E&P | NGI All News Access | NGI The Weekly Gas Market Report

WPX Retreats, Drops Rigs, But ‘Primed to Accelerate’

Tulsa-based onshore operator WPX Energy Inc. is dropping 10 of 16 drilling rigs in the core Colorado, New Mexico and North Dakota operations but plans to “stay primed to accelerate development,” said CEO Rick Muncrief.

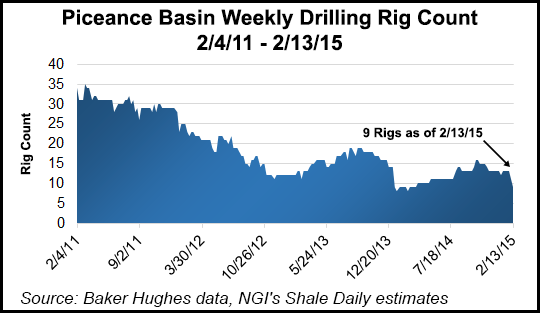

The natural gas-heavy has set a capital expenditure plan of $725 million for 2015, versus $1.5 billion in 2014. The company last month already had signaled less spending this year after announcing it would halt completions on about 20 newly drilled wells in Colorado’s Piceance Basin, its primary focus (see Shale Daily, Jan. 26). WPX operates more than 4,400 gas wells in the Piceance, including some of the biggest gushers to date (see Shale Daily, Oct. 28, 2013; April 9, 2013).

“Head winds bring challenges and opportunities,” Muncrief said. “We’re ready for both. It’s why we have a long-term plan to reshape WPX and grow our margins and cash flow. Margin expansion comes from diversifying our production and right-sizing our cost structure.”

In Western Colorado’s Piceance Basin, WPX had been running eight rigs. WPX now plans to average three rigs for the year on a capital budget of $200-225 million. The Williston Basin, where five drilling rigs have been in operation, should see only one rig by late spring and for “the balance of the year.” Spending in Williston also is set at $200-225 million.

WPX started 2015 with three rigs working the San Juan, but one rig already has been dropped. Two rigs are planned through the rest of the year with $275-300 million earmarked for capital spending.

An additional $25 million is planned for exploration activities across the onshore. The 2015 guidance and plans are based on New York Mercantile Exchange price assumptions of $3.00/Mcf natural gas and $55.00/bbl oil.

“Our capital plan is prudent, disciplined and consistent with our long-term focus,” Muncrief said. “At the same time, we have financial and operational flexibility because of how well we executed over the past year, completing asset sales, increasing oil volumes and heavily hedging our 2015 production at very favorable prices. We’ll stay primed to accelerate development, even as we take appropriate steps to respond to current prices.”

Despite the pullback, the independent still expects its production to increase, particularly on the oil side, which it has been targeting to balance the portfolio. Oil production this year is set to climb by 15-20% from 2014 levels. Last year oil output rose 56% from 2013, well ahead of company guidance of 40% growth. In 4Q2014, oil volumes rose 6,500 b/d to 32,300 b/d, 25% higher sequentially, and accounted for almost 20% of total output.

The expected increase in oil production this year is forecast to be offset in part “by an expected decline of about 4% in overall equivalent production from reduced development activity — normalized for divestitures over the past year.” Among other things, WPX exited the Appalachian Basin to focus on its western projects (see Shale Daily, Dec. 3, 2014; Oct. 9, 2014).

About 75% of 2015 gas production has been hedged at an average price of $4.10/Mcf, with 66% of oil output hedged at $95.00/bbl.

WPX said cash expenditures reported in 2015 likely would exceed $725 million primarily because some capital costs incurred in 2014 would be paid this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |