Western Colorado County Goes to Bat for Jordan Cove LNG

Elected officials in natural gas-rich Garfield County in the Piceance Basin in western Colorado have written FERC urging expedited approval of the proposed Jordan Cove liquefied natural gas (LNG) export project at Coos Bay, OR.

David Ludlam, head of the western range chapter of the Colorado Oil and Gas Association (COGA) called attention last Friday to the move by Garfield County with a letter to Cheryl LaFleur, chair of the Federal Energy Regulatory Commission (FERC).

The Garfield County commissioners pledged their “full support” for Jordan Cove, which is proposed as a tolling project for Rockies and western Canadian gas supplies and various end-use markets in Japan, China and other Asian nations.

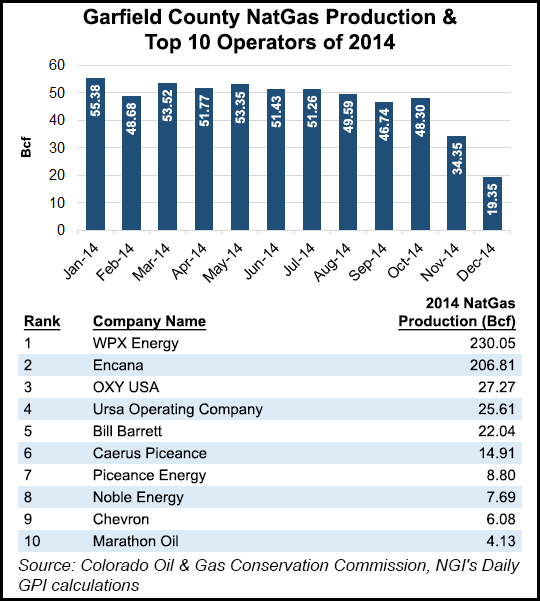

In its three-page letter to LaFleur, Garfield County commissioners stressed their county’s role as Colorado’s largest natural gas-producing county, boasting more than 10,000 active wells with more than 12,000 jobs directly created by the gas sector between 2005 and 2012. “That is more than 12.5% of the jobs created by Colorado employers during this period,” they said.

“By being able to market the abundant natural gas supply produced in the Piceance Basin to a broader market beyond the United States, we believe that will result in a stabilized production program over longer periods of time, significantly reducing the sharp up/down swings in gas price volatility and development activity that exists in a smaller U.S.-contained market economy.”

To underscore the importance of natural gas to the local county’s economy, Garfield submitted data showing that 70% of the county’s assessed value was attributable to oil and gas activities. And for specific fire, school and hospital districts within the county, the percentages are much higher, ranging from 87% to 94%, they said.

The Calgary-based backer for the proposed Jordan Cove export terminal and Pacific Connector transmission pipeline, Veresen Inc., recently divulged that FERC has delayed until June the date for completing the project’s draft environmental impact statement (DEIS) (see Daily GPI, Feb. 9). In an environment of depressed global oil prices, the delay could prove to be even more problematic, although Veresen representatives indicated they are not worried.

Veresen and Jordan Cove project officials have downplayed the significance of either the permitting delay or the oil price plunge. In fact, a Canada-based executive told NGI recently that project sponsors are still expecting to have binding agreements with two to four customers to announce this year to replace the nonbinding agreements now in place (see Daily GPI, Oct. 11, 2013).

Project sponsors originally anticipated the DEIS this Friday from FERC.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |