NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

North America Seen Leading Global Unconventional Resources Growth to 2035

Unconventional resources are abundant around the world, but North America has all the advantages to keep it as pack leader to 2035, BP plc said Tuesday.

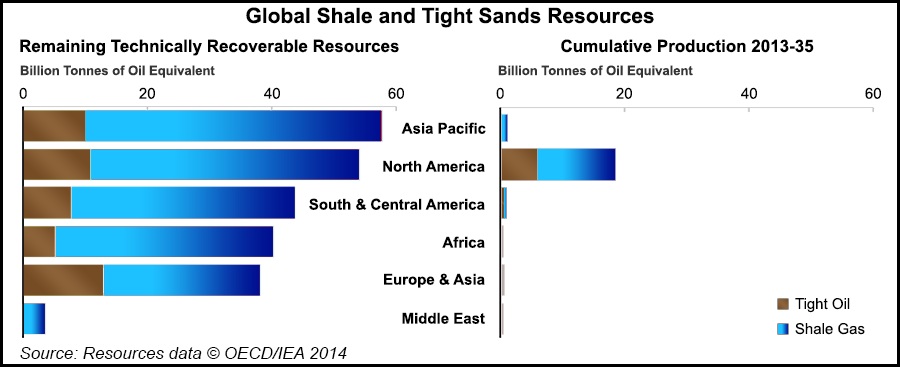

Between 2013 and 2035, about half of the tight oil resources and close to one-third of the unconventional gas cumulatively are to be produced in North America, according to BP’s Energy Outlook 2035. For the rest of the world only 3% of the technically recoverable oil reserves are expected to be produced, with 1% of the natural gas set to be recovered.

The annually updated outlook is put together by BP’s economics team, providing a strategic road map for the company. Chief economist Spencer Dale, who presented the report with Group CEO Bob Dudley, said the forecast is “our view of the most likely path, not our view of what we would like to happen.”

“While production increases outside North America, the factors that have enabled the dramatic growth of North American production are unlikely to be quickly replicated elsewhere,” Dale said. The drivers of unconventional supplies in the United States “include rapid growth of investment and significant innovation.”

Productivity, measured by new-well production per rig, increased 34%/year for oil and 10%/year for gas between 2007 and 2014. However, U.S. unconventional oil supplies are seen flattening out in the coming years, reflecting “high well decline rates and less extensive resources than gas,” Dale said.

“In contrast, U.S. shale gas production is expected to grow rapidly over the outlook,” 4.5%/year,” with growth rates moderating gradually.

“Shale gas production is dominated by North America, which currently accounts for nearly all of shale gas supply and continues to account for around three-quarters in 2035,” Dale noted. “However, growth in shale gas outside North America accelerates, and by the 2030s overtakes North American growth (in volume terms).

“China is the most promising country outside North America, accounting for 13% of the increase in global shale gas. By the end of the outlook, China and North America account for around 85% of global shale gas production.”

Domestic natural gas liquids (NGL) reserves also are rising to 2035, again with U.S. growth leading the way. In the next 20 years, liquids supplies are seen expanding by almost 20 million b/d, “led by growth in North America during the early part of the outlook, before the Middle East gains ground during the latter part. North American production expands by 9 million b/d by 2035, with growth concentrated in the first half of the outlook.”

With the shale gas growth in North America comes more power through liquefied natural gas (LNG) exports, BP’s chief economist said.

“The LNG market is poised for a growth spurt with a slew of new projects adding 22 Bcf/d by 2020,” Dale noted. “LNG supply grows 7.8%/year between 2013-2020. Overall, LNG supply grows by 48 Bcf/d by 2035, with Australia (16 Bcf/d) and the U.S. (14 Bcf/d) each contributing around a third of that increase. African LNG supply, led by East Africa, increases by 12 Bcf/d.

“As a result, Qatar, which has the largest market share today, is overtaken by Australia,” expected to have a 24% share of the market by 2035. Africa by then is expected to take 21% of the market, with the United States capturing 18%. Asia over the next 20 years still is seen as “the largest destination for LNG, with its share in global LNG demand remaining above 70%. “By 2035, China becomes the second largest LNG importer (12 Bcf/d), just behind Japan (13 Bcf/d).”

North American liquids growth also will rise over the next two decades on growth from unconventional oil, NGLs and oilsands.

“Outside of North America, South and Central American liquids production expands by 4 million b/d by 2035, largely due to Brazil,” Dale said. “Middle East production expands after 2020, as North American growth slows. Middle East output increases by a little over 5 million b/d by 2035.

Tight oil supply, notably in the United States, is seen escalating in the first part of the forecast, up by around 3 million b/d to 2035. Domestic tight oil supplies are expected to account for around two-thirds of global production in 2035.

The demise of OPEC isn’t at hand, Dale said.

“The strength of tight oil and the relative weakness of demand have reduced the market requirement for OPEC crude in recent years,” he noted. “This pressure on OPEC is likely to persist in the early years of the outlook, and the response of OPEC to this reduction is a key uncertainty. Further out, as tight oil supply growth slows and demand strengthens, the call on OPEC crude begins to increase, exceeding the historical high (32 million b/d in 2007) by 2030. OPEC’s market share by the end of the outlook is around 40%, similar to its average of the past 20 years.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |