Markets | NGI All News Access | NGI The Weekly Gas Market Report

Frigid Cold Boosts Northeast, Midwest Natural Gas Forwards Basis

Natural gas forwards basis markets were up across the board from Friday, Feb. 6, to Wednesday, Feb. 11, with the strongest gains seen in the high-demand regions of the U.S. Midwest and Northeast as forecasts showed plummeting temperatures and more snowfall over the next week, and longer-range outlooks were more convincing the cold would stick around.

At the Algonquin Gas Transmission citygates in New England, March basis shot up $2.011/MMBtu from Friday to Wednesday, to reach plus $6.40/MMBtu, according to NGI’s Forward Look.

The gains come on the heels of a dramatic rise in cash prices. During the same time period, cash prices at Algonquin surged more than $10 to average $19.27/MMBtu for Thursday’s gas delivery, NGI data shows.

Meanwhile, the next two winter strips at the constrained market hub picked up between 40 and 45 cents.

Despite the sharp rise in prices at Algonquin during the week, Northeast traders said the volatility this winter has been rather muted, especially when compared with last winter.

“Supply and demand is different this year because of low oil prices, thus low global LNG, thus LNG imports,” one trader said. “We have 2 Bcf/d of imports this year. Only Canaport and Everett imported last winter. Plus, oil and propane switching is more prevalent.”

Indeed, strong demand in New England and the greater Northeast region has attracted increasing amounts of LNG, and forecasters appear to be more confident the cold is here to stay.

“Next week’s cold blast continues to look quite strong and will also push deeper into the central and southern U.S. with widespread sub-freezing temperatures, including over Texas,” forecasters with NatGasWeather said.

Weather patterns continue to look fairly cold through Feb. 20-21, and forecasters are keeping a close eye on models for the timeframe around Feb. 24-25 to see if the cold air hovering over Canada will once again push into the U.S.

“We believe weather patterns are looking cold enough to support bullish weather sentiment until the pool of frigid Arctic temperatures over Canada finally shows signs it’s going to fizzle or retreat far enough north to only minimally impact the U.S.,” NatGasWeather said. “However, the latest weather data continues to show the reloading of cold air over Canada going well into the last week of February, which will result in national eight- to 14-day outlook maps showing fairly intimidating cool/blue temperatures.”

But while it may take a while for areas like New England to dig their way out of the snow that’s accumulated there in recent weeks, another trader warned, “Once the cold is gone, watch out.”

Elsewhere in the Northeast, Transco zone 6-New York March basis jumped $1.625 from Friday to Wednesday to land at plus $2.49/MMBtu, while April edged up 16.1 cents to minus 14.7 cents/MMBtu. The winter 2015-2016 and winter 2016-2017 strips were up 10 cents apiece.

Cash prices at the New York hub jumped nearly $12 during that time to average $15.22/MMBtu for Thursday’s gas day.

Over at Texas Eastern Transmission M3, March was up 62.7 cents to plus 51 cents/MMBtu, while the next two winter packages climbed 26 cents and 23 cents, respectively. The gains come as cash prices there moved up $6 during the same time.

Midwest basis prices also got a shot in the arm this week as demand is expected to remain high thanks to below-average temperatures on tap for the rest of the month.

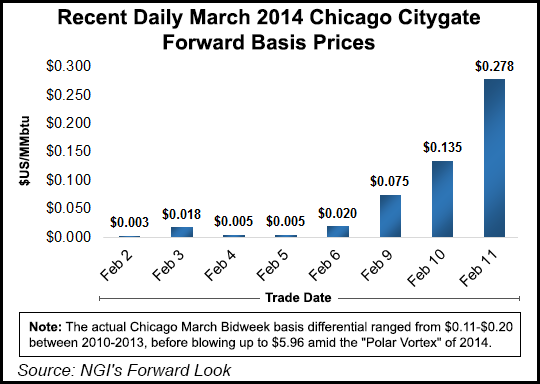

At the Chicago citygates, March basis soared 25.8 cents to plus 27.8 cents/MMBtu, while April inched up 6.5 cents to plus 4 cents/MMBtu.

Michigan Consolidated Gas saw March bump up 23.7 cents from Friday to Wednesday to reach plus 35.4 cents/MMBtu, while April was up just 6.4 cents to plus 16.1 cents/MMBtu.

Gains in the cash market at those market hubs were far less pronounced than the Northeast, with Chicago adding some 55 cents and Michigan tacking on 45 cents during the same timeframe.

Other gas markets across the U.S. were also strong this week, though gains were limited to around 5 cents or so. The modest strength comes on the heels of a 21.8-cent rise in Nymex futures from Friday to Wednesday.

Nymex was poised to give back some of those gains Thursday after the U.S. Energy Information Administration reported yet another smaller-than-expected 160 Bcf withdrawal from storage.

Current storage inventories are now at 2,268 Bcf, which is 0.5% below the five-year average of 2,279 Bcf but 31.4% above last year’s level of 1,760 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |