Bakken Shale | E&P | NGI All News Access

Canada’s Pembina to Expand Pipeline in Bakken

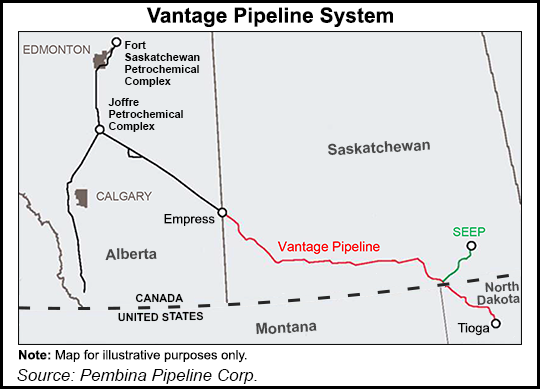

Calgary-based Pembina Pipeline Corp. has inked agreements for an $85 million expansion of the Vantage pipeline system, which it bought last year.

The move is geared to boost takeaway capacity for ethane associated with Bakken Shale natural gas production in North Dakota.

As part of two deals totaling more than $1 billion, Pembina last September acquired Vantage Pipeline for $650 million, ushering in the opportunity for an expanded role in the natural gas liquids trade among Canada, the United States and overseas markets (see Shale Daily, Sept. 2, 2014).

“This expansion has been a priority for us since acquiring Vantage, and we are very pleased to see it come to fruition,” said Pembina CEO Mick Dilger, who said the additional capacity fits the company’s strategy of expanding its fee-for-service cash flow stream.

The expansion will increase Vantage’s mainline capacity from 40,000 b/d to about 68,000 b/d through the addition of mainline pump stations and the construction of a 50-mile, eight-inch diameter gathering lateral. The expansion is supported by a long-term fee-for-service agreement with a substantial take-or-pay component, the company said.

Subject to regulatory and environmental approvals, the expansion is expected to be in service early next year.

Vantage is a 435-mile high-pressure pipeline that links ethane produced as a byproduct of Bakken associated gas production with markets in the petrochemical sector in Alberta. The pipeline originates at the Hess gas processing plant in Tioga, ND, extending northwest through Saskatchewan and terminating near Empress in Alberta.

Pembina still needs to obtain approvals from North Dakota regulators for the lateral and from Canada’s National Energy Board for the proposed pump stations in Alberta. No U.S. State Department approval will be necessary because there is no new pipe crossing the border into Canada.

When the expansion is in service, Pembina estimates that its ethane extraction plant in Saskatchewan should provide $75-110 million in gross earnings.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |