Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

Pioneer Cuts Capex 45%, Misses 4Q2014 Earnings Estimates

Pioneer Natural Resources Co. said it will focus on drilling in the Spraberry/Wolfcamp and Eagle Ford shales in South Texas in 2015, but will cut the number of horizontal rigs deployed there and its overall capital expenditure (capex) budget by nearly half, as revenue increased but earnings missed analysts’ estimates for the fourth quarter of 2014.

On Tuesday, the Irving, TX-based company reported adjusted income of $116 million for 4Q2014 (down 17.1% from $140 million in 4Q2013), while earnings per share (EPS) was $0.80/share in 4Q2014 (down 20% from $1.00/share in 4Q2013). Revenue was $1.67 billion for 4Q2014, up 74.8% from the $953 million in revenue in 4Q2013.

Topeka Capital Markets analyst Gabriele Sorbara called Pioneer’s 4Q2014 results — as well as its production guidance for 1Q2015 — “disappointing,” in part because the company missed the firm’s EPS estimate of $0.99/share for 4Q2014.

“However, we believe focus will shift to its high-graded 2015 budget,” Sorbara said in a note Wednesday. “This is a solid program that preserves capital and maintains the balance sheet integrity; however, we reduce our [revalued net asset value] to $156 (from $171) and price target to $135 (from $150) on the deceleration of activity and our reduced cash flow estimates. We reaffirm our hold rating, given the lack of upside in the current commodity price environment.”

Pioneer said it would reduce the number of horizontal rigs deployed in the Spraberry/Wolfcamp and Eagle Ford to 16 by the end of February, a nearly 50% reduction. It also plans to shut down the vertical drilling program in the Spraberry/Wolfcamp by the end of the month.

Of the 16 rigs, six would be deployed in the northern Spraberry/Wolfcamp and six would be in the Eagle Ford. The remaining four rigs would be deployed in the southern Wolfcamp, a joint venture (JV) area of 200,000 net acres Pioneer has with Sinochem Petroleum USA LLC, a U.S. subsidiary of China’s Sinochem Group (see Shale Daily, Jan. 31, 2013).

“Even with this slowdown, we will be able to continue to prudently develop and grow our industry-leading positions in the Spraberry/Wolfcamp and Eagle Ford shale plays during 2015 by focusing our drilling activity in the best areas of both plays,” said CEO Scott Sheffield.

The company said it could add additional rigs later in 2015 if oil and natural gas prices improve.

Pioneer said it plans to spend $1.85 billion on capex in 2015, a 45% reduction from capital spent on continuing operations in 2014. Of the total for 2015, $1.6 billion would be devoted to drilling — including $1.05 billion in the northern Spraberry/Wolfcamp, $120 million in the southern Spraberry/Wolfcamp JV area, and $390 million in the Eagle Ford — while the remainder would go toward water infrastructure, vertical integration and facilities.

By comparison, the company had projected spending $3.0 billion on drilling in 2014 (see Shale Daily, Feb. 12, 2014).

According to Pioneer, nearly all ($1.7 billion) of its 2015 capex program would be funded from operating cash flow, assuming oil prices are $55/bbl and gas prices are $3.00/Mcf. Cash on hand of $1.0 billion would provide the rest of the program’s funding.

Gordon Douthat, analyst with Wells Fargo Securities LLC, said Pioneer’s cut in capex was more than Wall Street analysts expected. He added that the expectation to grow production by more than 10% in 2015 was “respectable,” but if commodity prices remain unchanged the trajectory into 2016 would point to a decline in production.

“Pioneer’s balance sheet remains in solid shape at $50/bbl oil and [an] Eagle Ford midstream sale brings in additional flexibility with potential for activity increases with further cost reductions and/or commodity price rebound,” Douthat said in a note Wednesday. Wells Fargo reduced its earnings per share (EPS) estimate for 2015 to $1.19/share, down from $1.73/share, and introduced an EPS estimate of $1.50/share for 2016. Pioneer stock was set to a neutral outlook.

Pioneer is trying to sell its 50.1% stake in Eagle Ford Shale Midstream (EFS Midstream), which it owns and operates with Reliance, which owns the remaining 49.9% share (see Shale Daily, Nov. 7, 2014). The JV was formed in 2010. Services are provided by the operator, Pioneer (46%), as well as Reliance (45%), Newpek LLC (9%) and various third parties. EFS Midstream has 10 central gathering plants and 460 miles of pipelines.

Despite the cut in capex, the company still expects to grow its production from continuing operations by more than 10% in 2015, with growth primarily occurring during the first half of the year. Pioneer said it expects 4Q2015 production to be essentially flat when compared to 4Q2014. Oil production is expected to increase more than 20% in 2015.

Pioneer issued production guidance of 192,000-197,000 boe/d for 1Q2015. The company said that in 2015, it plans to put 85-90 horizontal wells in the northern Spraberry/Wolfcamp into production (compared to 97 in 2014), plus 75-80 horizontal wells in the southern Spraberry/Wolfcamp JV area (113 in 2014) and 95-100 horizontal wells in the Eagle Ford (128 in 2014).

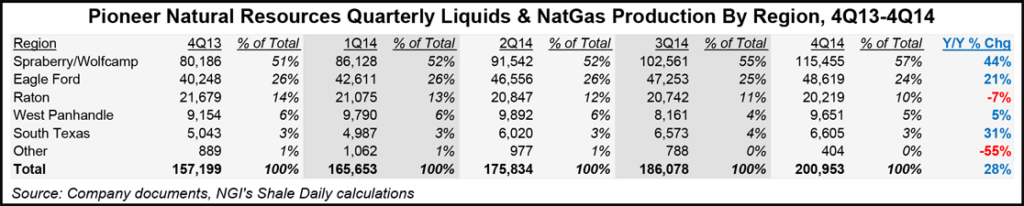

Production from continuing operations in 4Q2014 totaled 200,953 boe/d, a 27.8% increase from the 157,199 boe/d produced in 4Q2013. Oil production rose 39.4% between the two quarters (from 72,129 b/d to 100,532 b/d), while natural gas liquids (NGL) production increased 33.8% (from 31,818 boe/d to 42,582 boe/d) and natural gas production went up 8.6% (from 319,508 Mcf/d to 347,035 Mcf/d).

Pioneer said its proved reserves at the end of 2014 totaled 799 million boe, 44% of which is oil, 21% natural gas liquids (NGL) and 35% natural gas. The company said 81% was classified as proved developed and 19% was proved undeveloped. Broken down by play, 476 million boe of the year-end proved reserves were in the Spraberry/Wolfcamp, while 142 million boe were in the Eagle Ford, 121 million boe were in the Raton Basin, and 60 million boe were in other plays. Pioneer said a 239% drillbit reserve replacement in 2014 added 177 million boe in proved reserves through discoveries, extensions and technical revisions of previous estimates.

Phillip Jungwirth, analyst with BMO Capital Markets Corp., said Pioneer had also missed its EPS estimate of $1.12/share. He said the firm expects production to peak at 211,000 boe/d in 2Q2015, then decline 3% quarter-to-quarter during the second half of the year.

“2016 looks more challenging as Pioneer needs to ramp drilling to hold production flat with 2H15 in decline and lower hedge realizations,” Jungwirth said in a note Wednesday. “In 2017, we think high-single-digit growth is achievable, but only with a $1.1 billion outspend and leverage increasing to 2.3 times as after-hedge realizations are flat with 2015-16 at our $65/bbl WTI [West Texas Intermediate] forecast (vs. $50/bbl in 2015) and the South carry is fully utilized.

“Bottom line, we view Pioneer as being in a strong position to ramp with higher prices, but an expensive (a growth multiple without the growth) way to get exposure as cash flows and returns/capital efficiencies make accelerating and realizing net asset value difficult.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |