Bakken Shale | E&P | Eagle Ford Shale | Haynesville Shale | Marcellus | NGI All News Access | Permian Basin | Utica Shale

U.S. NatGas Prices to Struggle Until Supplies Stall, Says Jefferies

Near-term domestic natural gas prices may struggle to gain momentum this year until there’s more evidence of stalling supply later this year, according to Jefferies LLC.

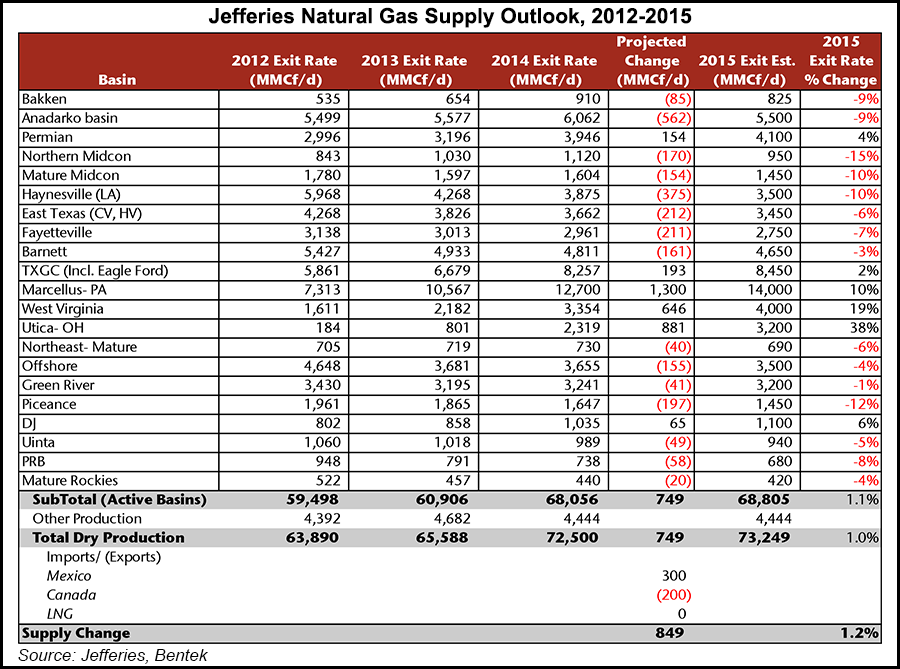

Analyst Jonathan D. Wolff and the Jefferies Americas equities team on Thursday outlined a bearish case for gas prices this year, even though most of the gassy basins are expected to see big production declines from 2014. Even with continued cutbacks by exploration and production (E&P) companies, however, Jefferies still expects U.S. gas supplies to grow modestly, with exit rates averaging about 849 MMcf/d higher than in 2014.

Jefferies has re-set its 2015 gas price forecast at $3.50/MMBtu, with a long-term view beginning in 2016 of $4.25.

“We expect U.S. natural gas prices should gradually recover on better demand (coal-to-gas switching), reduced supply growth due to transportation bottlenecks (Northeast) and lower associated gas growth on falling liquids development,” Wolff wrote.

Meanwhile, oil prices aren’t going anywhere either, with West Texas Intermediate prices expected to average $50.25/bbl and $64.50 in 2016. Brent prices are set to average the same in 2015, $50.25. Those low oil prices may do a number on several of the greenfield liquefied natural gas (LNG) export proposals, Wolff said. “LNG project deferrals are likely on weak oil” as global trade is oil-linked.

“We expect producers to lower 2015 budgets to plan for prices closer to the current $50/bbl oil curve,” said the Jefferies analysts. “Natural gas is also soft with the 12-month strip at $2.90/MMBtu. There’s still a lot of gas production coming, even if it’s only from a few select basins. Inventories as of Jan. 30 stood at 2,428 Bcf and were 468 Bcf more than last year and 29 Bcf below the five-year average (see Daily GPI, Feb. 5).

The active onshore gas basins are seen lifting domestic supplies overall by 1.1% by year’s end, with an exit rate of 68,805 MMcf/d, versus year-end 2014 production was 68,056 MMcf/d, Jefferies said. Total dry production is forecast at 73,249 MMcf/d, 1% higher than last year. According to the Energy Information Administration, gas production in the Lower 48 rose marginally in November to 81.54 Bcf/d, an increase of 0.76 Bcf/d (0.9%) from October (see Shale Daily, Feb. 2).

Where the gains are expected to come from is no surprise, nor are there any shockers on the other end of the spectrum.

Utica Shale gas production from Ohio is expected to pace all other gains this year, increasing 38% to an exit rate of 3,200 MMcf/d. At the end of 2014, Ohio gas output was estimated at around 2,318 MMcf/d. By comparison, the 2013 exit rate from the still-emerging play was 801 MMcf/d, and it was 184 MMcf/d at the end of 2012.

West Virginia, seen up 19% this year, and Pennsylvania’s Marcellus Shale, forecast to rise by 10%, are in the No. 2 and 3 positions, according to Jefferies. Other gas production gains are projected from:

Gas declines in the onshore are much more prevalent, per Jefferies. The northern gas fields in the Midcontinent are projecting to see a production decline of 15%. Also down sharply this year is the Piceance Basin forecast, where a 12% decline is seen in the Colorado fields. Gas output from “mature” fields in the Midcontinent are predicted to decline by 10%, while the venerable Haynesville Shale is seen dropping also by 10%.

Gas output from both the Bakken Shale and Anadarko Basin is expected to decrease by 9%, while Powder River Basin output could be down 8%. A 7% decline in gas output from a year ago is projected from the Fayetteville Shale, while a 6% drop is expected from both East Texas plays (Cotton Valley/Haynesville) and the mature fields in the Northeast.

Analysts are projecting Uinta Basin gas production should fall off by 5% from 2014, while other mature plays in the Rocky Mountains may see output off by 4%. Output from the granddaddy Barnett Shale is expected to decline by 3% from 2014, while Green River Basin gas production should remain almost flat, down about 1%.

The U.S. rig count continues to decline, according to Baker Hughes Inc. In its weekly report on Friday, the domestic rig count fell from a week ago by 87 total to 1,456, which 315 fewer than a year ago. Five gas rigs were dropped to bring the count to 314. Eighty-three oil rigs were dropped, with the total count at 1,140. The horizontal drilling rig count fell by 80 to 1,088.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |