E&P | Eagle Ford Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin | Utica Shale

Onshore Vendors Offering Deep Pricing Concessions, Says Basic Energy CEO

Vendors have begun offering concessions on pricing for oilfield service (OFS) customers “all over the map” to stay in business, Basic Energy Inc. CEO Roe Patterson said Friday.

“Chemical providers are coming around the quickest,” he told analysts during a quarterly results conference call. Since the end of 2014, prices for chemicals have fallen by about one-third. Sand operators have cut prices by 10-15%, “and they will go much lower…Everybody’s trying to chip in, but the rates are going down faster than the input costs…”

The reaction since the end of the year has been chaotic, Patterson said, “knee-jerk, scorched earth,” with capital expenditure (capex) cuts by producers forcing vendors to “call a timeout…and it’s going to take quite some time to get it all sorted out.” He declined to name any names but said there already are “dead men walking” among producers and small OFS operators because they don’t have the financial prowess to take a wait-and-see approach on oil prices.

For all of the activity that stormed across the Permian Basin, it’s particularly “bloody,” he said. The area with the most rigs to lose is the center of the biggest “brawls” now.

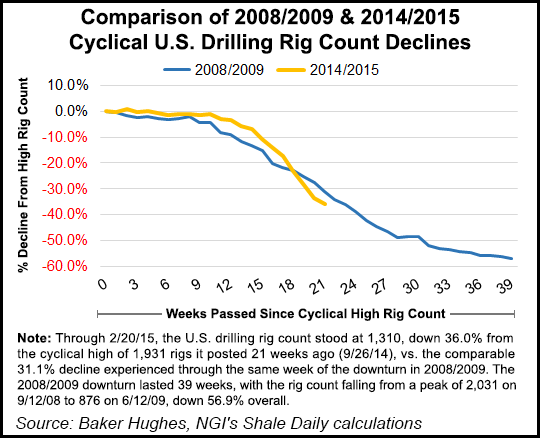

Some operators have compared today’s downturn to 2009, but it’s nothing like it, said Patterson.

“The one big difference was when the gas market shut down, the move was to oil. Now, there’s nowhere to hide, nowhere to run. It’s bad and and it’s going to be bad across the board. We’re going to get there quicker because there’s no place to go.”

Basic provides well site services at more than 100 points in Texas, Louisiana, Oklahoma, New Mexico, Arkansas, Kansas, the Rocky Mountains and in Appalachia. About 5,400 people were employed at the end of 2014. Since then, more than 10% of the workforce has been cut.

That’s what happens when more than 600 land rigs are idled in 80 days, Patterson said. “Industry has the capacity to react quickly when prices are going into a free fall, and as service providers, we have to react quickly as well…We don’t see prices returning to bolster customer confidence before the end of year, which means we won’t see more projects…We have not reached a bottom for activity.”

Basic management expects to see “hundreds more rigs stacked before it’s over…driving activity even lower.”

The Fort Worth, TX-based service operator is “more exposed to the completion-oriented side of the business this time around, and that will have an impact,” Patterson said. “We will see the number of completions shrink. How do we react? We discount, we stay competitive, we stay utilized. Some of our customers are hedged and they will stay busy. We will keep as many people fed as we can…People are hard to replace, and we want to keep the veteran employee employed…”

Staying in constant touch with its vendors and in turn with its customers is providing Basic with a less rocky road than some of its peers, the CEO said. Basic’s forte is in-field drilling and horizontal drilling using smaller, “Super Single” rigs capable of drilling to depths of 12,000 feet and diesel-electric rigs capable of drilling to 16,000 feet.

Basic’s rig fleet is capable of doing just about anything a customer wants, Patterson explained. The huge, high-specification rigs aren’t made for workovers, and as those big rigs are stacked, Basic sees more business in remedial and maintenance, as well as its fluid services, all saltwater-based.

It’s going to take a bit of time before the lower costs have any impact on onshore operations, said Patterson. To that end, Basic’s capex plan for 2015 is set at $100 million, versus $309 million in 2014. CFO Alan Krenek said there would be no qualms about cutting another 20-25% as the year progresses.

As it stays within cash flow, Basic is prepared to jump on top of any distressed assets that fit the bill.

“Over the next few quarters we hope to participate in service-side consolidation…that is very likely to come about,” Patterson said. “We plan to grow our asset base as we find compelling acquisition targets…”

A big squeeze is already happening, he said. “It’s become very competitive in quick fashion. When you lose 600 rigs in 80 days, you get rates down in a hurry. We have a lot of small vendors, competitors fighting for business in the local markets. A lot of those guys are going to get desperate and that’s when we’ll really see the bottom drop out of rates; that’s what’s going to drive pricing.”

The idea is to be patient and wait for potential deals.

“We think a lot more pain is to come. The valuation for acquisition targets is going to improve as we go through the trough. We’ll…build a war chest, be very careful with capex and have as much dry powder to do what we want to do at the end of the tunnel. Buying early doesn’t make any sense. There will be more targets and more value later on…” As to what Basic might be looking for, the field’s wide open. “If it makes sense, if there’s value there, we’re not scared.”

Basic isn’t going to be choosy about what it does as the slowdown continues. Some operators “are taking the noble road and stacking assets because they refuse to operate at current margin levels,” Patterson said. “They’re going to have a hard time coming back and will have to bid their way back into the market and then have to drop rates anyway.”

First quarter revenues are expected to decline by 21-26% from 4Q2014 as activity slows down and winter weather conditions have an impact, Patterson said.

If a customer “asks us to do a job, we’re going to do it. Our equipment doesn’t care whether it’s working on a vertical well or a horizontal well. We’ll do our functions at the well site…” It wasn’t that long ago when Basic had more of a choice but at this point, “we really don’t care. We’ll go wherever the work is.”

Once capex cuts catch up with the “real-time” calendar, the decline in pressure pumping and related drilling work should “come on pretty quick, in the next month or two,” he said. “You will begin to see spots, gaps in the calendar…A lot of white space…Some of our peers already are seeing some spreads hit the grass. We’ve had a gap here and there with idle time. The lack of drilling is going to trickle into all completion-related activity. We expect to see some signs in a big way toward the end of the first quarter and they should be very obvious in the second quarter…

“The calendar will be getting sloppy with hit-and-miss work..If you have a spread in a particular geographic area with weak utilization, you may have to stack it and cover it with another spread…We’re streamlining the business and the scale of each yard. We are trying not to keep the payroll too high if we do have a ‘gappy’ calendar so that we can try to maximum each spread.”

Basic reported a net loss in 4Q2014 of $18.8 million (minus 45 cents/share), in part on goodwill impairments from well servicing and fluid services segments. Excluding the one-time items, profits were $4.7 million (11 cents/share), reversing year-ago losses of $7.1 million (minus 18 cents), but down from 3Q2014 earnings of $9.9 million (24 cents).

Revenue was 2% higher sequentially and 31% higher year/year at $401 million, driven by big bump (65%) from completions and remedial services, particularly stimulation and coiled tubing activity.

Completion and remedial services revenue increased sequentially by 5% to $203.4 million after additional equipment was deployed. At the end of December Basic had 443,000 hydraulic horsepower (hhp) in operation, versus 413,000 hhp in 3Q2014 and 297,000 hhp in 4Q2013. Segment margins fell 60 basis points sequentially to 38%, mostly because of inclement weather and in part from pricing discounts given late in the quarter to customers in response to weakening demand in competitive markets. During 4Q2013, segment profit was $43.7 million, or 35% of revenue.

Fluid services revenue, all saltwater disposal, increased 1% sequentially, a modest increase that came from adding trucking capacity to support disposal wells acquired in the third quarter. The weighted average number of fluid services trucks rose 2% to 1,043 in 4Q2014, increasing by 18 trucks sequentially. Truck hours of 661,900 increased 2% from the third quarter and rose 14% year/year.

Well servicing revenues decreased 3% sequentially to $88 million but were up from year-ago revenues of $81 million. At the end of the year, the well servicing rig count was 421, the same as in 3Q2014 and the year-ago period. Rig hours totaled 204,400 in 4Q2014, down from 217,500 in 3Q2014 but higher from year-ago hours of 194,200. Rig utilization was 67% in 4Q2014, down from 71% sequentially and up from 65% in 4Q2013.

Contract drilling revenue decreased 3% sequentially. Basic operated 12 drilling rigs during 4Q2014, the same as in the third quarter and a year ago. However, revenue per drilling day in 4Q2014 was $16,600, down from $16,800 in the previous quarter, but higher from year-ago revenues of $16,400. Rig operating days fell 2% to 948 from 968 in 3Q2014, resulting in rig utilization of 86% versus 88%. In 4Q2014, rig operating days were 781, producing a utilization rate of 71%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |