Markets | NGI All News Access | NGI Data

Bulls Circling Wagons Following Lean Storage Draw

Natural gas futures careened lower after the release of government storage figures Thursday showing inventory drawdowns well below trader expectations.

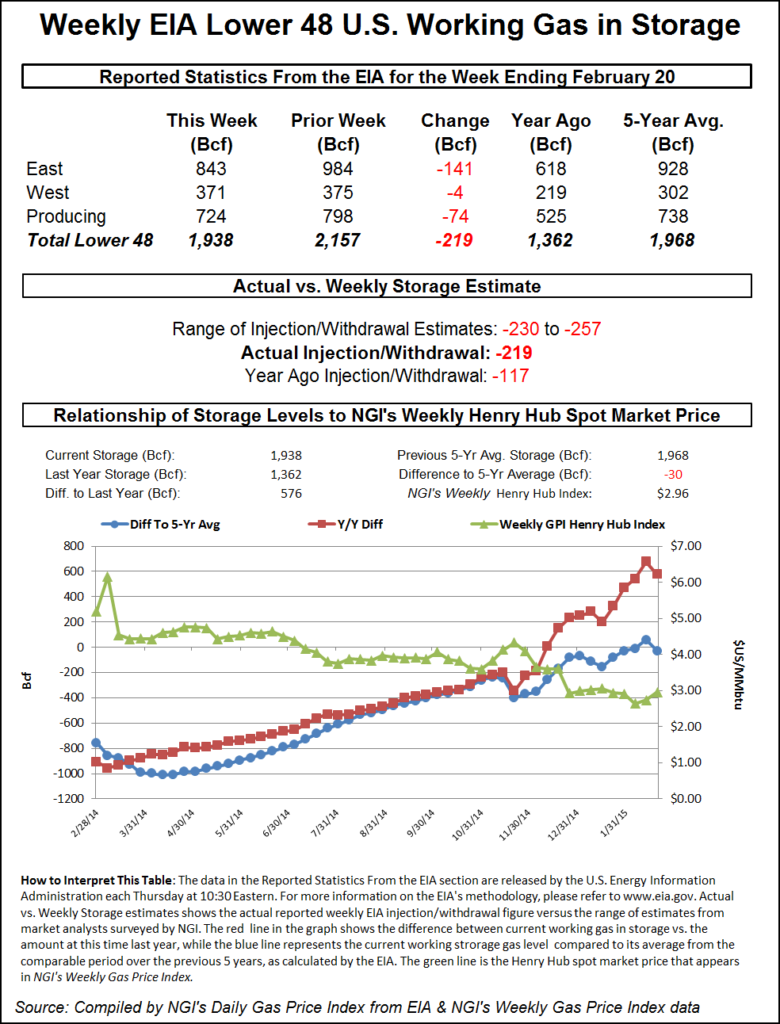

For the week ended Feb. 20, the Energy Information Administration (EIA) reported a decrease of 219 Bcf in its 10:30 a.m. EST release. April futures fell to a low of $2.723 after the number was released and by 10:45 a.m. April was trading at $2.738, down 12.4 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease in the 240 Bcf area. A Reuters survey of 23 traders and analysts showed an average 241 Bcf with a range of 230 Bcf to 257 Bcf. Analysts at ICAP Energy were looking for a 234 Bcf pull, and Bentek Energy’s flow model predicted a 233 Bcf withdrawal.

“Everyone was looking for a 240 to 241 withdrawal, and the 219 Bcf was [way] less than expectations,” said a New York floor trader. “I’m thinking we’ll settle above $2.75 and still remain within that $2.75 to $3.00 trading range.”

Analysts are scratching their heads as to why last week’s brutal cold didn’t have more of an impact.

“The net withdrawal of 219 Bcf was at the bottom of the range of expectations, implying a smaller than expected impact from last week’s cold temperatures,” said Tim Evans of Citi Futures Perspective. “This will also warrant a bearish revision to the forward storage outlook. The draw was still more than the 130 Bcf five-year average for the date, but disappointing on a weather-adjusted basis.”

Inventories now stand at 1,938 Bcf and are 576 Bcf greater than last year and 30 Bcf below the five-year average. In the East Region 141 Bcf was withdrawn and the West Region saw inventories decrease by 4 Bcf. Stocks in the Producing Region declined by 74 Bcf.

The Producing region salt cavern storage figure fell by 41 Bcf from the previous week to 181 Bcf, while the non-salt cavern figure dropped 34 Bcf to 542 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |