Bakken Shale | E&P | NGI All News Access

Tesoro CEO Reiterates Commitment to, Confidence in Bakken

While they are seeing various producers adjusting or delaying capital spending plans in the face of the depressed crude oil prices, senior executives at San Antonio-based Tesoro Corp. and its midstream unit, Tesoro Logistics LP (TLLP), refused to blink on Thursday in talking about 2014 results and Tesoro’s plans for this year during an earnings conference call.

Low oil prices and growing circumspection among producers has not dampened Tesoro CEO Greg Goff’s enthusiasm for the Bakken or the Rockies natural gas assets acquired in the company’s QEP midstream purchase last year (see Shale Daily, Oct. 20, 2014).

“In the Bakken all of our new projects are fully committed by our customers,” said Goff, citing three projects for primary focus there: the Connolly gathering system, expansion of the Bakken Area Storage Hub (BASH), and additional interconnections to the High Plains [oil] pipeline system.

“In our new Rockies business we have seen a lot of producers announcing lower drilling expenditures for 2015, but so far we have not seen any significant reductions in the basins where we operate,” Goff said. “Our 2015 plans are to grow volumes through compression projects that continue to be well supported by our customers.”

Two of Tesoro’s four strategic areas, Goff said, are organic growth of its existing assets and continuing strategic acquisitions. “We continue to look for third-party acquisitions [in addition to TLLP’s ongoing expansions] that fit our western U.S. strategic footprint and give us the ability to drive growth for TLLP.”

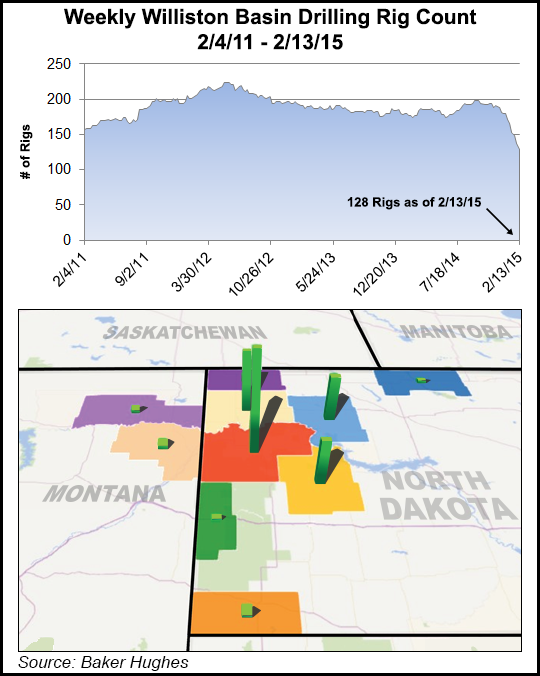

Since early last year, TLLP has launched binding processes to assess shipper interest in firm capacity on a Tesoro High Plains Pipeline system in its two-phase expansion to transport crude from various points in the Williston Basin in North Dakota.

TLLP also is pursuing an expansion of its BASH terminal facility under construction near the High Plains’ Ramberg Station, providing capability to allow shipper access to and from multiple pipelines and rail loading facilities in the Bakken area from points in Burke, McKenzie and Williams counties (see Shale Daily, Feb. 7, 2014).

In responding to a question about the impact of falling commodity prices on Tesoro’s plans for $400 million in projects in the Rockies and the Bakken this year, Goff said that “the majority of those projects that comprise the organic growth capital for TLLP are in development and committed to by our customers, and they are advancing without any slowdown.

“The only item [pending] is the reversal of the High Plains pipeline that is in open season right now so we’ll have an indication there [of customer interest] in a little bit. Most of our work in North Dakota with the pipelines is in the core of the production fields and helps drive cost savings and efficiencies for the producers, so we’re confident in our outlook for both the natural gas business and the Bakken crude oil business.”

In response to another question on TLLP’s success in attracting customers to the QEP assets, Goff said the midstream unit is talking to a number of prospective customers and there have been “some encouraging developments.”

Tesoro did take a one-time hit in 4Q2014 for both the QEP acquisition and an oil spill in the Bakken. One was $34 million in “transaction costs” related to buying QEP Field Services LLC, or the Rockies natural gas business, and the other was $17 million to cover higher-than-expected remediation costs related to the 2013 oil pipeline leak near Tioga, ND (see Shale Daily, Nov. 4, 2013).

For all of 2014, Tesoro Corp. reported net income of $843 million ($6.44/share) compared to $412 million ($3/share) for all of 2013, and for 4Q2014 net income was $145 million ($1.13), compared with a $7 million loss in the same quarter in 2013.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |