Wisconsin Energy Rides Gas, Proppant Growth, CEO Says

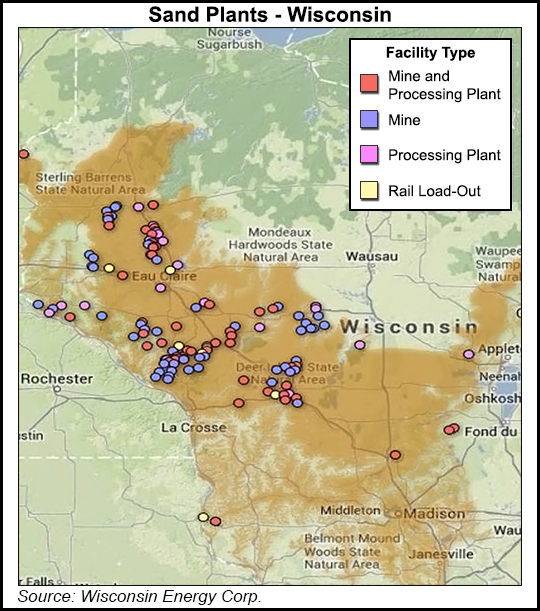

With a greater emphasis on natural gas with its pending Integrys Energy acquisition (Daily GPI, Aug. 1, 2014), Milwaukee-based Wisconsin Energy (WE) is gearing up for gas infrastructure growth with one of its drivers being the state’s leading role as sand supplier for proppant used in hydraulic fracturing (fracking).

During an earnings conference call reporting increased year-over-year profits in 2014, CEO Gale Klappa outlined continued double-digit growth in the company’s natural gas utility connections last year and progress on a $175-185 million, 85-mile gas pipeline lateral in the west-central part of Wisconsin that is principally being built to serve the growing fracking sand industry.

“The new pipeline will address gas reliability concerns in this area of the state, meeting demand from customers converting from propane to natural gas, and by the growth of the sand mining industry in that part of the state,” said Klappa, who added that state approval of the lateral also included franchises to begin bringing natural gas distribution service to 10 small towns along the pipeline route. Wisconsin is now the nation’s leading producer of frack sand, he said.

The complete pipeline project is scheduled to be completed in the fourth quarter. To date, Wisconsin Energy has completed two of three branch pipelines, and construction of the third branch started last month. Route clearing for the large lateral line began earlier this year.

“We continue to see an uptick in our customer growth of WE utilities [not counting the ones that Integrys will add], particularly in our natural gas business,” said Klappa, while reporting 2014 profits of $588.3 million ($2.59/share) compared to $577.4 million ($2.51) for all of 2013. He said 4Q2014 results were down compared to the same quarter a year earlier ($121.4 million vs.$144.3 million).

New natural gas connections rose by more than 28% last year, Klappa said, and electricity connections grew by 5.7%.

WE doesn’t serve electricity in the part of the state where the frack sand production growth is taking place, Klappa said. “From the standpoint of the sand mining production, it is largely related to our natural gas distribution network, and of course, now we are building the new pipeline lateral that will increase our capacity to serve the sand mines.”

The mines represent about 2% of WE’s overall gas load, Klappa said. “It grew by about 30% last year; it was way up,” he added.

Despite low oil and natural gas prices, Klappa said WE continues to see “a huge expansion” in sand mining for energy development purposes. “Right now, we are not seeing any reduction in frack sand production in western Wisconsin,” he said.

“In our talks with frack sand producers [the end of last year] they were still quite optimistic. I would say the growth is going to level off, and for the near term we’re not going to see any additional growth, but they aren’t seeing a downturn either. I think that is in part because Wisconsin has become the No. 1 supplier of frack sand in the country.”

Quality, proximity to shale plays and cost advantages are pumping up the frack sand business for the state, he said. “We’re not seeing any deterioration and the customers we talk to are not seeing it either for 2015.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |