Infrastructure | NGI All News Access

Low Oil Prices Impacting NGV Push in Oregon

More than a year after it won state regulators’ approval to offer a utility-sponsored natural gas vehicle (NGV) fueling program (see Daily GPI, Jan. 18, 2014), Portland, OR-based NW Natural is still struggling to complete its first deal for compressed natural gas (CNG) fueling.

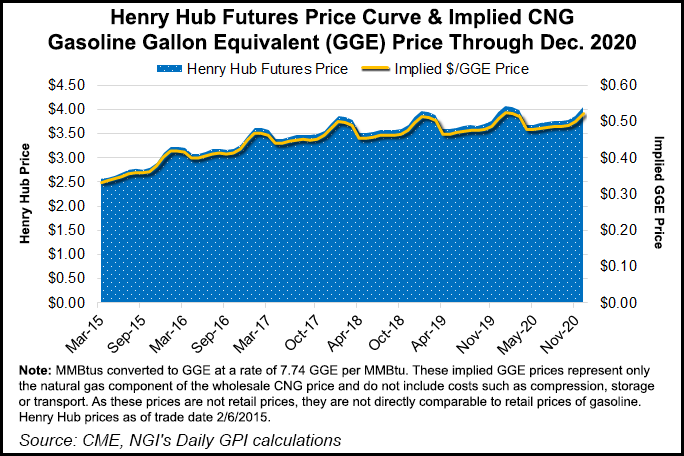

Falling oil prices that have cut gasoline pump prices and have diminished natural gas price advantages, but NW Natural officials are confident in the long-run that those advantages will return.

Under the utility program approved by the Oregon Public Utility Commission last year, NW Natural is focusing on nonresidential customers with fleets of 40 or more vehicles that return to the same location at night. To get the service, fleet operators must enter contracts of at least 10 years’ duration.

NW Natural is now geared up to design, plan, engineer, permit, construct, install, inspect, test and maintain the CNG facilities. In that regard, a utility spokesperson told NGI that NW Natural is working with two customers on the feasibility stage of its CNG tariff.

“We hope to head into the design stage with them later this spring,” said the spokesperson, while acknowledging that the oil price nosedive has slowed progress on signing up customers.

“The silver lining is that on the next wave of diesel price increases — combined with environmental advantages that CNG holds — our tariff should be well positioned to accelerate the market here in Oregon.”

At the national level, the NGV sector received a boost in Congress with the reintroduction of bipartisan legislation (S. 344) to create what NGVAmerica called “a level playing field” for liquefied natural gas (LNG) in competition with diesel as a transportation fuel. The bill would simply change taxing formulas to assess the two fuels by their energy content rather than on a volumetric basis.

On a volumetric basis, LNG is taxed at a rate 70% higher than diesel. On an energy content basis, the two fuels would be taxed on an equal basis, leaving them to compete on a cost, environmental and performance basis without the tax biasing the competition.

Elsewhere in the LNG transportation sector, Applied LNG said last Monday that it has closed a $22.5 million senior secured loan from Texas Capital Bank, allowing it to move ahead with building a new LNG production facility at Midlothian, TX (see Daily GPI,Nov. 21).

The financing will support Applied’s first liquefaction train at the Midlothian facility that is slated to be completed at mid-year. It will be the company’s third U.S. train; the other two are located at Topock, AZ, at the California border.

In Canada, a global provider of CNG, propane and hydrogen fueling dispensers, Manitoba-based Kraus Global was acquired by an Ontario, Canada-based private equity firm, PRIVEQ Capital Funds for $6.2 million in common equity. Kraus is a leading North American provider of CNG fueling dispensers and electronic control systems.

Kraus has been around for 30 years and have provided more than 6,000 CNG installations worldwide. PRIVEQ was founded in 1994 to target small value-added equity plays in the $3-7 million range.

Also to the north, Winnipeg-based New Flyer Industries recently signed a contract to provide 18 of its Xcelsior 60-foot CNG buses to the city of Hamilton, Ontario, which operates more than 250 New Flyer buses in its fleet. “New Flyer has built transit buses for Hamilton in a variety of models, lengths and propulsion systems ranging from diesel-fueled, diesel hybrid and CNG,” officials at the vehicle maker said.

New Flyer also said that in the first quarter this year it will deliver the first complement of 60-foot Xcelsior buses to the Long Beach Transit system in Southern California.

In Florida, the city-owned Pensacola Energy natural gas utility said its largest CNG customer, a county utilities authority, EUCA, will add 51 NGVs this year, including 34 CNG refuse trucks. EUCA operates Florida’s most diverse NGV fleet, including Chevrolet and Ford pickup trucks and Peterbilt tractors. Pensacola operates three public access CNG stations that serve these and other NGVs.

New CNG stations are planned in Colorado and Iowa by Sapp Brothers Travel Centers and Stirk CNG at existing Sapp centers — in Council Bluffs, Iowa, across the Missouri River from Omaha, NE, and Commerce City, northeast of Denver.

The Commerce City station is being built as a four-CNG outlet facility with support from the Colorado Energy Office, and is slated to open late this spring. The Council Bluffs construction is scheduled to begin in March with an opening slated for early summer. Black Hills Energy will provide the natural gas in Iowa.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |