E&P | Bakken Shale | Eagle Ford Shale | NGI All News Access | Shale Daily

Continental, Newfield Forego Drilling Elsewhere to Focus on Oklahoma’s SCOOP

Continental Resources Inc. and Newfield Exploration Co., two companies devoted to drilling in the South Central Oklahoma Oil Province (SCOOP), said separately they plan to intensify their focus on the legacy play in 2015, while scaling back capital expenditure (capex) dollars and rigs in other unconventional areas.

In an earnings release Tuesday, Oklahoma City-based Continental said it operated an average of 15 rigs in the Woodford Shale portion of SCOOP during the fourth quarter of 2014, and still had 15 deployed there as of Feb. 20. The company said it plans to keep an average of 10-13 operated rigs in the play through the end of the year.

Drilling in the Springer Shale portion of SCOOP is being slightly curtailed. Continental operated an average of 12 rigs there during 4Q2014, but had cut down to five rigs as of Feb. 20. The company said it plans to keep between three and six rigs deployed in SCOOP/Springer through the end of 2015.

However, Continental cut more rigs in the Bakken Shale, where it is the largest operator. The company had been operating an average of 23 rigs during 4Q2014 but was operating 12 earlier this month. It said it expects to be down to 10 rigs in the Bakken by March and would keep an average of 10 rigs deployed there through the rest of the year.

“The strength of our assets and our operational flexibility have enabled us to adjust quickly to market conditions,” said Continental COO Jack Stark. “Our 2015 drilling program will focus on core properties to maximize returns and will continue to expand our proven assets through a strategic combination of step-out drilling, density drilling and enhanced completions.

“We now believe we will see at least 15% cost savings by mid-year and even more by year end which will further enhance returns.”

Despite low oil and natural gas prices, Continental did not change its plans announced in December to spend a total of $2.7 billion on capex in 2015 (see Shale Daily, Dec. 23, 2014). On Tuesday, the company said it plans to use a total of 31 rigs to drill 813 gross (283 net) wells over the course of 2015. The total includes $1.55 billion for drilling in the Bakken, with 11 rigs, and $720 million in SCOOP, with 16 rigs. The company said it plans to drill 631 gross (191 net) wells in the Bakken in 2015, and 157 gross (81 net) wells in SCOOP.

“Looking ahead, our strategy is to maintain our financial strength and focus on operating efficiencies until commodity prices improve,” said CFO John Hart. “We have ample liquidity and no near-term debt maturities, providing a great deal of flexibility in how we deploy capital in 2015 and beyond.”

Continental’s total production for 2015 is forecast to be 16-20% higher than 2014, when it averaged 174,189 boe/d.

Meanwhile, Newfield on Tuesday unveiled a $1.2 billion capex budget for 2015, which includes wells operated by others and is based on price of $55/bbl for crude oil and $3.00/MMBtu for natural gas. The company estimated its 2015 production at 52-55 million boe.

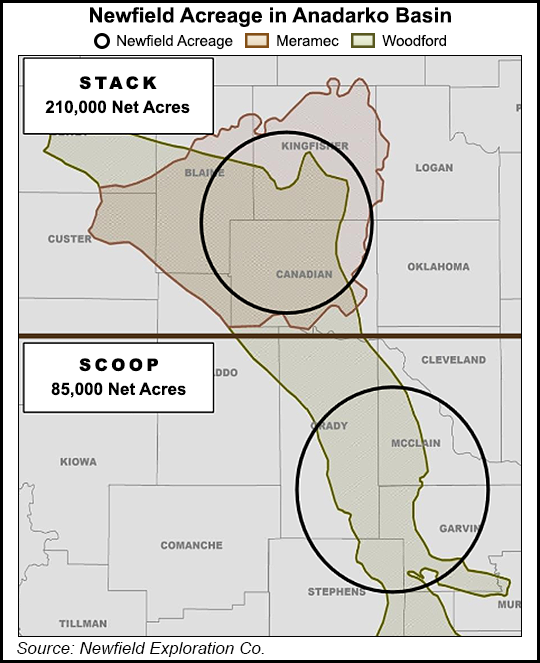

In an earnings report that was also released Tuesday, Newfield said it plans to devote about 70% of the budget, $820 million, to the SCOOP/Springer and STACK plays in the Anadarko Basin. The company said it would have 10 operated rigs in the basin, with Anadarko production set to increase 40% over 2014 levels. It plans to drill more than 50 STACK wells in 2015.

“This drilling campaign is expected to grow production in the play while holding acreage by production,” Newfield management said. The company’s net production in the Anadarko averaged 54,000 boe/d in 4Q2014, and totaled 15.4 million boe for the full-year 2014, a more than 100% increase over 2013.

STACK, like SCOOP, is a multi-horizon oil play in Oklahoma that Newfield claimed as a discovery in 2013, deriving its name from the stacked pay zones there (see Shale Daily, Nov. 7, 2013). The area, however, has been drilled for decades. STACK’s horizons, like parts of SCOOP, include the Meramec and Woodford shales and range in depth from 8,000 to 11,000 feet. Newfield currently holds 210,000 net acres in the STACK play, as well as 85,000 net acres in the SCOOP.

Newfield, based in The Woodlands, TX, near Houston, began to ramp up its activities in the SCOOP and STACK plays in early 2014 (see Shale Daily, May 1, 2014).

Drilling in the other shale plays where Newfield is active is expected to slow in 2015. The company said it plans to run a one-rig program in the Bakken Shale in the Williston Basin in Montana and North Dakota in 2015, down from an average of four rigs in 2014. Newfield said it has suspended drilling in the Uinta Basin in eastern Utah and in the Eagle Ford Shale in South Texas for 2015, citing low commodity prices for oil and natural gas.

Net production for 4Q2014 averaged 25,000 boe/d in the Uinta Basin and 20,000 boe/d in the Williston Basin, while full-year 2014 net production was about 9.4 million boe in the Uinta and 6.6 million boe in the Williston. Newfield said it expects production would decline about 15% in the Uinta and 13% in the Eagle Ford in 2015, but remain flat in the Williston.

“By keeping the Bakken ‘warm’ and keeping the momentum going, we believe 2016 production growth [for Continental] would be peer leading,” analysts with Jefferies LLC said in a note Tuesday. “This strategy could pay off for the shareholders if oil prices were to improve quickly in the second half of the year, but at our price deck we project a rather significant outspend of about $1 billion…”

In a separate note Tuesday, BMO Capital Markets Corp. analysts Phillip Jungwirth and Oana Dancescu said they had expected Continental to make a minor trim to their capex budget, but noted that the company “now plans to defer completions in the Bakken to benefit from the contango, which should smooth production throughout the year, whereas we had expected a modest 2H15 decline…

“Continental believes it will see at least 15% cost savings by midyear, and even more by year-end, while its $2.7 billion budget is based on cost reductions of 5-8% in 1Q2015, 10-12% in 2Q2015, 15% in 3Q2015, and 20% by year-end. That said, 4Q2014 and 2014 capital spending exceeded [the] budget, and we think risk exists in 2015 that spending will be above [the] plan.”

Jefferies said Newfield’s $1.2 billion capex budget was about $150 million more than it expected. “The capital plan…yields some exit-rate growth but is more aggressive than we were modeling and utilizes near-term hedging gains,” the firm said.

BMO’s Dan McSpirit and A.J. Donnell added that Newfield’s full-year production guidance of 52-55 million boe was above their estimate of 48 million boe. “Our original cut at 2015 was not far removed from what the company is now guiding,” they said, later adding that Newfield’s “capex/cash flow in 2015 sits near 1:1 on a hedged basis and stays well below the class average on an unhedged basis at less than 150% in 2015.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2158-8023 |