during the year-ago period.

RRC data proves the adage that what goes up will come down. Last year’s overall completions tally for Texas was 29,554, up from 24,922 in 2013, 15,041 in 2012 and 8,790 in 2011.

And permitting is off, too. RRC issued 1,102 original drilling permits in January compared to 1,791 in January 2014, a 38% decline. The most recent tally included 971 permits to drill new oil/gas wells, 18 to re-enter existing well bores and 113 for recompletions. Permits issued in January included 254 oil, 90 gas, 697 oil and gas, 39 injection, zero service and 22 other permits.

Eagle Ford Shale operator Penn Virginia, for instance, just announced a 2015 capital expenditure program that is 60% lower than last year’s. The company recently dropped its rig count from eight to three and intends to stay at three rigs for the remainder of the year, CEO Baird Whitehead said during an earnings conference call Thursday.

“Our 2015 drilling program will focus on higher reserve and higher rate-of-return drilling opportunities in both the Lower and Upper Eagle Ford,” Whitehead said. “Based on reduced well cost levels, which we are already achieving, we estimate that we will generate pretax returns of 20% or greater even with lower commodity prices.”

SM Energy Co., which is active in the Eagle Ford, as well as the Bakken/Three Forks in North Dakota, also is dropping its budget — and dropping rigs — from last year’s levels.

The company made 90 flowing completions in its operated Eagle Ford program last year, 23 of which were during the fourth quarter. At year-end, SM Energy had 334 net wells producing. This year the company plans to make 75 flowing completions on its operated Eagle Ford acreage. Nearly all of the planned activity this year will take advantage of enhanced well design, similar to wells drilled and completed in the second half of 2014.

RRC’s estimated final production for December is 83.72 million bbl of crude oil and 553.22 Bcf of gas well gas. RRC derives final production numbers by multiplying the preliminary December production totals of 71.07 million bbl of crude oil and 474.09 Bcf of gas well gas by an adjustment factor of 1.1779 for crude oil and 1.1669 for gas well gas. These totals do not include casinghead gas or condensate.

Texas oil and gas wells produced 627.69 Bcf of gas based upon preliminary figures for December, which is up from the December 2013 preliminary total of 552.75 Bcf. Texas preliminary December total gas production averaged 20.25 Bcf/d.

Texas production last December came from 160,670 oil wells and 90,448 gas wells.

RRC production data shows that last year, monthly crude production figures were higher than those for their corresponding months in 2013. The January 2014 crude production figure was 72.46 million bbl, and December’s preliminary figure is 71.07 million bbl.

Total crude production for 2014, including the preliminary figure for December, came in at 901.8 million bbl, up from 770.6 million bbl in 2013.

Last year’s total natural gas production figure of 8.19 Tcf was down from 2013’s nearly 8.25 Tcf.

The Texas average rig count as of Feb. 13 was 598, according to Baker Hughes Inc. The RRC said that in the last 12 months, total Texas reported production was 901 million bbl of oil and 8.2 Tcf of natural gas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |